- Taiwan

- /

- Tech Hardware

- /

- TWSE:2059

3 Asian Stocks Estimated To Be Up To 35.3% Below Intrinsic Value

Reviewed by Simply Wall St

Amidst the backdrop of global trade tensions and muted market reactions to new tariffs, Asian markets have experienced a mix of challenges and opportunities. With investor sentiment influenced by economic data releases and policy shifts, identifying undervalued stocks has become increasingly important for those seeking potential value in the region. In this environment, a good stock is often characterized by strong fundamentals that suggest it may be trading below its intrinsic value, offering potential for future appreciation despite current market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| SILICON2 (KOSDAQ:A257720) | ₩52800.00 | ₩104187.44 | 49.3% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥52.55 | CN¥103.62 | 49.3% |

| Peijia Medical (SEHK:9996) | HK$7.93 | HK$15.57 | 49.1% |

| Nanya New Material TechnologyLtd (SHSE:688519) | CN¥42.94 | CN¥85.38 | 49.7% |

| Medy-Tox (KOSDAQ:A086900) | ₩162200.00 | ₩322233.66 | 49.7% |

| Mandom (TSE:4917) | ¥1419.00 | ¥2835.57 | 50% |

| Livero (TSE:9245) | ¥1727.00 | ¥3430.34 | 49.7% |

| Hugel (KOSDAQ:A145020) | ₩355000.00 | ₩698441.84 | 49.2% |

| HL Holdings (KOSE:A060980) | ₩41500.00 | ₩82181.95 | 49.5% |

| ALUX (KOSDAQ:A475580) | ₩11500.00 | ₩22593.59 | 49.1% |

Here we highlight a subset of our preferred stocks from the screener.

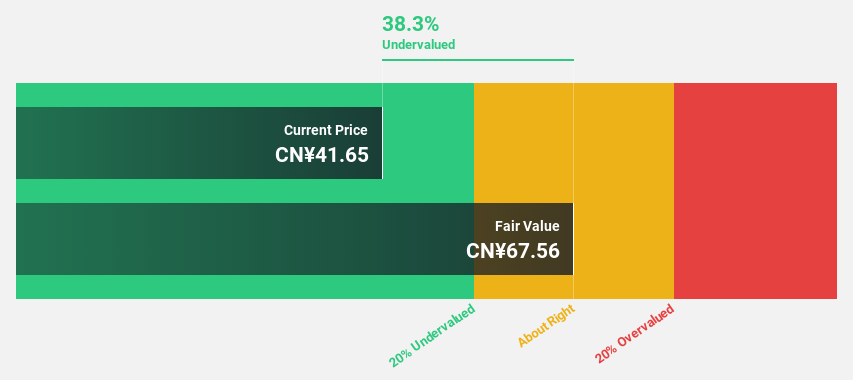

HMT (Xiamen) New Technical Materials (SHSE:603306)

Overview: HMT (Xiamen) New Technical Materials Co., Ltd. operates in the technical materials sector and has a market cap of CN¥13.15 billion.

Operations: The company's revenue from the automobile parts manufacturing industry is CN¥2.28 billion.

Estimated Discount To Fair Value: 35.3%

HMT (Xiamen) New Technical Materials is trading at CNY 44.39, significantly below its estimated fair value of CNY 68.64, suggesting it may be undervalued based on cash flows. Despite a recent dividend decrease and ongoing private placement approvals, the company has shown robust revenue growth, with earnings rising by 16% last year and forecasted to grow over 20% annually. However, its return on equity is expected to remain low at around 10.9%.

- The growth report we've compiled suggests that HMT (Xiamen) New Technical Materials' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of HMT (Xiamen) New Technical Materials.

