- United States

- /

- Diversified Financial

- /

- NYSE:CPAY

3 Stocks That Investors Might Be Undervaluing By An Estimated 15.7% To 46.8%

Reviewed by Simply Wall St

As the S&P 500 and Nasdaq reach record highs, investors are keenly observing market movements amid ongoing economic developments such as the Federal Reserve's interest rate cuts and a prolonged government shutdown. In this buoyant yet uncertain environment, identifying undervalued stocks can be an effective strategy for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $135.08 | $260.69 | 48.2% |

| Metropolitan Bank Holding (MCB) | $75.49 | $150.26 | 49.8% |

| McGraw Hill (MH) | $12.50 | $24.53 | 49% |

| Investar Holding (ISTR) | $22.985 | $45.40 | 49.4% |

| Hess Midstream (HESM) | $33.43 | $66.31 | 49.6% |

| HCI Group (HCI) | $194.72 | $376.13 | 48.2% |

| First Commonwealth Financial (FCF) | $16.73 | $32.97 | 49.3% |

| First Busey (BUSE) | $23.37 | $45.30 | 48.4% |

| Alnylam Pharmaceuticals (ALNY) | $450.68 | $886.56 | 49.2% |

| AGNC Investment (AGNC) | $10.16 | $19.46 | 47.8% |

Let's take a closer look at a couple of our picks from the screened companies.

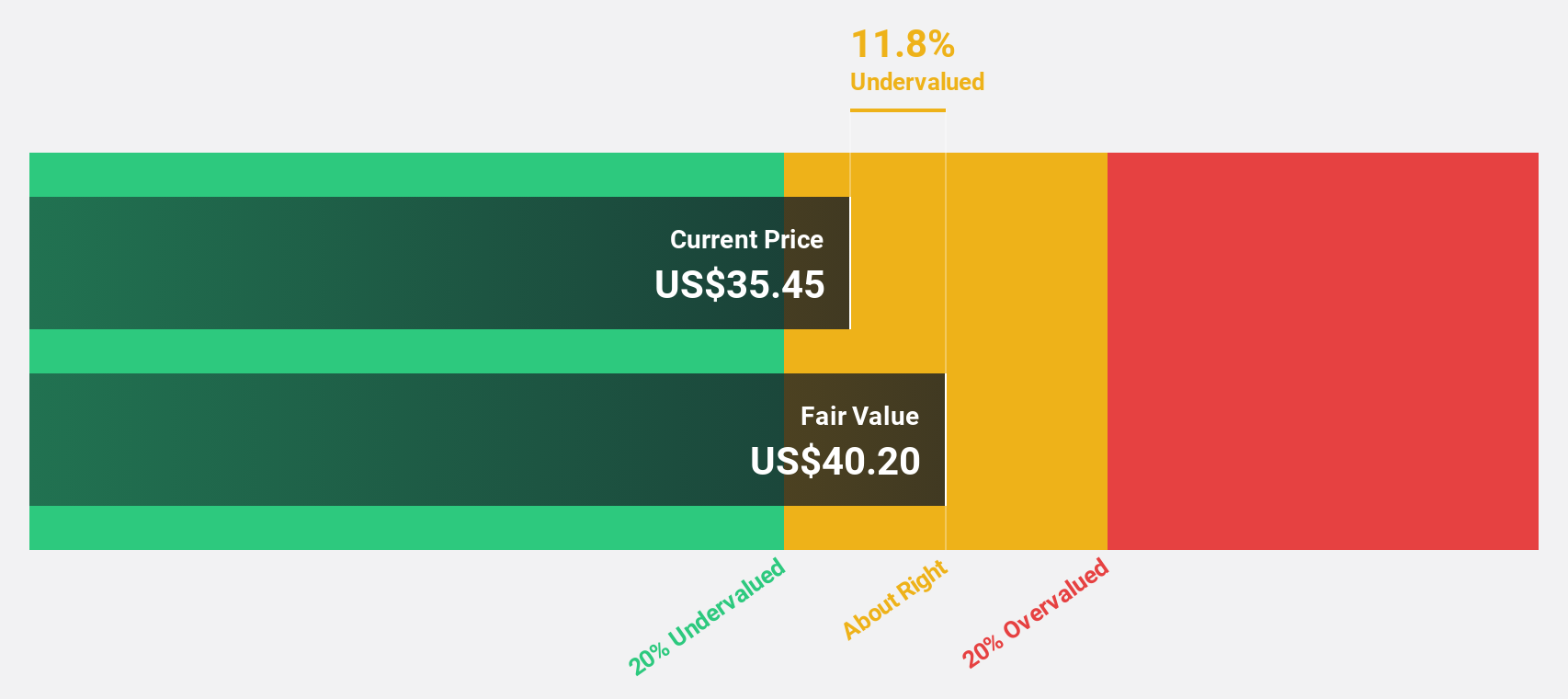

Firefly Aerospace (FLY)

Overview: Firefly Aerospace Inc. is a space and defense technology company offering mission solutions to national security, government, and commercial clients, with a market cap of $4.17 billion.

Operations: Firefly Aerospace Inc. generates revenue of $102.81 million from its Aerospace & Defense segment, serving national security, government, and commercial sectors.

Estimated Discount To Fair Value: 15.7%

Firefly Aerospace is trading at US$31, below its estimated fair value of US$36.77, suggesting potential undervaluation based on cash flows. Despite recent volatility and a significant net loss in the latest quarter, revenue is projected to grow at 44.8% annually, outpacing market averages. The company anticipates profitability within three years and has secured a $10 million NASA contract addendum for lunar data acquisition, enhancing its strategic positioning in aerospace ventures.

- Our comprehensive growth report raises the possibility that Firefly Aerospace is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Firefly Aerospace stock in this financial health report.

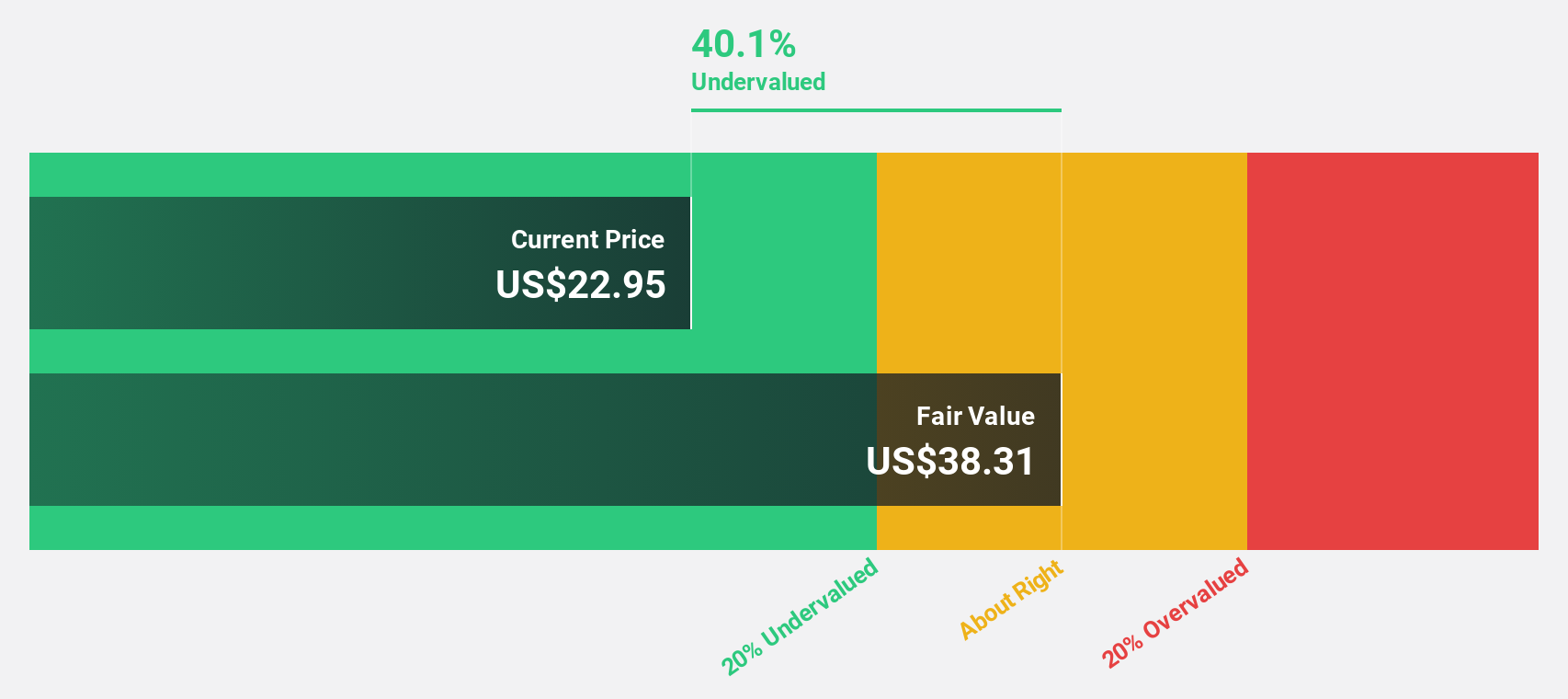

Vertex (VERX)

Overview: Vertex, Inc. offers enterprise tax technology solutions for the retail, wholesale, and manufacturing sectors both in the United States and internationally, with a market cap of $3.95 billion.

Operations: The company's revenue segment is primarily derived from Software & Programming, totaling $710.51 million.

Estimated Discount To Fair Value: 34.5%

Vertex, Inc. is trading at US$25.57, significantly below its estimated fair value of US$39.02, indicating potential undervaluation based on cash flows. Despite a recent net loss and lowered full-year guidance due to extended sales cycles, revenue grew to US$184.56 million in Q2 2025 from the previous year and is expected to grow faster than the overall market at 12.4% annually. Profitability is anticipated within three years with a high forecasted return on equity of 38.3%.

- The growth report we've compiled suggests that Vertex's future prospects could be on the up.

- Dive into the specifics of Vertex here with our thorough financial health report.

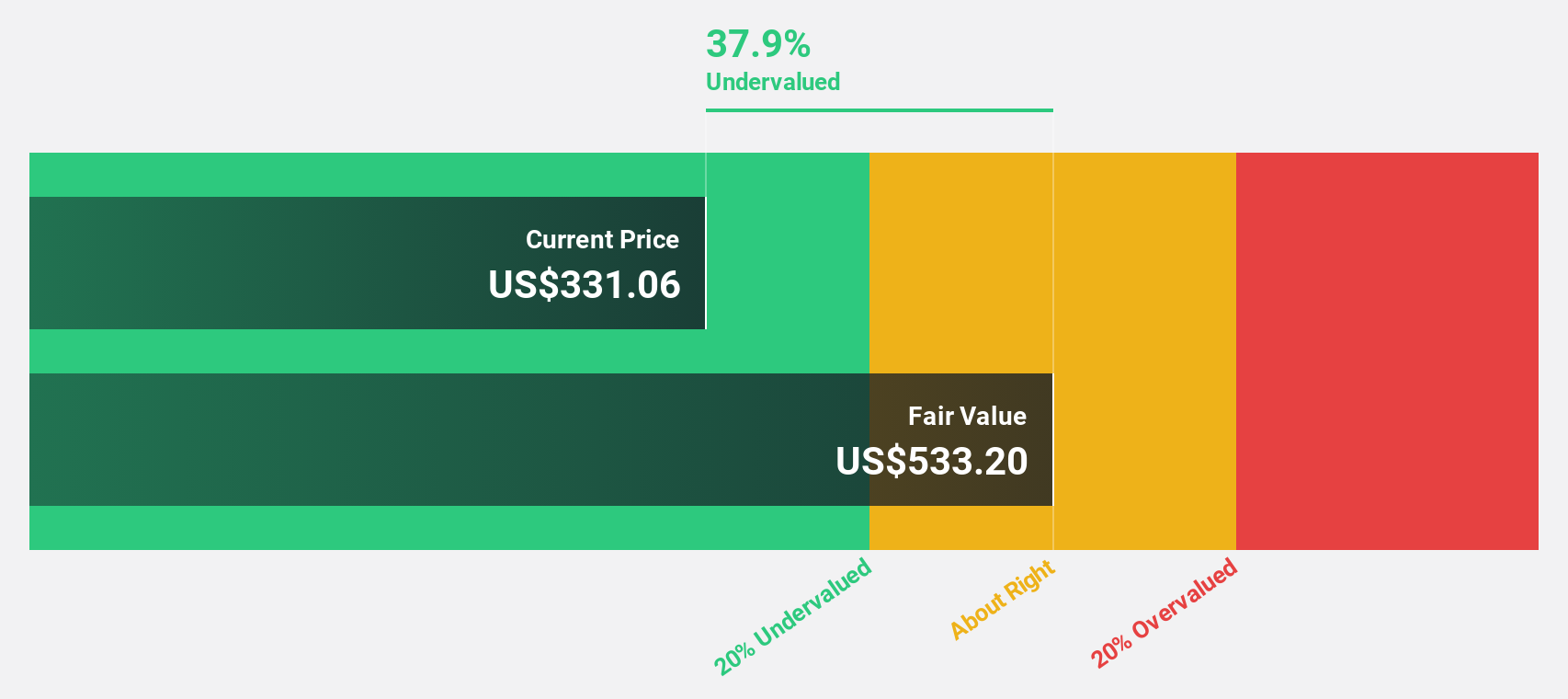

Corpay (CPAY)

Overview: Corpay, Inc. is a payments company that facilitates the management of vehicle-related expenses, lodging expenses, and corporate payments for businesses and consumers in the United States, Brazil, the United Kingdom, and internationally with a market cap of $20.41 billion.

Operations: Corpay's revenue is primarily derived from three segments: Vehicle Payments at $2.02 billion, Corporate Payments at $1.41 billion, and Lodging Payments at $484.93 million.

Estimated Discount To Fair Value: 46.8%

Corpay, Inc. is trading at US$292.27, well below its estimated fair value of US$549.19, highlighting potential undervaluation based on cash flows. Recent strategic expansions with Mastercard and integration into the UK Faster Payment Service enhance global payment capabilities and client offerings. Despite high debt levels, Corpay's earnings are forecasted to grow 17.17% annually, outpacing the market average with a strong expected return on equity of 35.5% within three years.

- Insights from our recent growth report point to a promising forecast for Corpay's business outlook.

- Click here to discover the nuances of Corpay with our detailed financial health report.

Key Takeaways

- Embark on your investment journey to our 184 Undervalued US Stocks Based On Cash Flows selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPAY

Corpay

Operates as a payments company that helps businesses and consumers manage vehicle-related expenses, lodging expenses, and corporate payments in the United States, Brazil, the United Kingdom, and internationally.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.