- South Korea

- /

- Industrials

- /

- KOSE:A078930

Asian Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience varying degrees of movement, with some regions seeing record highs and others facing mixed returns, Asia presents a unique landscape for investors seeking stability through dividend stocks. In the current environment, where economic indicators show both resilience and challenges across different sectors, selecting dividend stocks in Asia could offer potential income opportunities while navigating market fluctuations.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.48% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.36% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.39% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 5.31% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.03% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.46% | ★★★★★★ |

| Daicel (TSE:4202) | 4.86% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 5.12% | ★★★★★★ |

Click here to see the full list of 1198 stocks from our Top Asian Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

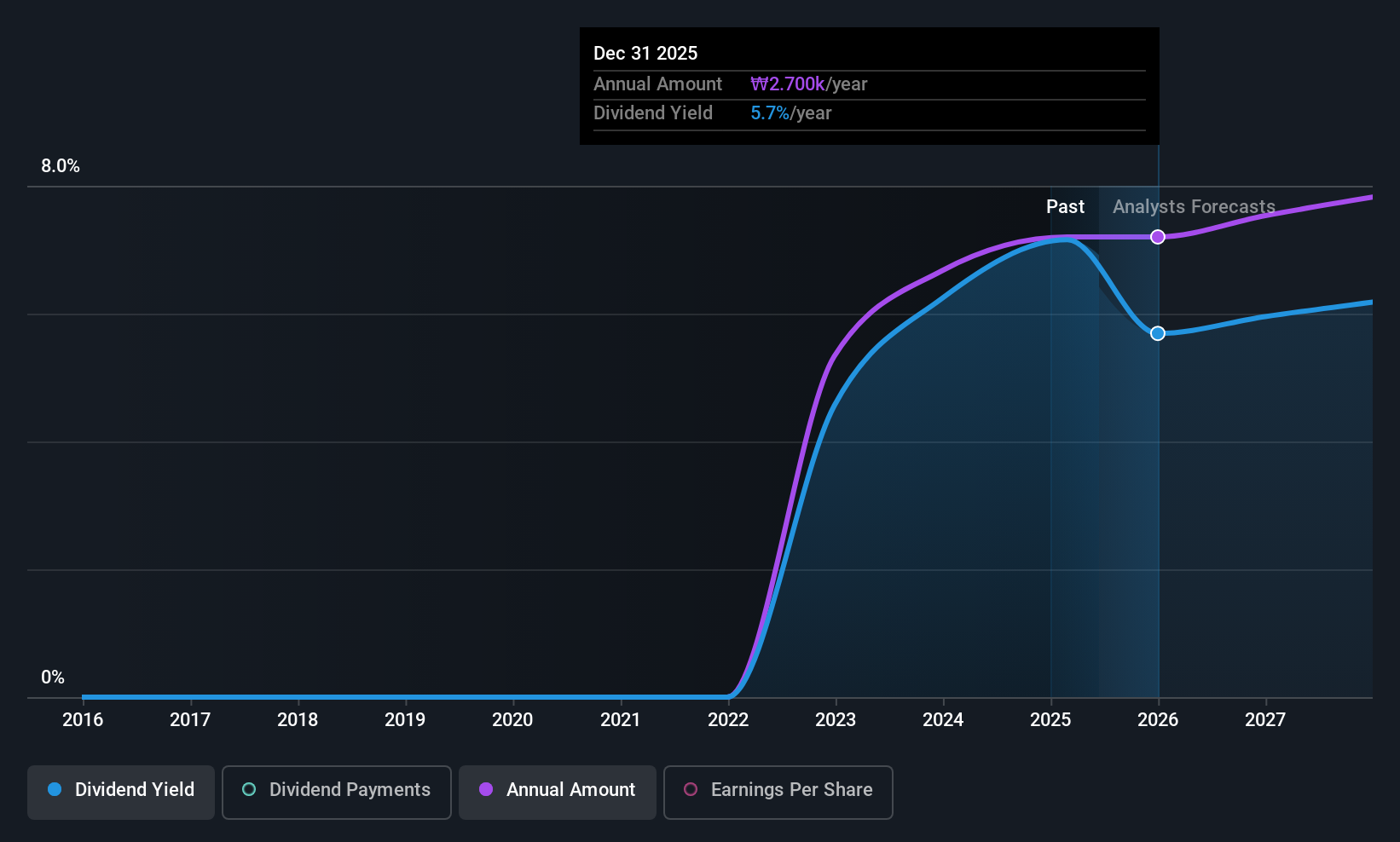

Samsung Fire & Marine Insurance (KOSE:A000810)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Samsung Fire & Marine Insurance Co., Ltd. offers non-life insurance products and services across several countries including South Korea, China, and the United States, with a market capitalization of approximately ₩19.32 trillion.

Operations: Samsung Fire & Marine Insurance Co., Ltd. generates its revenue primarily from its insurance business, amounting to approximately ₩20.15 billion.

Dividend Yield: 4%

Samsung Fire & Marine Insurance's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 44.6% and 42.3%, respectively. Despite a volatile dividend history over the past decade, its yield is in the top 25% of KR market payers. Recent Q1 2025 earnings showed a decline in net income to ₩608.10 billion from ₩701 billion year-over-year, which may affect future dividend stability despite low trading valuation estimates at present.

- Navigate through the intricacies of Samsung Fire & Marine Insurance with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Samsung Fire & Marine Insurance's current price could be quite moderate.

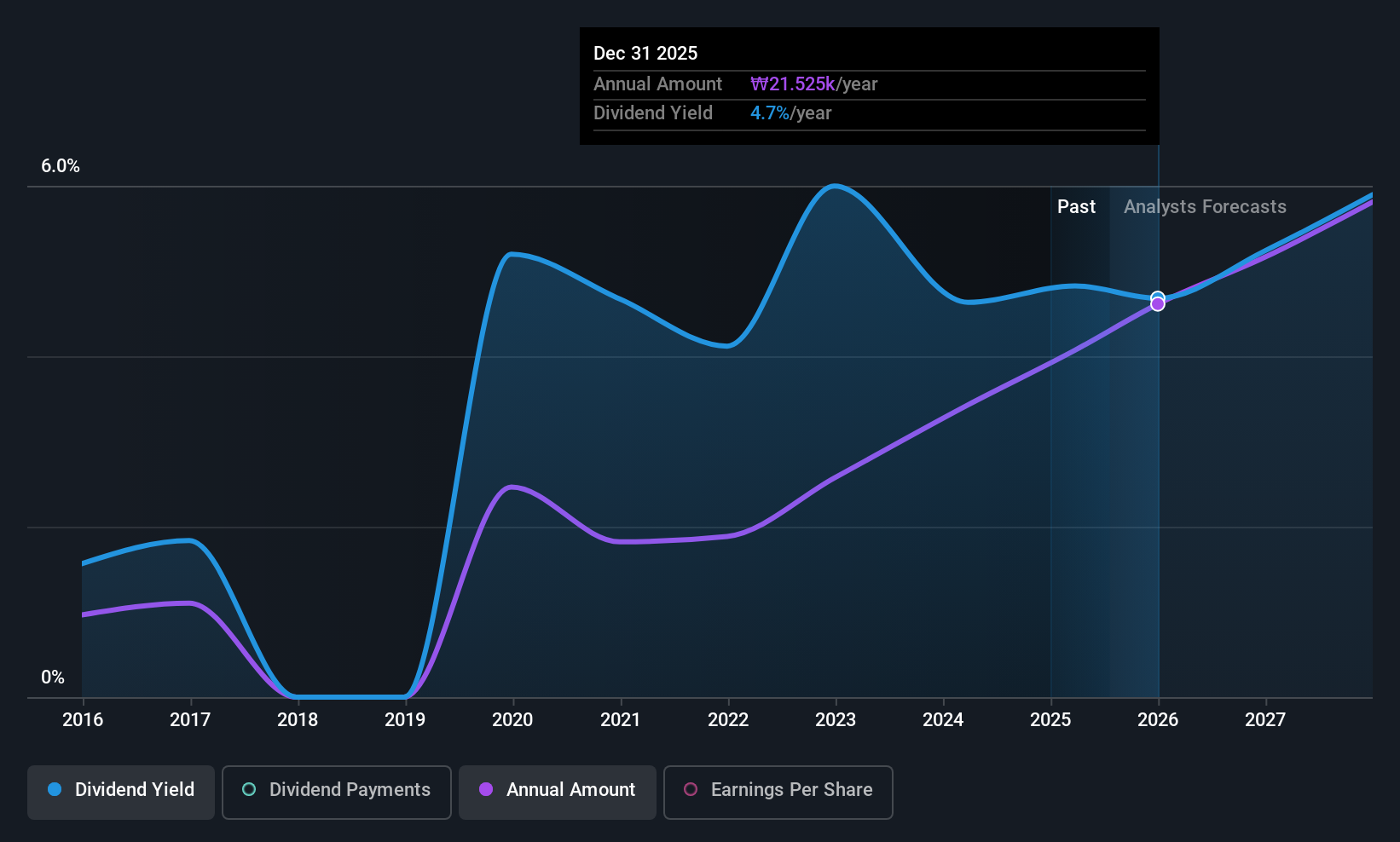

GS Holdings (KOSE:A078930)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GS Holdings Corp., along with its subsidiaries, operates in the energy, power generation, retail, service, construction, and infrastructure sectors with a market cap of approximately ₩5.01 trillion.

Operations: GS Holdings Corp.'s revenue is primarily derived from its Distribution segment at ₩11.39 billion, followed by the Gas and Electric Business at ₩7.43 billion, and Trade at ₩3.91 billion.

Dividend Yield: 5.1%

GS Holdings' dividend yield ranks in the top 25% of Korean market payers, supported by a sustainable payout ratio of 63.7% from earnings and 47.4% from cash flows. Despite only three years of dividend history, payments have been stable and growing. The stock trades at a significant discount to its estimated fair value, although recent profit margins have decreased to 1.6% from last year's 5.2%, potentially impacting future dividends.

- Delve into the full analysis dividend report here for a deeper understanding of GS Holdings.

- In light of our recent valuation report, it seems possible that GS Holdings is trading behind its estimated value.

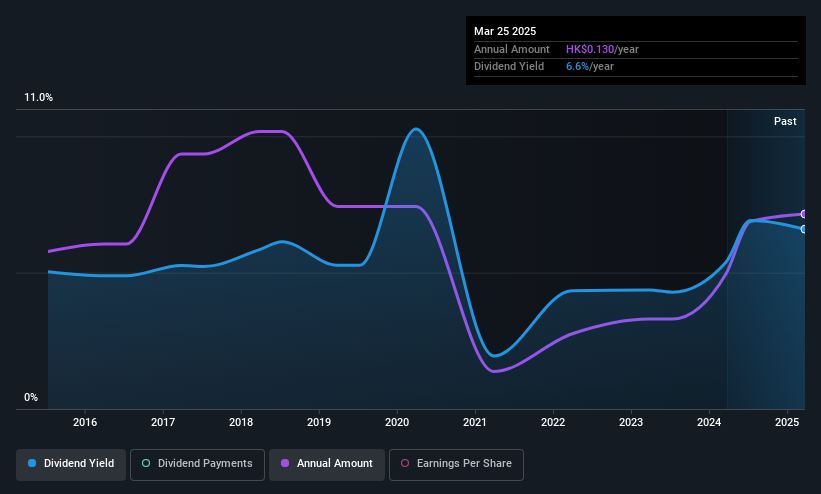

Pico Far East Holdings (SEHK:752)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pico Far East Holdings Limited is an investment holding company involved in exhibition, event, and brand activation services, as well as visual branding and themed environments, with a market cap of HK$3.31 billion.

Operations: Pico Far East Holdings Limited generates its revenue from several segments, including Exhibition, Event and Brand Activation (HK$6.21 billion), Museum and Themed Entertainment (HK$552.41 million), Visual Branding Activation (HK$263.23 million), and Meeting Architecture Activation (HK$164.10 million).

Dividend Yield: 5%

Pico Far East Holdings announced an interim cash dividend of HK$0.055 per share, with a payout ratio of 42.7% indicating sustainability from earnings and a low cash payout ratio of 17.9%. Despite trading at a significant discount to its estimated fair value, the dividend yield is lower than the top Hong Kong payers and has been volatile over the past decade. Recent earnings growth, with sales reaching HK$3.47 billion, supports current dividends but past instability remains a concern for reliability.

- Click to explore a detailed breakdown of our findings in Pico Far East Holdings' dividend report.

- Our expertly prepared valuation report Pico Far East Holdings implies its share price may be lower than expected.

Seize The Opportunity

- Take a closer look at our Top Asian Dividend Stocks list of 1198 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A078930

GS Holdings

Together its subsidiaries, engages in the energy, power generation, retail, service, construction, and infrastructure businesses.

Good value with adequate balance sheet and pays a dividend.

Market Insights

Community Narratives