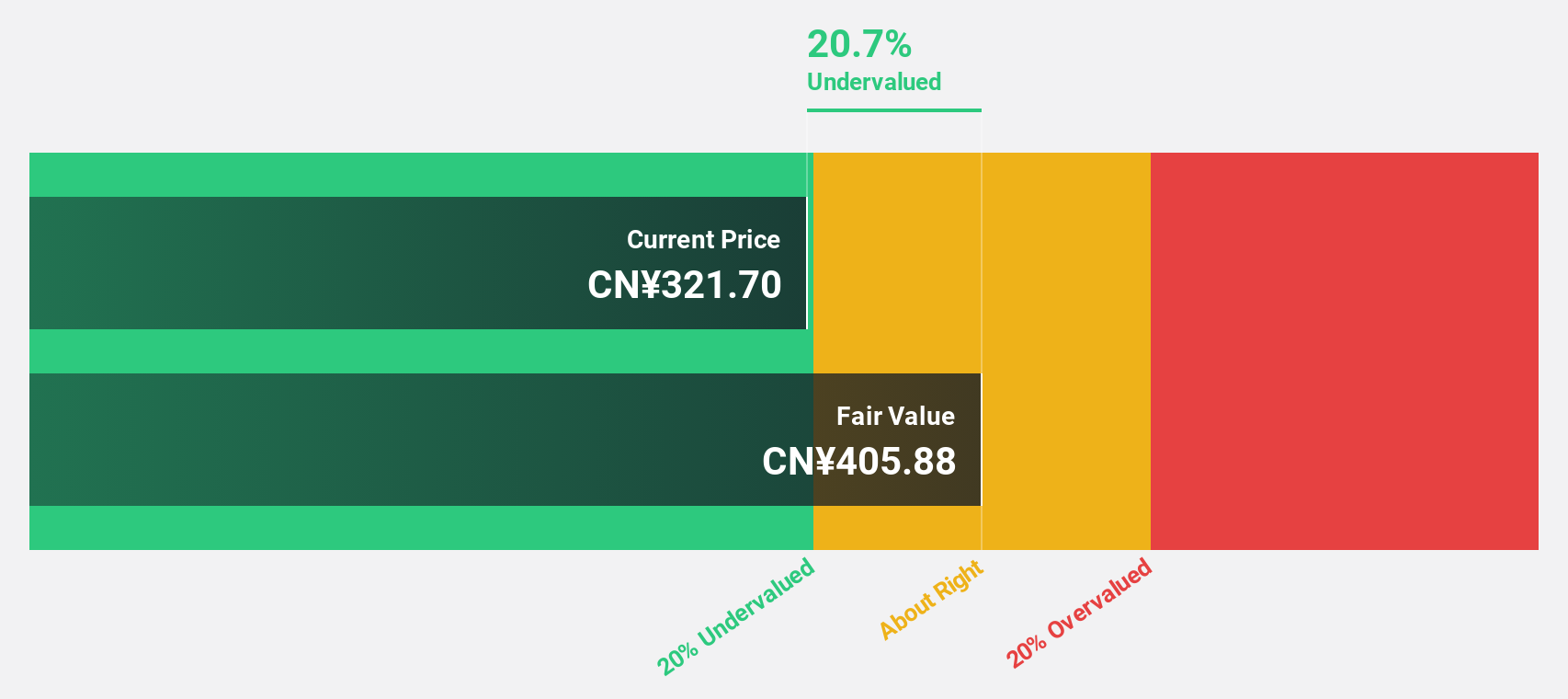

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. focuses on the research, development, production, and sales of beverages in China with a market cap of CN¥155.49 billion.

Operations: The company generates revenue primarily through its production, sales, and wholesale of beverages and pre-packaged foods, totaling CN¥17.20 billion.

Estimated Discount To Fair Value: 26.3%

Eastroc Beverage (Group) is trading at CN¥299.01, well below its estimated fair value of CN¥405.88, highlighting potential undervaluation based on cash flows. The company has experienced significant earnings growth of 65.1% over the past year and is forecasted to continue growing at 22.99% annually, outpacing the market's revenue growth expectations. However, it faces challenges with an unstable dividend track record and recent removal from a major index constituent list in June 2025.

- Insights from our recent growth report point to a promising forecast for Eastroc Beverage(Group)'s business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Eastroc Beverage(Group).

