As European markets navigate the complexities of recent tariff announcements and economic fluctuations, the pan-European STOXX Europe 600 Index has shown resilience, ending higher amid hopes for new trade deals. However, with looming threats of increased tariffs from the U.S., investors are keenly observing how these developments might impact dividend-paying stocks. In such a climate, selecting dividend stocks that offer stability and consistent returns can be a strategic approach to mitigating market volatility while capitalizing on potential income opportunities.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.10% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.71% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.91% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.54% | ★★★★★★ |

| ERG (BIT:ERG) | 5.49% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 4.11% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.63% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.46% | ★★★★★★ |

Click here to see the full list of 231 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

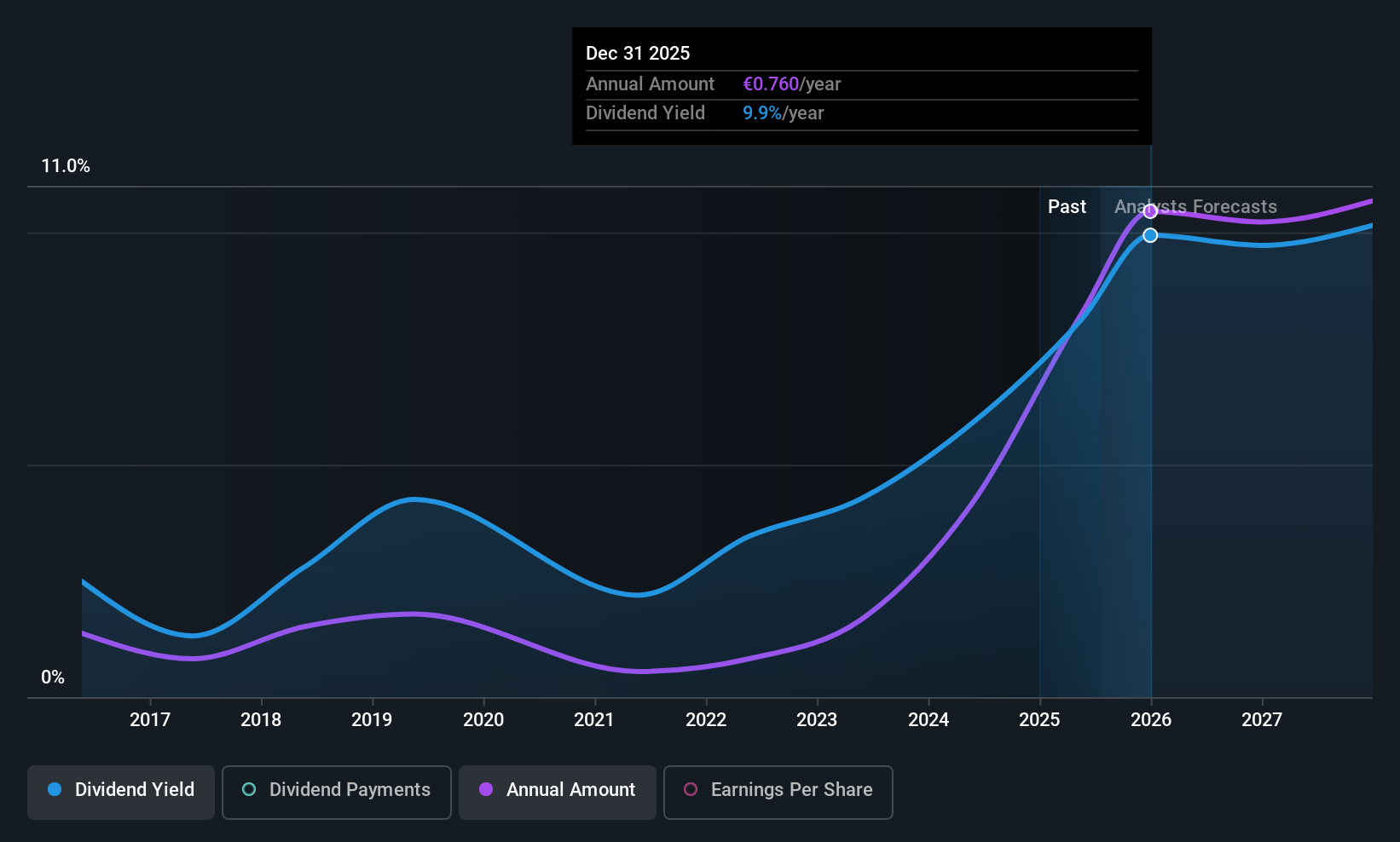

BPER Banca (BIT:BPE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BPER Banca SpA offers a range of banking products and services to individuals, businesses, and professionals in Italy and internationally, with a market cap of €11.17 billion.

Operations: BPER Banca SpA's revenue segments include €1.50 billion from net interest income, €1.10 billion from net commission income, and €0.30 billion from other banking income.

