Narratives are currently in beta

Key Takeaways

- Intel's focus on EUV, new node launches, and portfolio streamlining aims to enhance profitability and efficiency through cost-competitive processes.

- Strategic partnerships and focus on AI performance are designed to capture market share, drive revenue growth, and boost competitiveness.

- Operational disruptions from restructuring, slow AI product adoption, and strategic transitions may pressure Intel's profitability, efficiency, and cash flow.

Catalysts

About Intel- Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

- Intel's transition to EUV and the launch of new nodes like Intel 18A is expected to create a more stable and cost-competitive process environment, potentially enhancing gross margins and overall profitability.

- The formation of the Intel Foundry as an independent subsidiary aims to attract external customers, which could drive future revenue growth through increased foundry services.

- The strategic focus on AI performance and new product releases, such as the Intel Core Ultra 200V Series, aims to capture increased market share and drive revenue growth in the AI and advanced processing sectors.

- The simplification and streamlining of Intel’s product portfolio, alongside the workforce reduction, are expected to unlock efficiencies and lead to a significant reduction in operating expenses, potentially improving net margins.

- Intel's partnerships, like the one with AMD for the x86 ecosystem, are designed to enhance product differentiation and widen market opportunities, potentially boosting future revenues and market competitiveness.

Intel Future Earnings and Revenue Growth

Assumptions

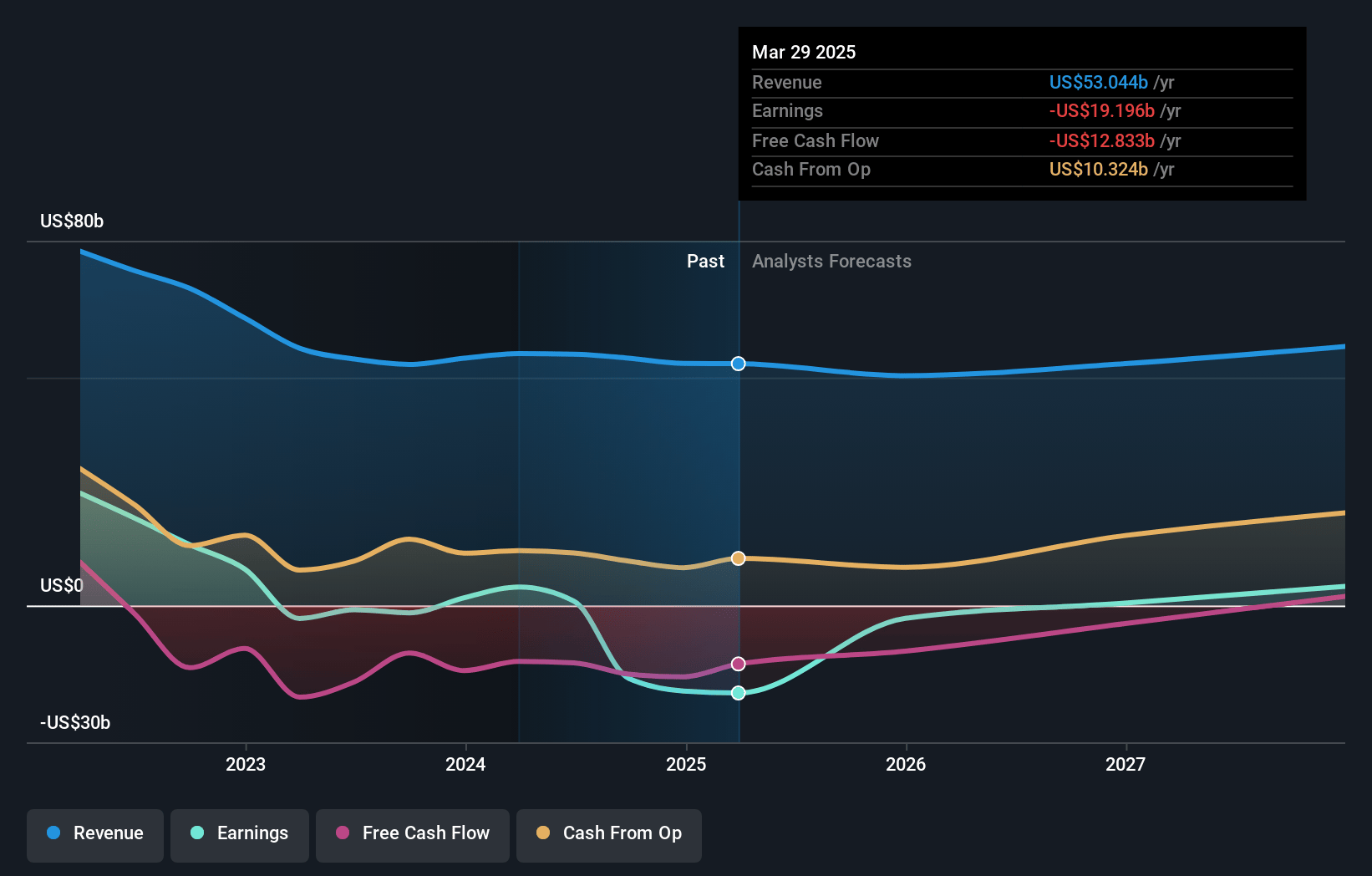

How have these above catalysts been quantified?- Analysts are assuming Intel's revenue will grow by 4.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -29.4% today to 8.1% in 3 years time.

