- Owing to its size, valuation, and strong presence in favourable mining regions, Newmont is an attractive stock for investors seeking to reduce exposure to geopolitical uncertainty.

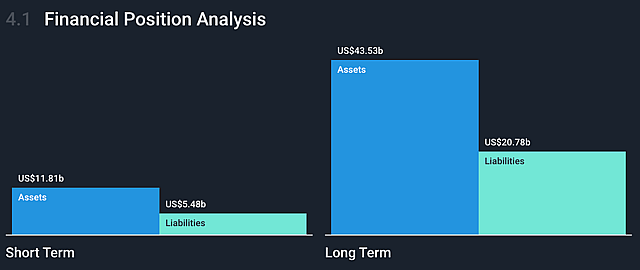

- Newcrest acquisition boosted the aging portfolio without significantly burdening the balance sheet.

- The management's focus on Tier 1 assets could push the production costs even lower, enhancing profitability in the face of the ongoing commodity supercycle.

- Asset concentration is a risk as unforeseen circumstances and environmental pressures could impact the production.

COMPANY CATALYSTS

Newcrest Acquisition Synergies and Expanded Resource Base

With last year's acquisition of Newcrest Mining, Newmont significantly boosted its reserves, adding around 44 million ounces of gold and 14 billion pounds of copper. This development solved one of the main issues for Newmont' – its aging portfolio.

The acquisition also boosted production capabilities, particularly in high-grade copper, with highly promising assets in tier-one jurisdictions like Canada, the United States, and Australia—a fact that is gaining importance in a de-globalizing world.

Cost Improvements Can Influence Profitability

In Q1 2024, Newmont reported an all-in-sustaining cost (AISC) of $1,439 per ounce, with further improvement expected in the latter half of the year. Streamlined operations, reduced costs, and overall higher productivity are expected to improve financial performance by boosting the margin.

With the ramp-up of newly acquired high-grade mines like Brucejack, the company can now operate below this AISC, while the price of gold is actually at new all-time highs.

Management recognized this, focusing on core assets and shedding higher-cost operations. With projected AISC margins potentially reaching $900 per ounce by next year, Newmont is well-positioned to enhance profitability and generate substantial free cash flow.

Historic Undervaluation Attracts Attention

Per recent earnings results, Newmont has shown improving operating cash flow, higher revenues and operational efficiency that's nullifying rising costs. Despite the recent market fluctuations, Newmont is currently trading at a substantial discount to its historical valuation metrics, with a forward EV/EBITDA multiple of 7.3x compared to its 30-year average of around 18x.

The market’s undervaluation of Newmont, combined with its strong free cash flow prospects and strategic cost optimizations, presents an asymmetrically favorable risk/reward ratio.

Size Advantage Is A Factor In Mining

The current higher cost of capital increases the financial burden on companies looking to invest in capital expenditures (capex). Larger producers, like Newmont, benefit from this scenario because they generally have stronger balance sheets and better financing access than smaller players. Big producers can absorb higher costs and secure funding more easily, allowing them to continue or expand their operations without significant financial strain.

Developing mines, especially Tier 1 assets, is a multi-year, multi-billion-dollar operation. Smaller companies may struggle to raise the necessary capital, making it harder for them to invest in new projects or maintain existing ones.

This dynamic consolidates the market power in favor of large producers, as they can capitalize on their financial stability to maintain or grow their market share while smaller competitors are constrained by limited financial resources.

INDUSTRY CATALYSTS

Persisting Inflationary Threats Make Gold Miners Attractive

Despite making positive pushes against inflation, Western economies are not yet proclaiming victory. They are well aware of the scenario from the 1980s, when inflation returned following a subdued period after an initial shock.

While commodities are generally seen as a hedge against inflation, inflationary shocks can negatively influence the economy, undermining the demand for the underlying commodity if it is connected to industrial demand—like silver or palladium. Gold, however, has a different status, owing to the long-standing tradition of its use as a currency and store of value.

Creation of Gold-Backed Currency (BRICS)

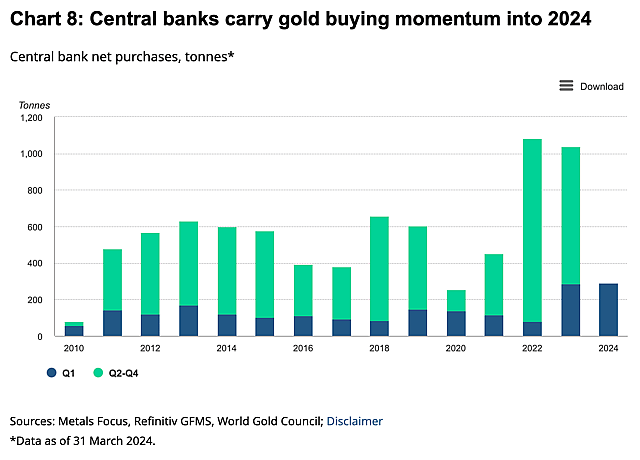

Developing a gold-backed currency by BRICS nations (Brazil, Russia, India, China, South Africa) boosts gold demand as these countries seek to reduce reliance on the US dollar. Central banks in these countries increase gold reserves to support their new currency, driving demand as they prepare for a more stable, gold-backed financial system.

According to the World Gold Council, central banks, particularly from China, India, and Turkey, have significantly increased gold purchases since 2022. As of March 2024, there have been 17 months of consecutive monthly purchasing increases, with volumes reaching almost double the previous yearly average.

Heightened Geopolitical Risks Benefit Gold

Escalating conflicts in Europe and the Middle East lead to increased gold demand due to its status as a safe-haven asset. In times of geopolitical instability, investors flock to gold to mitigate risks associated with currency fluctuations and economic uncertainty, as gold tends to retain value during crises.

Per BNP’s research, deglobalization and international tensions create a new global framework that benefits precious metals.

RISKS (to my thesis)

Gold Price Volatility and CAPEX Risks

Newmont's increased capital expenditure (CAPEX) amid soaring gold prices pose significant risks due to gold's inherent volatility. While investing in CAPEX during high gold prices appears strategic, the lengthy nature of mining projects means the gold market could experience a downturn before these projects become profitable.

If gold prices decline significantly during the extended payback period of new capital projects, the return on these investments could be much lower than expected, diminishing shareholder value and potentially impacting Newmont’s financial stability.

Additionally, high CAPEX commitments reduce financial flexibility, making it challenging for Newmont to adapt to unexpected changes in the gold market or broader economic conditions.

Higher Concentration of Assets Poses Higher Production Risks

Concentrating its portfolio by divesting multiple assets can be risky for a few reasons.

- It reduces geographic and operational diversification, exposing the company to heightened risks from regional political, environmental, or economic issues.

- A concentrated portfolio increases dependency on the performance of fewer assets, making the company more vulnerable to operational disruptions or declines in commodity prices specific to those assets. Brucejack mine, which produced 37,000 oz in Q1 2024 following a fatal accident, is such an example since this mine regularly produces almost double that output.

- Concentrating on fewer projects could limit future growth opportunities and reduce the company's ability to capitalize on emerging trends or discoveries in the mining sector, potentially impacting long-term profitability and sustainability.

ASSUMPTIONS

Commodity supercycle: I am assuming that analysts like Marko Papic are correct in estsimating that we're in the new commodity supercycle, and I expect a large miner with an integrated operation like Newmont to take advantage of that situation.

Capital Expenditures: As a large company, I expect Newmont to have an advantage in capital expenditures over its smaller peers due to the elevated cost of capital. Although mining capex is long-term, usually at 7+ years, despite a prospect of lowering interest rates, I expect this situation to contribute to a positive investor sentiment.

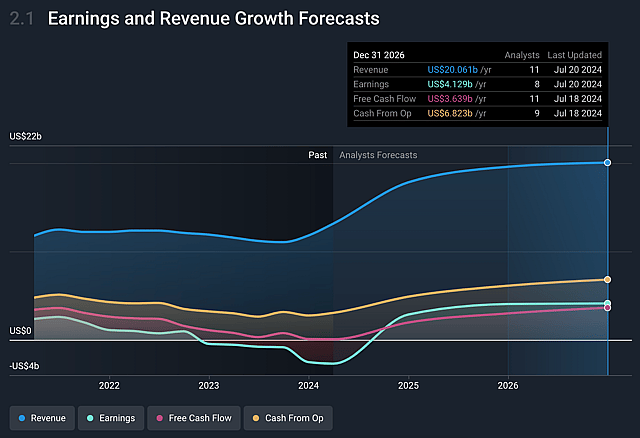

Revenue growth: I expect the company to significantly boost its revenues compared to the previous fiscal year ($11.8b), reaching $18 billion per year by 2029 (in line with the Wall Street consensus forecast), due to higher commodity prices and successful asset consolidation, focusing on Tier 1 mines.

Margin Improvement: Owing to such developments in the commodity markets and the company’s efforts to focus its portfolio on the best assets, I expect the net margin to improve to 19% from 17%.

Stock Buybacks: I expect the company to buy back about $1 billion of its stock, reducing the number of shares outstanding by approximately 2.6%, to 1.12 billion by 2029.

VALUATION

- A $19 billion revenue with a 19% net margin results in net revenue of $3.61 billion ($19bn x 0.19).

- When divided by 1.12 billion shares outstanding (3.61/1.12), we get an EPS of $3.22.

- Assuming a median P/E ratio (over the last decade) of 23.58, it results in a price per share of $76 ($3.22 x 23.58).

- By discounting this price using a Simply Wall St rate of 8%, I've arrived at a present value of the stock at $51.7, which is 10% above the current stock price.

Have other thoughts on Newmont?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst StjepanK has a position in NYSE:NEM. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.