Dividend Yield: 7.6%

BPER Banca's dividend yield of 7.6% places it among the top 25% of Italian dividend payers, although its track record is marked by volatility and a history of less than ten years. The current payout ratio of 61.2% suggests dividends are covered by earnings, with forecasts indicating continued coverage at 78.6%. However, the bank's high level of bad loans at 2.2% may pose risks to sustainability despite trading below estimated fair value and offering good relative value compared to peers.

- Get an in-depth perspective on BPER Banca's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that BPER Banca is priced lower than what may be justified by its financials.

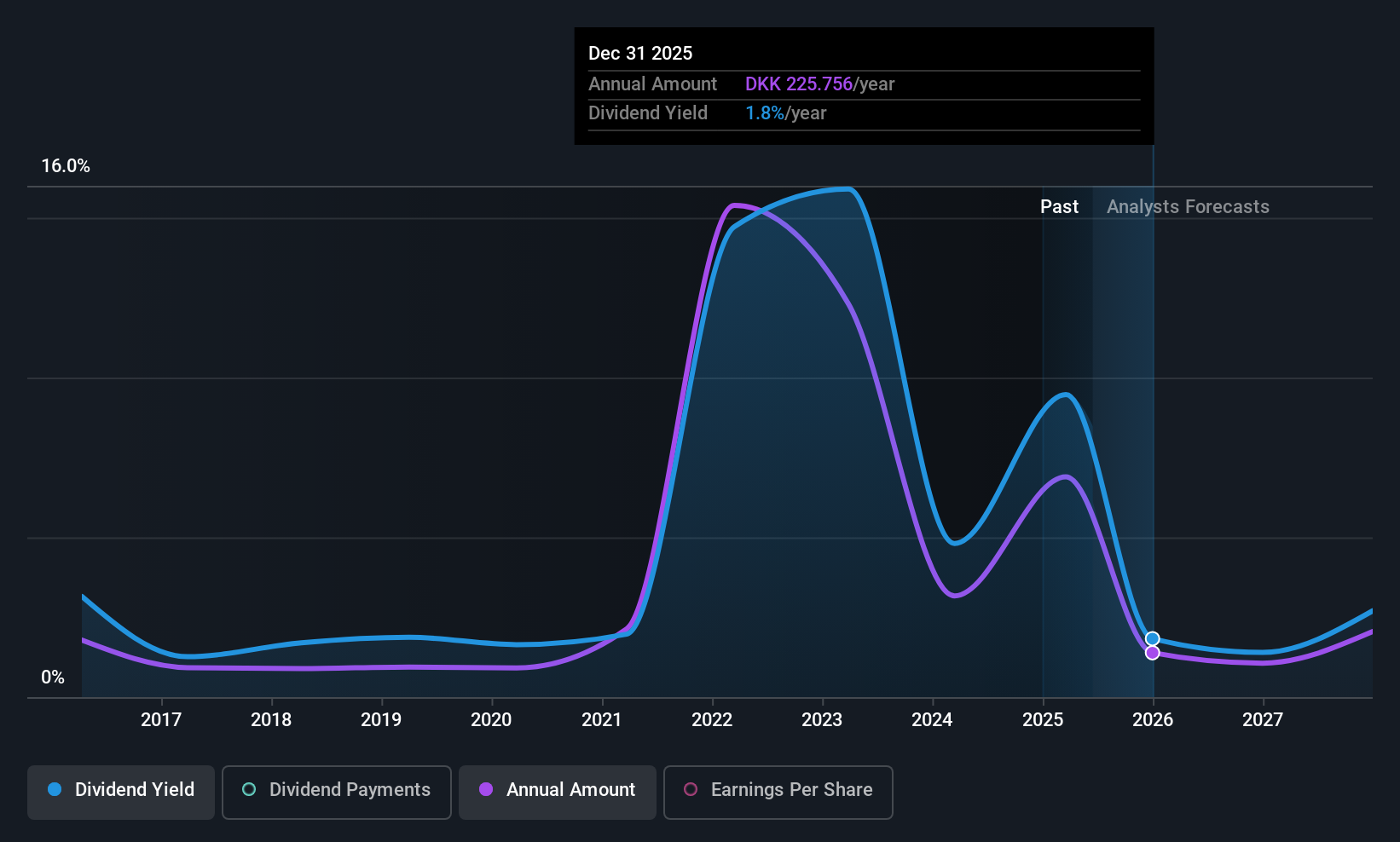

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: A.P. Møller - Mærsk A/S operates as an integrated logistics company in Denmark and internationally, with a market cap of DKK188.45 billion.

Operations: A.P. Møller - Mærsk A/S generates revenue from various segments, including Ocean ($38.29 billion), Terminals ($4.70 billion), and Logistics & Services ($14.90 billion).

Dividend Yield: 7.9%

A.P. Møller - Mærsk offers a dividend yield of 7.93%, ranking it in the top 25% of Danish dividend payers, but its dividends have been volatile over the past decade. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios at 34.4% and 28.8%, respectively. Recent earnings growth has been strong; however, future forecasts suggest significant declines in earnings, potentially impacting dividend sustainability despite current low trading valuation relative to fair value estimates.