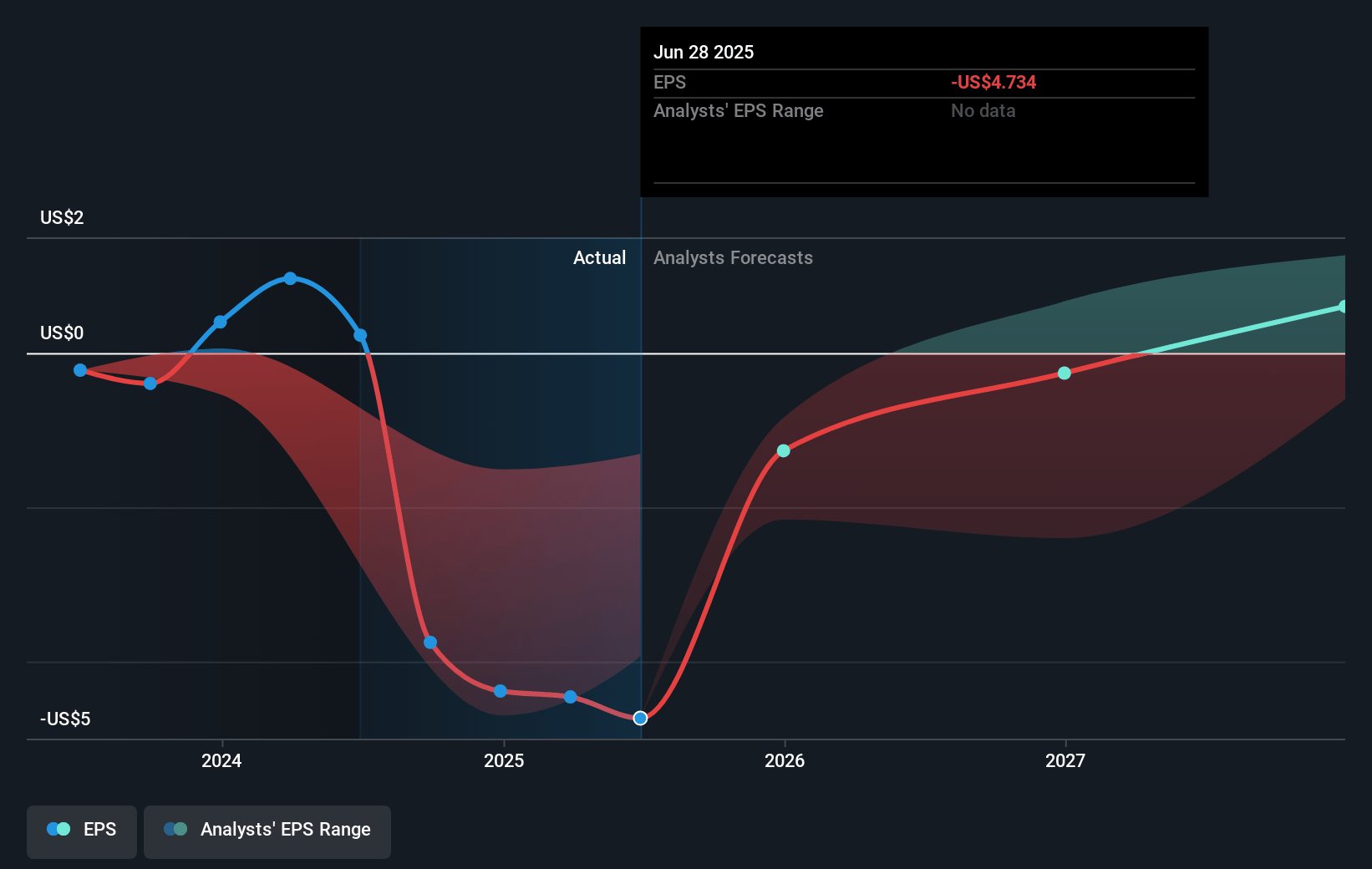

- Analysts expect earnings to reach $5.0 billion (and earnings per share of $1.24) by about November 2027, up from $-16.0 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.5 billion in earnings, and the most bearish expecting $1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 26.1x on those 2027 earnings, up from -6.5x today. This future PE is lower than the current PE for the US Semiconductor industry at 29.0x.

- Analysts expect the number of shares outstanding to decline by 2.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.53%, as per the Simply Wall St company report.

Intel Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intel's gross margin has been significantly impacted by non-cash impairment charges and accelerated depreciation, which may limit profitability in the near term. This could affect earnings guidance and investor confidence.

- The slow adoption and revenue ramp of new AI accelerators like Gaudi 3, coupled with a missed revenue target for Gaudi products, could hamper future revenues and profitability in the AI market.

- Continued restructuring and workforce reductions may create operational disruption and execution risk, impacting operating efficiency and net margins.

- The transition to in-house silicon manufacturing, while strategic, involves substantial capital expenditures and operational adjustments, which could pressure cash flow and net CapEx in the short to medium term.

- The reliance and potential risks associated with external foundry customers and achieving scale in the Intel Foundry segment might complicate revenue generation and impact overall financial performance in this new independent subsidiary.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.68 for Intel based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $31.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $61.8 billion, earnings will come to $5.0 billion, and it would be trading on a PE ratio of 26.1x, assuming you use a discount rate of 9.5%.

- Given the current share price of $24.05, the analyst's price target of $24.68 is 2.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

US$19.66

FV

20.3% overvalued intrinsic discount3.00%

Revenue growth p.a.

42users have liked this narrative

0users have commented on this narrative

12users have followed this narrative

15 days ago author updated this narrative

US$24.48

FV

3.4% undervalued intrinsic discount13.00%

Revenue growth p.a.

7users have liked this narrative

0users have commented on this narrative

11users have followed this narrative

about 1 month ago author updated this narrative

RI

Equity Analyst and Writer

Ambitious Product Roadmap And A Cyclical Recovery In PC Market Will Drive EPS Growth

Key Takeaways Market has low expectations for Intel due to a series of strategic errors in recent years. Market is underestimating Intel’s aggressive strategy to regain product leadership.

View narrativeUS$79.00

FV

70.1% undervalued intrinsic discount10.00%

Revenue growth p.a.

84users have liked this narrative

0users have commented on this narrative

9users have followed this narrative

2 months ago author updated this narrative

US$32.74

FV

27.8% undervalued intrinsic discount19.00%

Revenue growth p.a.

3users have liked this narrative

0users have commented on this narrative

7users have followed this narrative

3 months ago author updated this narrative