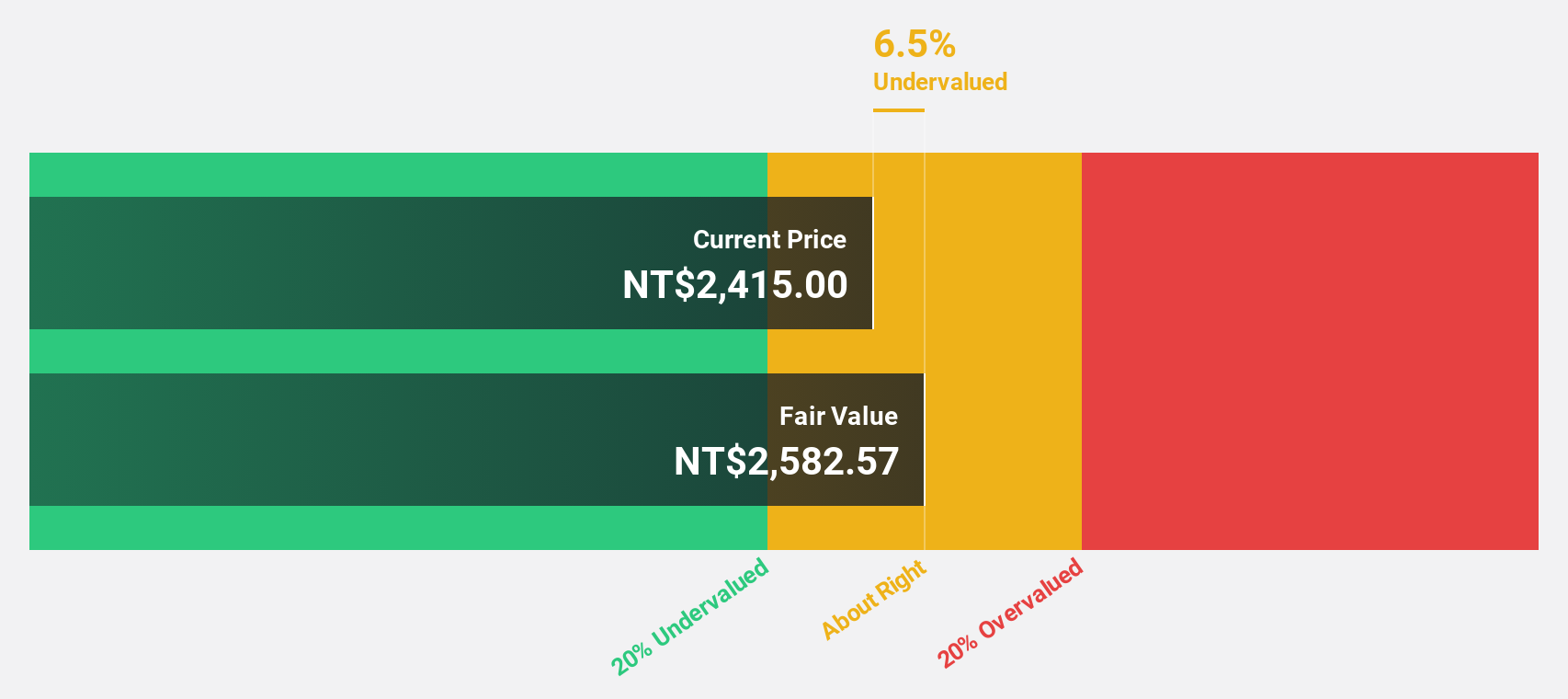

King Slide Works (TWSE:2059)

Overview: King Slide Works Co., Ltd. designs, manufactures, and sells rail kits for computer and network communications equipment, furniture wooden kitchen accessories, slides, and molds across Taiwan, the United States, China, and internationally with a market cap of NT$213.47 billion.

Operations: The company's revenue segments include NT$2.12 billion from King Slide Works Co., Ltd. and NT$10.47 billion from King Slide Technology Co., Ltd.

Estimated Discount To Fair Value: 13.3%

King Slide Works is trading at NT$2,240, slightly below its estimated fair value of NT$2,582.78. The company reported substantial earnings growth over the past year, with net income rising to TWD 2.51 billion in Q1 2025 from TWD 1.39 billion a year prior. Earnings are projected to grow at 14.12% annually, surpassing the TW market's average growth rate and highlighting its potential as an undervalued stock based on cash flows in Asia.

- Our earnings growth report unveils the potential for significant increases in King Slide Works' future results.

- Get an in-depth perspective on King Slide Works' balance sheet by reading our health report here.

Seize The Opportunity

- Click this link to deep-dive into the 253 companies within our Undervalued Asian Stocks Based On Cash Flows screener.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if King Slide Works might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2059

King Slide Works

Designs, manufactures, and sells rail kits for computer and network communications equipment, furniture wooden kitchen accessories, slides, and molds in Taiwan, the United States, China, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives