- United States

- /

- Biotech

- /

- NasdaqGS:MGX

3 Penny Stocks With Market Caps Over $80M To Watch Closely

Reviewed by Simply Wall St

The U.S. stock market has been navigating a wave of uncertainty, with recent tariff threats from President Trump causing fluctuations across major indices such as the Dow Jones, S&P 500, and Nasdaq. Amid these broader market dynamics, penny stocks — often representing smaller or emerging companies — continue to capture investor interest due to their potential for significant growth. This article will explore three noteworthy penny stocks that demonstrate strong financial health and promising prospects in today's complex economic landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.45 | $513.56M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $1.03 | $157.85M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.21 | $238.33M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.75 | $465.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $99.92M | ✅ 3 ⚠️ 2 View Analysis > |

| Safe Bulkers (SB) | $4.05 | $385.71M | ✅ 2 ⚠️ 3 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84154 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.89 | $45.03M | ✅ 2 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.2853 | $27.24M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 419 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Alector (ALEC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Alector, Inc. is a late-stage clinical biotechnology company that develops therapies to combat neurodegenerative diseases, with a market cap of approximately $165 million.

Operations: The company generates revenue from its Biotechnology segment, totaling $88.34 million.

Market Cap: $164.99M

Alector, Inc., a biotechnology company with a market cap of approximately US$165 million, has been added to several Russell indexes, enhancing its visibility among investors. Despite being unprofitable and experiencing significant insider selling recently, Alector's financial stability is supported by short-term assets exceeding liabilities and sufficient cash runway for over two years. The company's strategic collaborations with GSK on late-stage clinical trials could potentially drive future growth. However, the stock remains highly volatile and carries inherent risks typical of penny stocks in the biotech sector.

- Get an in-depth perspective on Alector's performance by reading our balance sheet health report here.

- Gain insights into Alector's future direction by reviewing our growth report.

Metagenomi (MGX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Metagenomi, Inc. is a genetic medicines company that develops therapeutics using a metagenomics-derived genome editing toolbox in the United States and has a market cap of $87.10 million.

Operations: Metagenomi generates revenue of $45.26 million from its segment focused on developing next-generation gene-editing technologies and therapies.

Market Cap: $87.1M

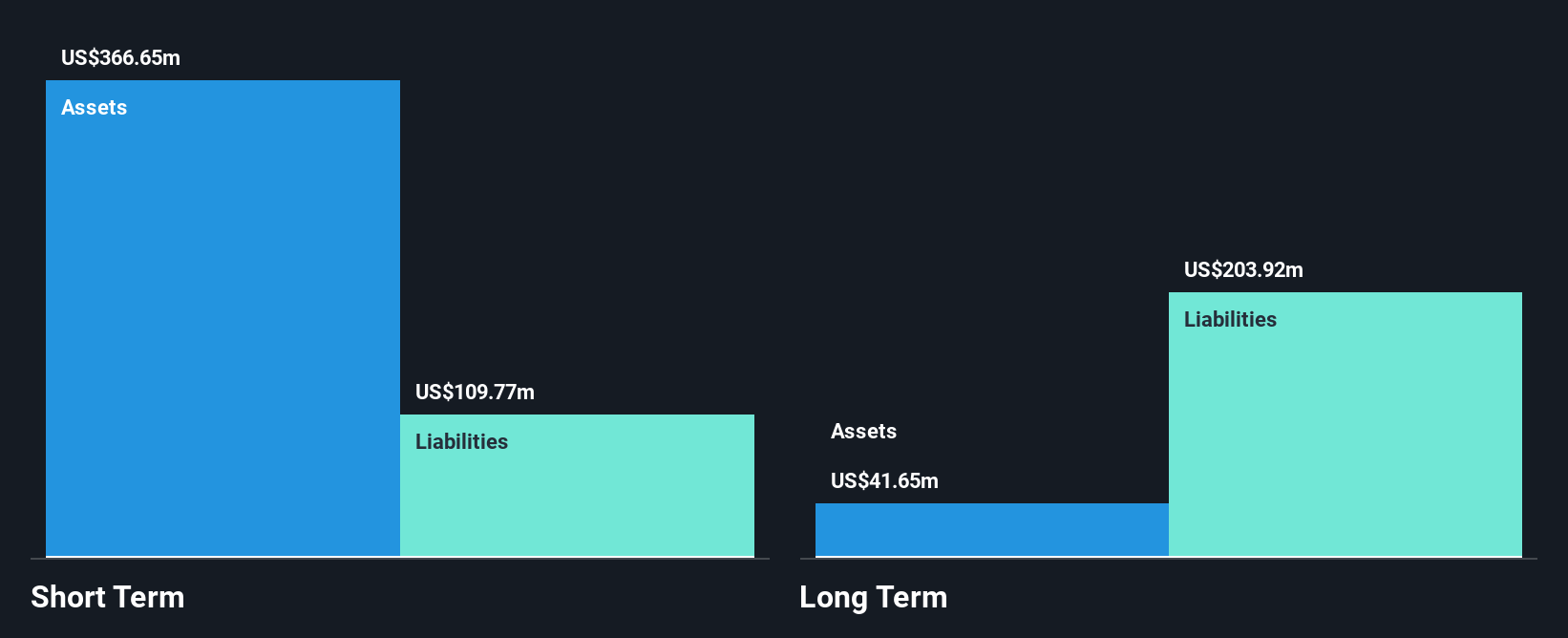

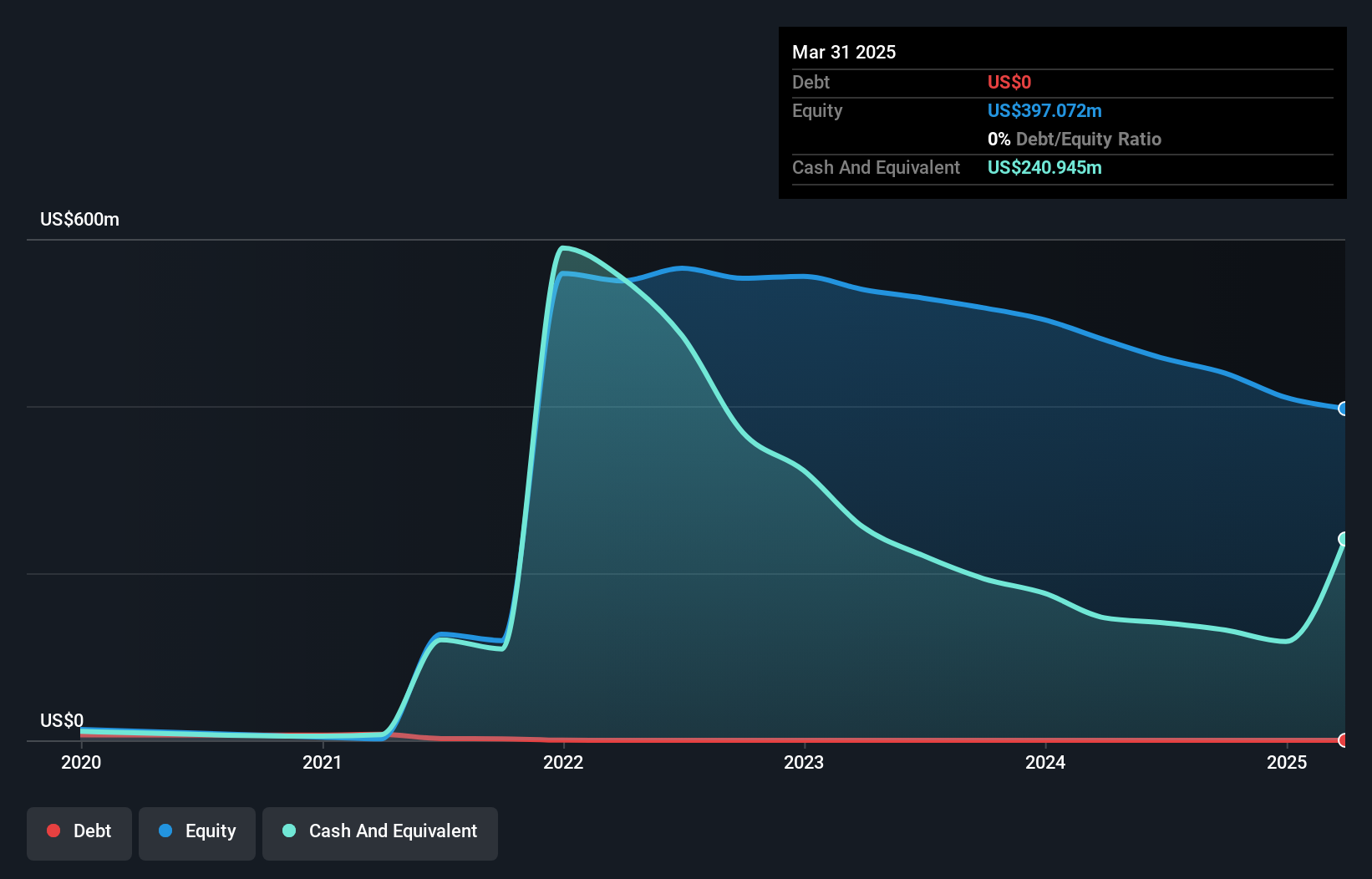

Metagenomi, Inc., with a market cap of US$87.10 million, has been dropped from multiple Russell indexes, potentially impacting its visibility among investors. The company remains unprofitable with increasing losses and is not expected to achieve profitability in the near term. Despite this, Metagenomi's financial position shows strength as short-term assets significantly exceed liabilities and it is debt-free. Recent advancements in gene-editing technologies highlight its potential for innovation in precision medicines, though volatility remains high. The management team is relatively experienced; however, the board lacks tenure which may influence strategic direction stability.

- Unlock comprehensive insights into our analysis of Metagenomi stock in this financial health report.

- Understand Metagenomi's earnings outlook by examining our growth report.

Solid Power (SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. focuses on developing solid-state battery technologies for electric vehicles and other markets in the United States, with a market cap of $462.75 million.

Operations: The company's revenue is derived entirely from its Auto Parts & Accessories segment, totaling $20.20 million.

Market Cap: $462.75M

Solid Power, Inc., with a market cap of US$462.75 million, has been added to several Russell growth indexes, enhancing its visibility among investors. Despite being unprofitable and having a negative return on equity of -22.78%, the company is debt-free and maintains a strong financial position with short-term assets of US$249.3 million exceeding liabilities. Revenue from its Auto Parts & Accessories segment reached US$20.20 million, though earnings are projected to decline slightly over the next three years. The management team is relatively new, while the board is experienced with an average tenure of 3.5 years.

- Click here and access our complete financial health analysis report to understand the dynamics of Solid Power.

- Assess Solid Power's future earnings estimates with our detailed growth reports.

Turning Ideas Into Actions

- Click here to access our complete index of 419 US Penny Stocks.

- Looking For Alternative Opportunities? We've found 16 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MGX

Metagenomi

A genetic medicines company, develops therapeutics for patients using metagenomics-derived genome editing toolbox in the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives