Last Update 22 Dec 25

Fair value Increased 1.63%CWEN.A: Solar Acquisition Will Support Future Distributions And Cash Flow Visibility

Analysts have nudged their price target on Clearway Energy modestly higher, with fair value rising to about $37.50 from $36.90 as they gain confidence in management's long term growth execution. They also see upside to the company's 2030 targets following recent guidance raises, M&A progress, and supportive Q3 results.

Analyst Commentary

Bullish analysts have steadily lifted their price targets into the high 30s and around $40, reflecting growing conviction that Clearway Energy can outperform its previously communicated long term plan. Recent meetings with management and progress on capital deployment have reinforced views that the stock still offers upside relative to updated fair value estimates.

At the same time, not all research voices are uniformly positive, with some maintaining more neutral stances despite acknowledging operational momentum. This mix of views highlights both the potential for upside revisions to 2030 targets and the need to monitor execution and market conditions closely.

Bullish Takeaways

- Bullish analysts see Clearway's 2030 financial targets as conservative, arguing that the company now has a credible path to revise those goals higher as execution and deal flow continue.

- Stronger than expected Q3 results, along with raised 2025 guidance and early 2026 guidance, are viewed as clear evidence that management can deliver on its long term growth promises, supporting higher valuation multiples.

- Recent M&A, including the acquisition of a large operating solar portfolio at an attractive double digit CAFD yield, reinforces confidence in Clearway's ability to source accretive growth and sustain dividend and CAFD per share expansion.

- The pattern of incremental price target raises into the high 30s and $40 suggests bullish analysts believe the market is still underappreciating Clearway's growth visibility and the durability of its contracted cash flows.

Bearish Takeaways

- More cautious analysts continue to assign only modest upside from current levels, maintaining neutral ratings despite lifting price targets, which implies limited margin of safety if execution or markets stumble.

- Expectations for softer results across the broader Power sector, driven by less favorable generation and pricing trends, temper enthusiasm about near term earnings momentum even for better positioned names like Clearway.

- Heightened volatility in markets and credit spreads introduces additional financing risk for capital intensive growth plans, potentially constraining the pace or economics of future acquisitions and projects.

- The recommendation to keep some regulated utility exposure as a defensive hedge underscores a view that Clearway's growth oriented profile, while attractive, may carry higher relative risk in a more uncertain macro environment.

What's in the News

- Clearway Energy's Board declared a quarterly dividend of $0.4528 per share on Class A and Class C stock, payable December 15, 2025, to shareholders of record as of December 1, 2025 (company announcement).

- Clearway Energy agreed to acquire an 833MWdc (613MWac) operational solar portfolio from Deriva Energy and Manulife Investment Management, with the deal expected to close by the second quarter of 2026 and terms undisclosed (company and transaction announcement).

Valuation Changes

- Fair Value: risen slightly to approximately $37.50 from $36.90, reflecting a modest increase in estimated intrinsic value.

- Discount Rate: increased slightly to about 10.09% from 9.90%, indicating a marginally higher assumed risk or cost of capital.

- Revenue Growth: edged up to roughly 11.03% from 10.89%, implying a small upgrade to long term top line growth expectations.

- Net Profit Margin: improved modestly to around 7.24% from 7.08%, suggesting incremental efficiency or profitability gains over time.

- Future P/E: declined slightly to about 45.9x from 46.1x, signaling a marginally lower multiple applied to forward earnings despite higher fair value.

Key Takeaways

- Strong project pipeline, customer contracts, and diversified assets position Clearway for sustained growth, stable cash flow, and margin expansion as clean energy demand rises.

- Efficient asset optimization and favorable financing reinforce the company's ability to invest in growth while maintaining competitiveness and steady earnings.

- Reliance on favorable financing, contract trends, regional policies, and incentives exposes the company to margin pressures, regulatory risks, and potential earnings volatility.

Catalysts

About Clearway Energy- Operates in the clean energy generation assets business in the United States.

- Clearway's significant pipeline of renewable and battery storage projects-much of which already qualifies for tax credits through 2029-positions the company to benefit directly from increasing demand for decarbonized energy as electrification and clean energy mandates accelerate, supporting sustained revenue and CAFD growth.

- Strategic long-term contracts with hyperscale data center customers and utilities are expanding, capitalizing on the rapid growth in corporate and industrial demand for renewable PPAs, which increases revenue visibility and underpins stable cash flows and earnings growth.

- The company's diversified asset base across wind, solar, and storage in multiple core U.S. markets, with continued investment in grid-relevant battery projects, reduces exposure to regional volatility and supports steady net margin expansion as grid modernization deepens.

- Ongoing repowering and optimization of existing assets with high, accretive CAFD yields extend the useful life of projects and improve operating efficiency, driving incremental increases in earnings and net margins.

- Enhanced access to capital at scale through growing investor preference for ESG-aligned companies and proactive interest rate hedging is expected to keep financing costs competitive, enabling Clearway to fund growth investments without materially pressuring margins.

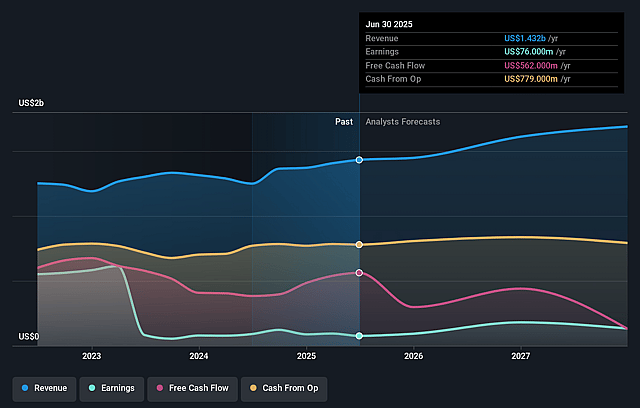

Clearway Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Clearway Energy's revenue will grow by 8.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.3% today to 9.1% in 3 years time.

- Analysts expect earnings to reach $166.6 million (and earnings per share of $0.52) by about September 2028, up from $76.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $191.3 million in earnings, and the most bearish expecting $40.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 59.5x on those 2028 earnings, up from 42.2x today. This future PE is greater than the current PE for the US Renewable Energy industry at 42.0x.

- Analysts expect the number of shares outstanding to grow by 0.37% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.42%, as per the Simply Wall St company report.

Clearway Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth plans rely on modestly increasing equity issuances and leveraging additional debt capacity, which could become more costly or less available if interest rates rise or credit markets tighten, negatively impacting net margins and future earnings.

- Heavier use of Power Purchase Agreements (PPAs) with large, sophisticated customers such as hyperscalers and utilities may expose Clearway to risk if wholesale power markets or contract pricing trends move unfavorably, potentially reducing future revenue and CAFD per share growth.

- Ongoing diversification into battery storage represents a growing share of the project pipeline, but increasing competition, rapid technology shifts, and evolving supply chain or tariff risks in the energy storage market could compress margins or delay projects, adversely affecting earnings and revenue predictability from new assets.

- Clearway's geographic concentration in core markets like California, PJM, and the Western states exposes the company to local regulatory, policy, or weather-related risks which could lead to earnings volatility, especially if regional Renewable Attribute (RA) pricing or contract structures change unfavorably.

- Although Clearway has pre-qualified much of its pipeline for tax credits, the company's future capital investment economics remain partially dependent on the continuation of favorable policy, subsidy, and tax incentive frameworks; any government policy rollback or accelerated phase-out of incentives could erode profitability and impair long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $36.111 for Clearway Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $40.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $166.6 million, and it would be trading on a PE ratio of 59.5x, assuming you use a discount rate of 10.4%.

- Given the current share price of $27.22, the analyst price target of $36.11 is 24.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Clearway Energy?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.