Key Takeaways

- Coca-Cola’s PE ratio has risen to the high 20s due to a recent revival in profit growth.

- However, several non-recurring factors have driven these improvement in margins and growth.

- Coca-Cola’s efforts to diversify are still dwarfed by its soft drinks business which is very mature.

- I believe EPS growth will inevitably revert to mid single digits, and the P/E ratio will fall to 20x.

Catalysts

Industry Catalysts

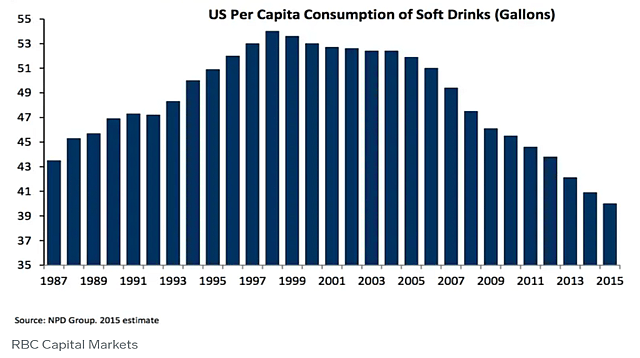

Carbonated soft drinks under pressure due to health concerns

Coca Cola is the global leader in the carbonated soft drink (CSD) market. However this market is under pressure due to the health concerns related to sugar sweetened soft drinks. In developed markets, per capita consumption of carbonated soft drinks has been declining for 25 years. In developing countries consumption is still rising along with disposable income, however governments are increasingly trying to discourage consumption with ‘sugar taxes’ and awareness campaigns.

Source: Business Insider

The trend toward healthier diets has also made room for alternatives like iced tea and coffee, fruit juices and sports drinks. Tea and coffee have also become a common alternative to CSDs.

While global non alcoholic beverages are forecast to increase at around 8.5% through 2030, the CSD segment is only expected to grow at 5% a year.

Company Catalysts

No meaningful traction in non-CSD Segments

The Coca Cola Company is well aware that its core market is mature and vulnerable to being displaced by a range of alternatives. It is actively diversifying into all of the alternative segments listed above, as well as energy drinks and even mixed alcoholic drinks.

To date Coca Cola’s traction in these other segments has been slow. CSDs still account for 70% of sales, and growth from the other segments isn’t fast enough to change the revenue mix meaningfully.

The company has a major advantage in the CSD space with the strength of its Coca Cola, Fanta and Sprite brands. But in other segments it has little competitive advantage besides its distribution networks - which can only take it so far. Beverage markets are fickle and no one, including Coca Cola, can guarantee success.

In 2021 Coca Cola entered a partnership deal with Monster Beverage, effectively getting Monster to market Coke’s energy brands. This deal gave Coca Cola a 16.7% stake in Monster. Coca Cola also bought UK coffee house chain Costa Coffee in 2019.

Coca Cola is likely to pursue more of these types of partnerships where it can, but they are still dwarfed by the legacy business meaning it will take a long time before they contribute to revenue growth. In addition, Coke is likely to face regulatory hurdles making large acquisitions.

The Current Valuation is Backward Looking and Likely too High

Several recent, but non-recurring, catalysts have contributed to a very strong earnings trajectory in recent years:

- In 2016 the company sold many of its low margin bottling assets. This resulted in the net income margin improving from around 16% to a range between 22-25%.

- In 2017 the company paid an additional $3.6 billion in tax on repatriated offshore earnings due to changes to the US tax code. This resulted in earnings declining 80% for the year, but set a very low base for subsequent growth. On the face of it, net income increased by 660% during the five years to 2022.

- Sales growth rates in 2021 and 2022 benefited from normalization after an 11% decline in 2020.

- Sales growth in 2022 also benefited from price increases due to inflation.

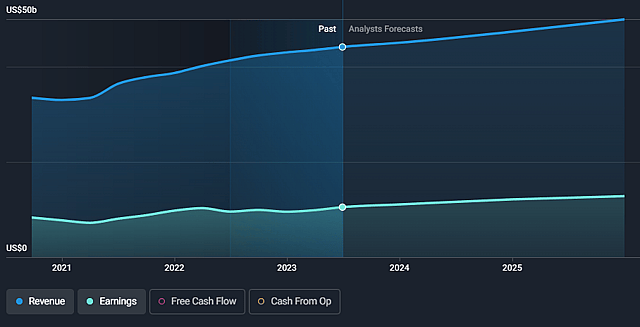

I believe the current P/E ratio of ~26.5x reflects recent growth rates which were abnormally high. If earnings growth settles into a new lower trajectory the P/E ratio will fall.

Source: Company Filings

Coca Cola’s margins have improved due to its restructuring but I also don’t see any reason for them to continue to improve from here. A 24% net income margin is very high for a business like this and reflects the benefits of scale and over a hundred years developing its distribution network. But I don’t believe there is room for improvement going forward.

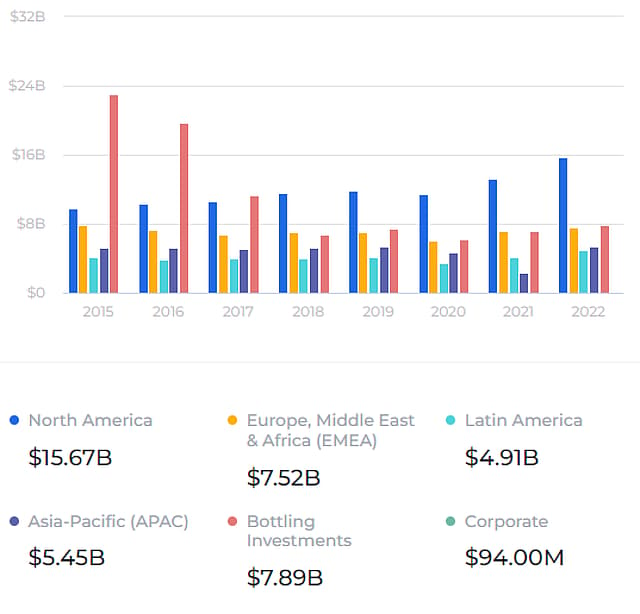

Lagging Growth in Developing Markets

Ironically most of the company’s recent growth has come from its most mature market, North America. Sales in other markets have been stagnant since 2015. In particular, sales in developing economies have barely increased despite reasonable economic growth in those economies.

Source: Wall Street Zen - Coca Cola Revenue by Segment

The company is working to localize marketing and pricing strategies - but there is no indication that these are going to result in a meaningful acceleration in sales any time soon.

Large and Looming possible IRS bill could lead to further weakness

Coca Cola faces some unique risks. First and foremost is an ongoing tax dispute with the US IRS. As it stands a court has ordered the company to pay $3.3 billion, and this decision is now being appealed. However, the total amount could reach $14 billion if the same ruling is applied to more recent periods. The company has only set $400 million aside to settle this liability.

High payout ratio leaves little buffer to continue dividend increases

Coca Cola is well known for its dividend which has been increased for 61 consecutive years. Over the last 15 years the payout ratio has risen from 40% to over 80% of free cash flows. This is manageable with the company’s current working capital requirements. However, this could put the company in a difficult situation if cash flow growth doesn’t allow further increases.

Assumptions

Coca Cola is a very profitable business, but the valuation needs to take realistic growth rates into account.

Revenue Growth to Normalize at 4%

I think revenues will increase by 6% over the next 18 months due to USD weakness, but growth will then fall to 4%. This is lower than the 5% growth rate of the last five years, but still slightly higher than the average over the last 20 years.

Total revenue will therefore reach $56.5 billion in 2028.

Net Income Margin to remain at 24.5%

I’m assuming the net income margin will remain at 24.5% as I don’t believe there is room for improvement. As mentioned it may fall, but for this analysis I’m keeping it at this level. Net Income for 2028 would therefore be $13.8 billion.

Share Buy Backs to Continue

I’m assuming that share buy backs will continue at 0.5% of outstanding shares each year. This would mean shares outstanding would decrease to 4.22 billion in 2028, down from 4.33 billion in 2022.

The P/E Ratio Will Contract

The assumptions above would result in EPS increasing from $2.19 in 2022 to $3.28 in 2028. With the EPS 5 year CAGR falling to 5% I believe the P/E ratio will fall to 20x, from 26.5x today. I think the P/E ratio would actually fall more if it wasn’t for the 3% dividend yield.

Risks

There are also two risks to the catalysts I described above:

- Coca Cola’s recent revenue from outside the US has been impacted by the strong USD. If the dollar weakens this would reverse and the international segments would see a sharp increase in revenue. This could be temporary or more permanent.

- Growth from developing market segments could also rise if the localized marketing strategies begin to pay off.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Richard_Bowman holds no position in NYSE:KO. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.