Last Update 29 Oct 25

Fair value Decreased 1.13%Analysts have revised their price target for Ovintiv slightly downward from $52.41 to $51.82. This change reflects updated expectations for softer revenue growth and a marginally lower profit margin outlook.

What's in the News

- The Board of Directors of Ovintiv Inc. has authorized a buyback plan scheduled for September 29, 2025 (Key Developments)

- Ovintiv Inc. (TSX:OVV) has announced a share repurchase program authorizing the repurchase of up to 22,287,709 common shares. Repurchased shares will be cancelled or returned to treasury as unissued shares. The program is valid until October 2, 2026 (Key Developments)

Valuation Changes

- Fair Value: Decreased slightly from $52.41 to $51.82.

- Discount Rate: Increased marginally from 7.72% to 7.74%.

- Revenue Growth: The projected decline deepened, moving from -1.88% to -3.09%.

- Net Profit Margin: Decreased from 25.94% to 24.76%.

- Future P/E: Rose from 7.38x to 7.94x.

Key Takeaways

- Diversified North American gas exposure and new marketing agreements provide revenue stability, pricing power, and support for sustainable long-term margin growth.

- Operational efficiency gains and disciplined capital allocation enhance cost control, production scalability, and drive continued improvement in net margins and shareholder returns.

- Over-dependence on North American shale and evolving industry pressures could threaten Ovintiv's long-term growth, margins, and competitiveness amidst shifting energy trends and increasing regulation.

Catalysts

About Ovintiv- Explores, develops, produces, and markets natural gas, oil, and natural gas liquids in North America.

- Anticipated growth in global energy demand-driven by economic expansion in emerging markets and a slower pace of energy transition-provides a structurally strong backdrop for hydrocarbon pricing and Ovintiv's revenue and free cash flow over the long term.

- Ovintiv's diversified North American natural gas exposure, reinforced by new marketing agreements (e.g., JKM and Chicago-linked contracts) and positioning for LNG exports, supports volume stability and higher realized prices, positively impacting revenue consistency and margin resilience.

- Significant operational efficiency improvements (driven by AI-enabled optimization, rapid asset integration, and 'cube' development) are reducing per-barrel costs and capital intensity, supporting ongoing net margin expansion regardless of the broader commodity price cycle.

- Deep premium drilling inventory in high-return shale plays (Permian, Montney, Anadarko) underpins sustainable production growth, scale-driven cost advantages, and long-term top-line growth potential.

- Disciplined capital allocation (including structural cost reductions, debt paydown, and aggressive share buybacks) is set to drive durable increases in earnings per share and further upside for equity valuation as capital markets recognize improved net margins and cash flow per share growth.

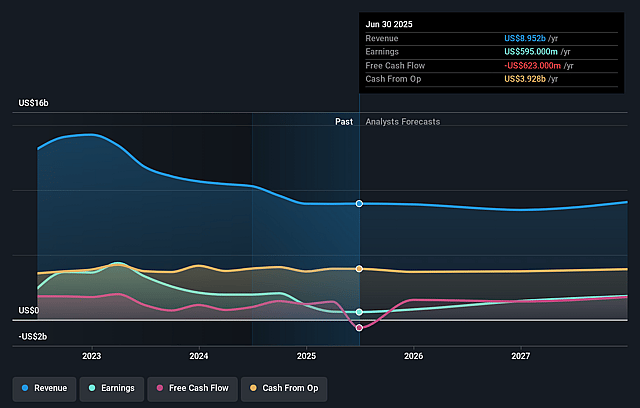

Ovintiv Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ovintiv's revenue will decrease by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.6% today to 27.0% in 3 years time.

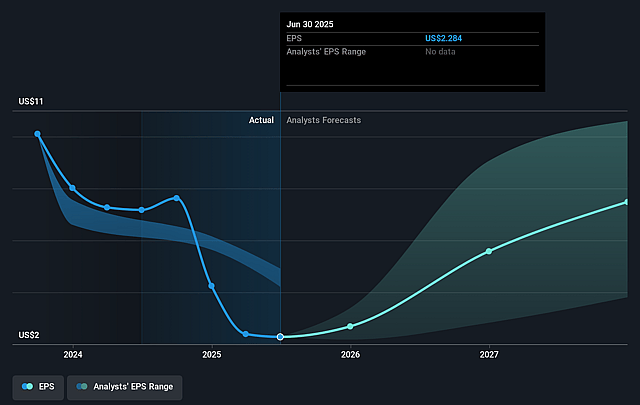

- Analysts expect earnings to reach $2.3 billion (and earnings per share of $7.54) by about September 2028, up from $595.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.2x on those 2028 earnings, down from 17.9x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 1.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.84%, as per the Simply Wall St company report.

Ovintiv Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ovintiv's heavy reliance on North American shale exposes it to regional price differentials, basin-specific downturns, and potential supply gluts (such as the historic oversupply referenced in the Canadian gas market), which could undermine long-term revenue stability and lead to periods of margin compression.

- Despite current cost efficiencies, persistent inflation in oilfield services, labor, and materials-or a reversal of current service cost deflation-could erode capital efficiency and margins if Ovintiv cannot continue to offset these pressures through operational improvements.

- Accelerating energy transition trends, technological advancements in renewables and battery storage, and increasing regulatory requirements for emissions and ESG compliance may structurally diminish long-term demand for oil and gas, shrinking Ovintiv's addressable market and potentially impacting future earnings and cash flows.

- The company's long-term inventory longevity depends on continued successful reserve replacement and the quality of its undeveloped locations; if core assets mature faster than expected or if upside drilling opportunities do not materialize, production volumes could decline, negatively impacting future revenue and share price growth.

- Growing competition and ongoing consolidation in Montney and U.S. shale could erode Ovintiv's cost advantages over time or limit its ability to acquire new high-return acreage at attractive prices, constraining future top-line growth and reducing opportunities for sustained net margin expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $54.0 for Ovintiv based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $67.0, and the most bearish reporting a price target of just $42.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $8.6 billion, earnings will come to $2.3 billion, and it would be trading on a PE ratio of 7.2x, assuming you use a discount rate of 7.8%.

- Given the current share price of $41.45, the analyst price target of $54.0 is 23.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Ovintiv?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.