- United Kingdom

- /

- Tech Hardware

- /

- AIM:CNC

3 UK Penny Stocks With Market Caps Under £200M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping due to weak trade data from China, highlighting global economic uncertainties. In such conditions, investors often seek opportunities in lesser-known areas of the market that may offer potential growth at lower price points. Penny stocks, despite being a term from earlier trading days, continue to represent an intriguing segment for investors interested in smaller or newer companies that can provide value through strong financials and growth potential.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.235 | £306.34M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.794 | £1.11B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.418 | £45.23M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.871 | £322.08M | ✅ 4 ⚠️ 3 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.55 | £127.67M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.11 | £177.08M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.835 | £11.5M | ✅ 4 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.24 | £69.27M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.265 | £854.97M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 296 stocks from our UK Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Anglo Asian Mining (AIM:AAZ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Anglo Asian Mining PLC, with a market cap of £193.07 million, owns and operates gold, silver, and copper producing properties in the Republic of Azerbaijan.

Operations: The company's revenue is primarily generated from its mining operations, which amounted to $39.59 million.

Market Cap: £193.07M

Anglo Asian Mining PLC, with a market cap of £193.07 million, is navigating challenges typical for penny stocks. The company reported a net loss of US$17.5 million for 2024 despite generating US$39.59 million in revenue from its mining operations in Azerbaijan. Recent developments include the commencement of production at the Gilar underground mine, which is expected to bolster output as it ramps up to target monthly ore production between 50,000 and 60,000 tonnes. While Anglo Asian has satisfactory short-term asset coverage and stable board experience, its high volatility and negative return on equity highlight ongoing financial pressures.

- Unlock comprehensive insights into our analysis of Anglo Asian Mining stock in this financial health report.

- Evaluate Anglo Asian Mining's prospects by accessing our earnings growth report.

Concurrent Technologies (AIM:CNC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Concurrent Technologies Plc designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers across various international markets, with a market cap of £172.86 million.

Operations: The company's revenue is primarily generated from the design, manufacture, and supply of high-end embedded computer products, totaling £40.32 million.

Market Cap: £172.86M

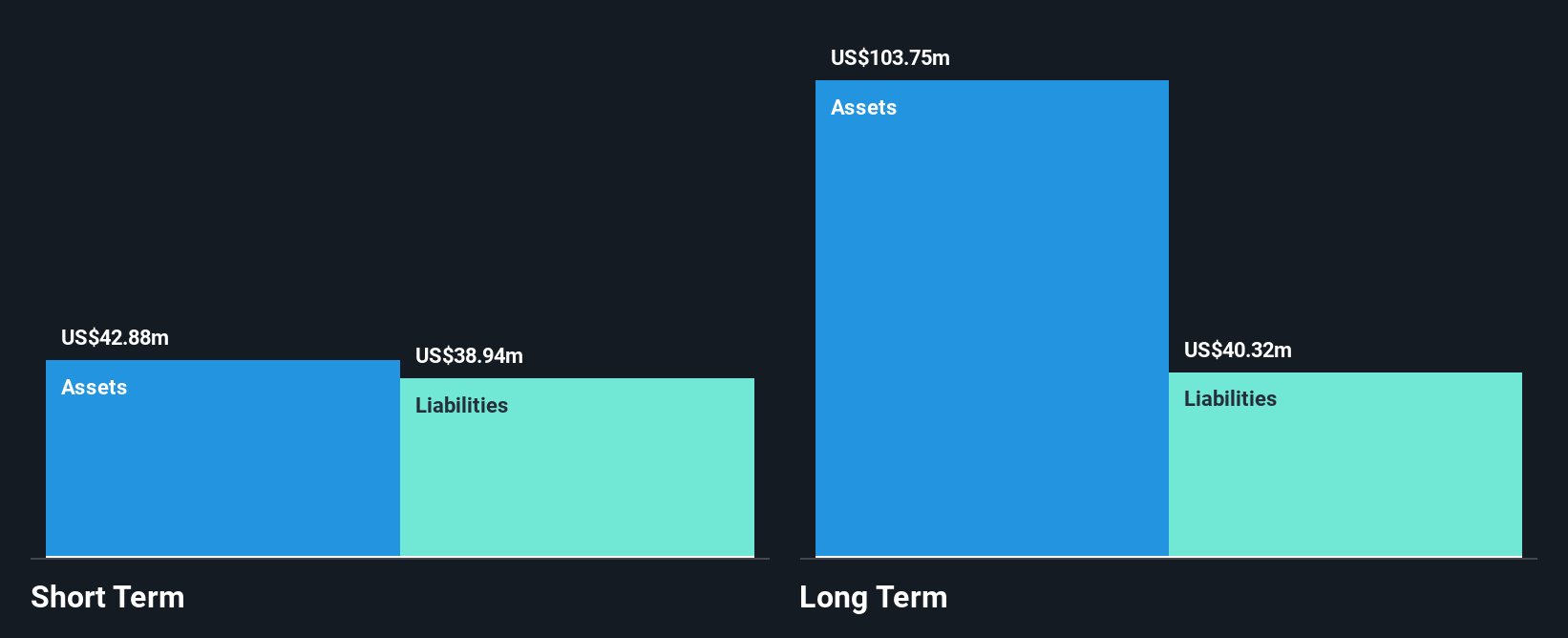

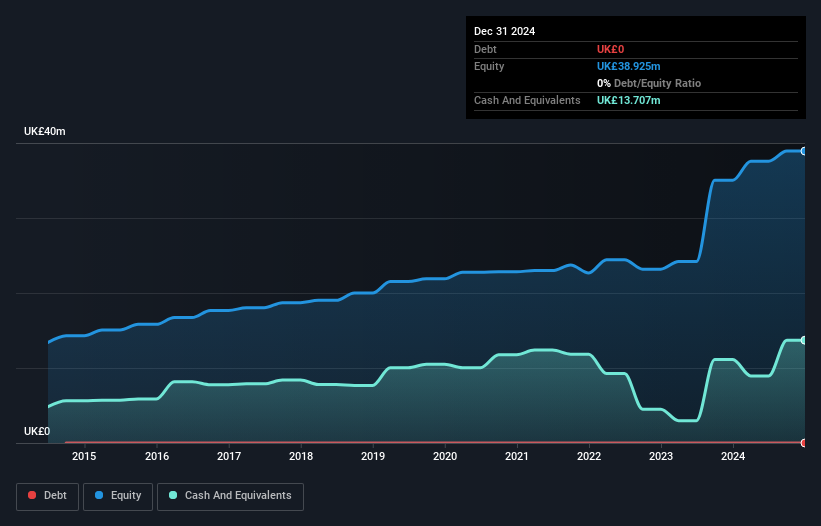

Concurrent Technologies Plc, with a market cap of £172.86 million, has demonstrated strong financial health and growth potential among penny stocks. The company reported sales of £40.32 million for 2024, reflecting a significant earnings increase of 48.8% over the past year, surpassing industry averages. Concurrent's debt-free status enhances its financial stability, while its experienced management team supports strategic execution. Recent shareholder approval for a dividend increase to 1.1 pence per share underscores confidence in sustained profitability and cash flow generation capabilities despite low return on equity at 12.1%. Short-term assets comfortably cover both short- and long-term liabilities.

- Click to explore a detailed breakdown of our findings in Concurrent Technologies' financial health report.

- Learn about Concurrent Technologies' future growth trajectory here.

Invinity Energy Systems (AIM:IES)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Invinity Energy Systems plc manufactures and sells vanadium flow batteries and related hardware for energy storage markets across Asia, Australia, Europe, and North America, with a market cap of £110.14 million.

Operations: The company's revenue is derived entirely from its Batteries / Battery Systems segment, totaling £5.02 million.

Market Cap: £110.14M

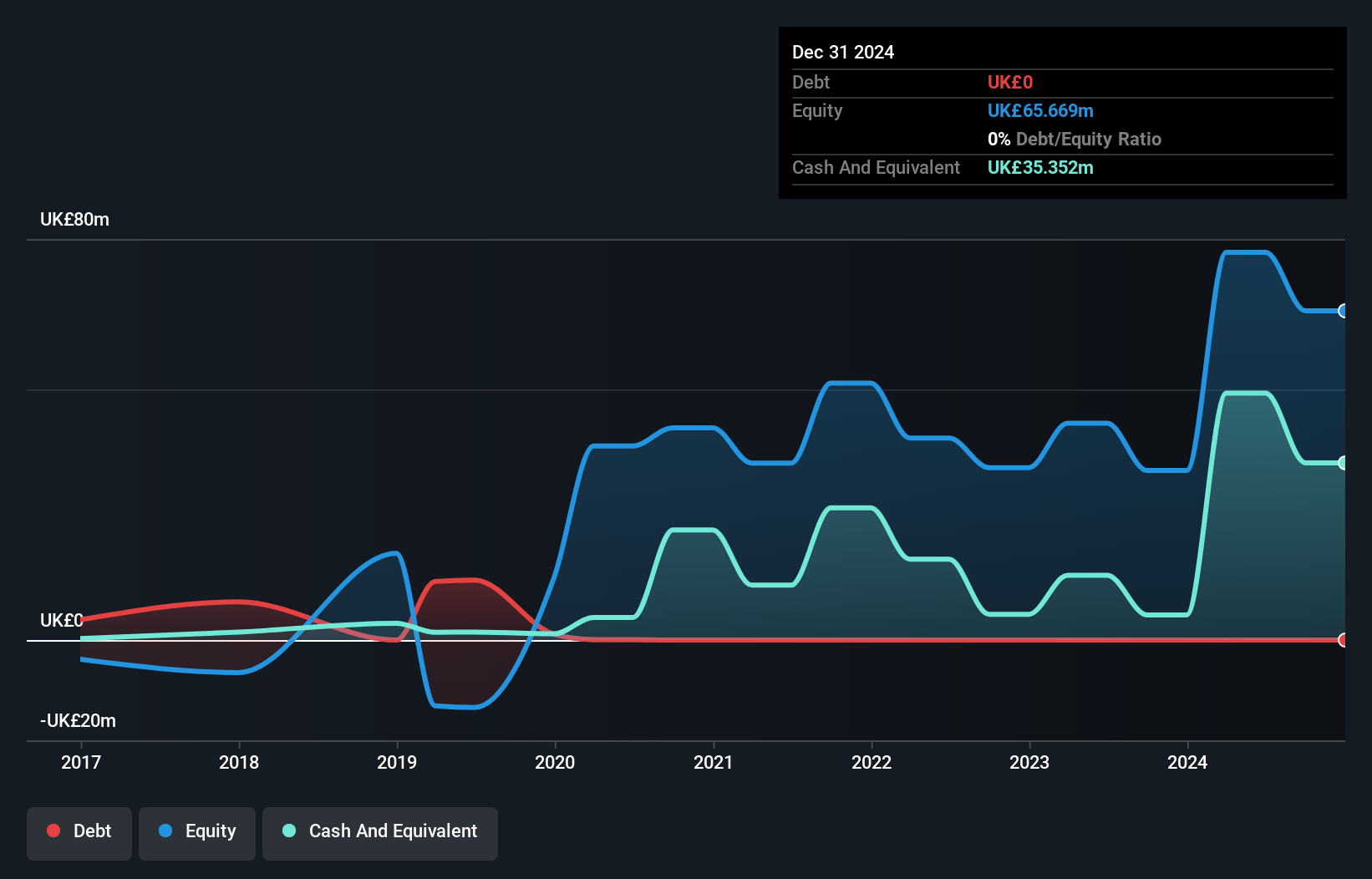

Invinity Energy Systems, with a market cap of £110.14 million, faces challenges typical of penny stocks but also shows potential through strategic initiatives. Despite reporting a significant net loss and reduced sales to £5.02 million in 2024 from the previous year, the company's focus on vanadium flow batteries has attracted substantial interest from UK developers under the LDES Cap and Floor Scheme. This interest could translate into future orders if bids succeed. Recent board changes bring experienced oversight, while its debt-free status and sufficient cash runway provide some financial resilience amidst high share price volatility.

- Take a closer look at Invinity Energy Systems' potential here in our financial health report.

- Gain insights into Invinity Energy Systems' future direction by reviewing our growth report.

Key Takeaways

- Jump into our full catalog of 296 UK Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:CNC

Concurrent Technologies

Designs, develops, manufactures, and markets single board computers for system integrators and original equipment manufacturers in the United Kingdom, the United States, Malaysia, Germany, rest of Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives