Key Takeaways

- ARM is a leader with a saturated number of customers limiting future growth.

- It’s in a highly competitive landscape and needs to innovate beyond patent expirations in the 2030s.

- As a controlled entity of SoftBank, I expect the board to push for buybacks in a bid to maximize returns.

- I expect SoftBank to slowly unload its stake, while ARM buys back their stock - this may initially sustain the price.

Catalysts

Prospects Are Still Solid After IPO

ARM designs and licenses processors to manufacturers, it is the engineering company behind the world’s CPUs.

About 70% of the world’s population uses Arm-based products. More than 30 billion ARM-based chips (smartphones, small electronics, data centers, networking equipment) were shipped in FY '23, representing an approximately 70% increase since 2016.

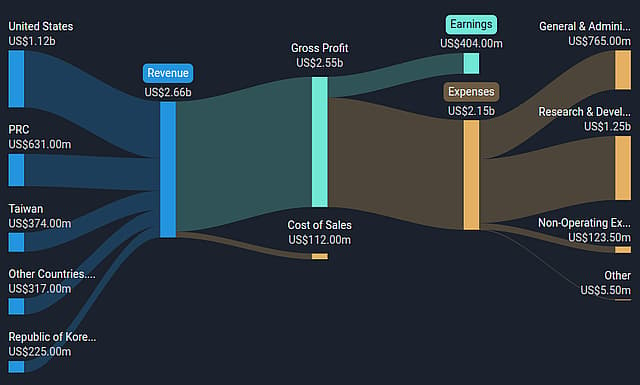

Most of ARM’s IP sales are in the United States, however a good combined portion are in East Asia, including China (PRC), Taiwan and South Korea:

ARM’s geographical revenue streams

The business model of the company is to design ARM-chips and license them out to manufacturers. It sells the intellectual property behind chips, but doesn’t produce the hardware. This is an engineering-first company, with approximately 80% of global employees focused on research, design, and innovation. The company reaches scale with the ability to license out each CPU product to multiple companies.

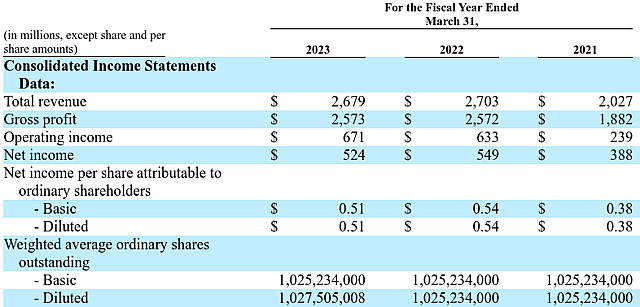

ARM is a high performing company, with a gross margin of 80% and operating margins of 25%. The company made $2.7 billion in revenues in 2022 that stagnated in the IPO year.

ARMs key financial performance between 2021 - 2023

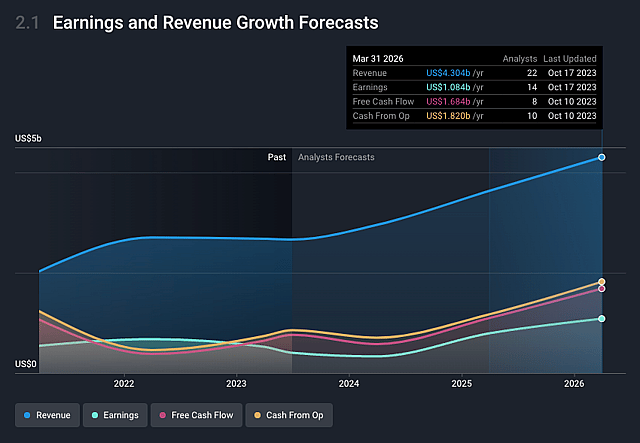

Despite stagnating in its IPO year, it’s future prospects from here are still solid as demand for their IP continue to grow. But I don’t believe it’ll grow revenues as fast as analysts are expecting (14% per year), which I’ll get into shortly.

Arm’s Earnings and Revenue Growth Forecasts

ARM’s Market Share May Suffer As Patents Expire

Arm has an addressable market of $202.5 billion, and expects it to grow at a 6.8% annual rate to $246.6 billion by the end of 2025. The company estimates the aggregate value of chips containing Arm technology to be approx. $98.9 billion in 2022, representing 48.9% market share.

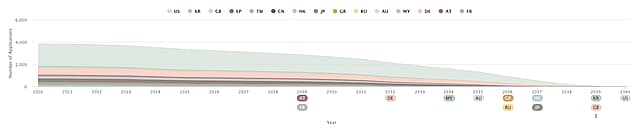

This market share is large even for a market leader. Competitors and expiring patents can become significant forces driving down the market share for ARM in the future. Notably most of the key ARM patents are expected to expire in the 2030s:

ARM’s patent portfolio expirations in 2020

The expiration of these patents can open the door for more companies to design and manufacture ARM-based chips.

Limited New Customer Growth, But Opportunities in Smart Devices

More than 260 companies reported that they had shipped Arm-based chips in 2023, including:

- Mobile computing: Apple, Guangdong OPPO, Samsung, Vivo Mobile, Xiaomi.

- Cloud computing: AWS and Alibaba

- Industrial IoT: Cruise and Mercedes-Benz, Raspberry Pi, Schneider Electric, and Siemens.

ARM also entered into a long-term agreement with Apple that extends beyond 2040 allowing the company to use Arm architecture for their CPUs.

The customer base for ARM is well established, and the company is at a phase where it will have a harder time acquiring new customers, rather it will have to rely on industry growth and innovation in order to increase revenue.

One of the highest-potential growth avenues for ARM is the smart devices vertical. ARM’s CPU architecture fits well in small devices, giving it an advantage over peers with larger CPUs. As compute power increases, it will become more practical for consumers to rely on mobile devices and wearables instead of larger devices for everyday needs, this has the potential to widen the TAM.

Another growth avenue for the company is the market adoption of electronically rich vehicles and EVs as well as the capitalizing on government programs subsidizing EVs. Vehicles have an increasing number of processing demands both in central systems, and IoT linked sensors.

Selling Pressure From SoftBank May Limit Price Appreciation

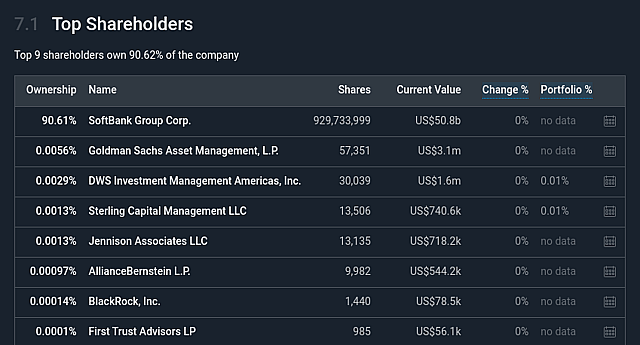

ARM is a controlled entity owned by SoftBank Group with approximately 90.6% of their outstanding ordinary shares following the completion ARMs IPO:

ARM’s IPO is pushed by SoftBank who is looking to cash-in on their investment or escape with minimal losses. One scenario is to expect a continuous selling from SoftBank, which means that there may be selling pressure for some time keeping price appreciation moderate until the stock flips to a diversified investor base.

Assumptions

- Business: I estimate that ARM will have difficulties increasing the number of large customers and market penetration. Because of this, I expect ARM to grow roughly at 10% - along the projected TAM expansion while keeping market share constant around 50%.

- Margins: I assume that operating margin gradually converges from 25% to 35% by 2029. I expect the profit margin to be 80% of operating profit.

- Projection: This translates to 2028 sales of $4.3 billion, $1.5 billion in operating profit and $1.2 billion in net profit.

- Outstanding shares: ARM has 1.025 billion shares. It is already investing in R&D, and has a board that is interested in maximizing their return (SoftBank). For this reason, I expect ARM to repurchase shares and reduce the share count by 4% annually, leading to 843 million in 2028 outstanding shares.

Risks

- ARM may continue to innovate and open new growth channels offsetting the potential decline from patent expirations.

- ARM may find ways to protect its IP, and make generic technology dependent on its new IP.

- ARM has lasting partnerships in place that will continue to generate revenue for years to come (like the one past 2040 with Apple). There’s a chance ARM establishes more long term partnership like this with other key customers.

Have other thoughts on Arm Holdings?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NasdaqGS:ARM. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.