- Dive into the specifics of A.P. Møller - Mærsk here with our thorough dividend report.

- Our valuation report here indicates A.P. Møller - Mærsk may be undervalued.

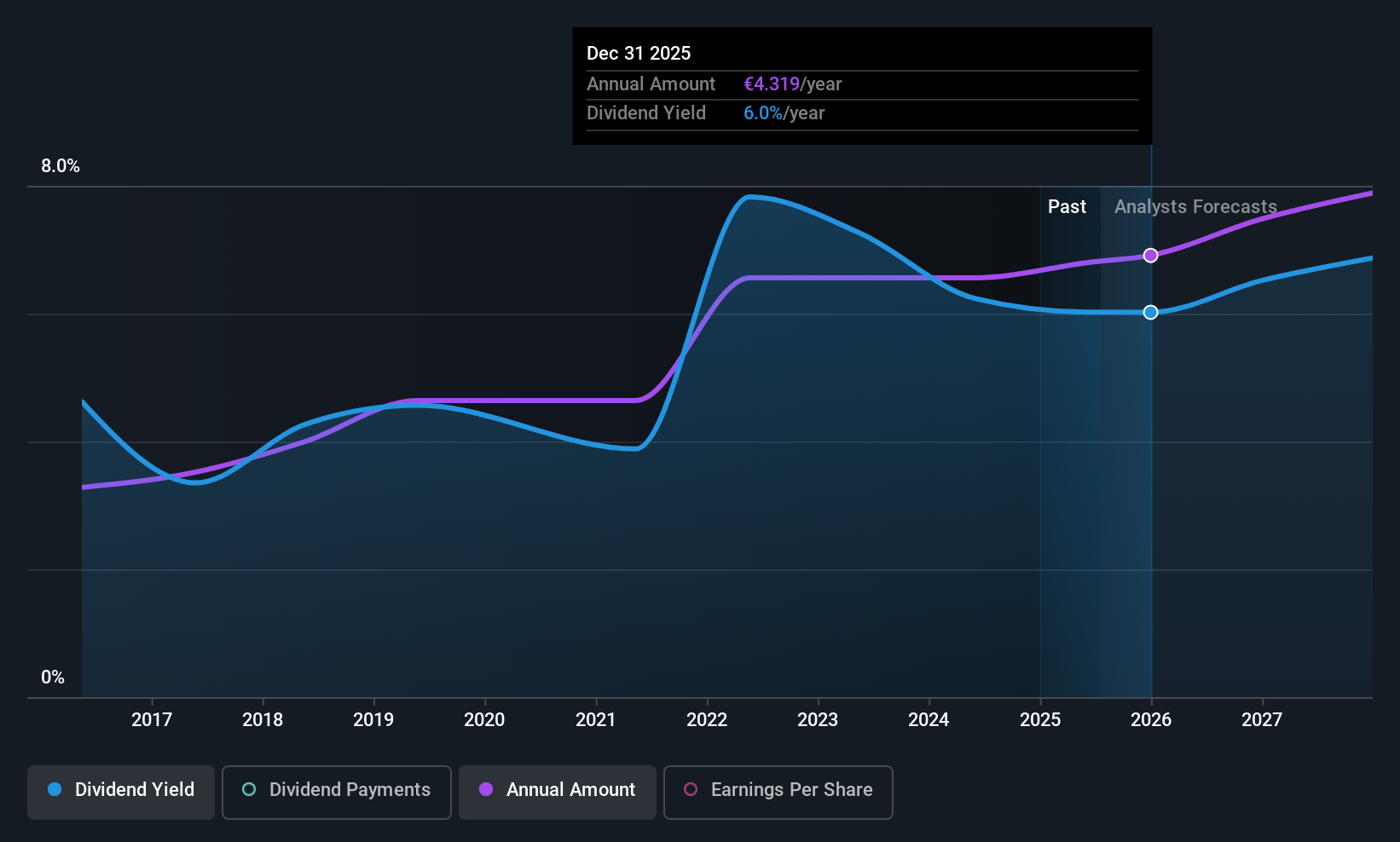

Amundi (ENXTPA:AMUN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Amundi is a publicly owned investment manager with a market cap of €14.54 billion.

Operations: Amundi generates its revenue primarily from its Asset Management segment, amounting to €6.74 billion.

Dividend Yield: 5.9%

Amundi's dividend yield of 5.95% places it in the top 25% of French dividend payers, supported by a payout ratio of 66.7%, indicating coverage by earnings and cash flows (56.8%). However, its dividends have been volatile over nine years, lacking stability despite recent revenue growth to €912 million in Q1 2025 from €824 million a year ago. Trading at a price-to-earnings ratio of 11.3x, Amundi offers good value compared to peers.

- Unlock comprehensive insights into our analysis of Amundi stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Amundi shares in the market.

Where To Now?

- Discover the full array of 231 Top European Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BPER Banca might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:BPE

BPER Banca

Provides banking products and services for individuals, and businesses and professionals in Italy and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives