Last Update14 Nov 24Fair value Increased 4.02%

Intel lands itself in hot water

- Intel has come under fire recently for a series of shortcomings and ‘failures to act’. Tech YouTuber, Gamers Nexus, has covered the Intel case in great detail and much of the information in my update was learned from their video.

- Following a series of disappointing earnings calls, Intel announced a $10 billion cost reduction scheme to try and pull the profitability lever. It’s surprising that in an AI ‘bubble’ like the one we’re in now, Intel has managed to miss the mark as spectacularly as it has, considering its market-leading position.

- Intel announced it needed to “chop some wood” which is a pretty distasteful euphemism for “cutting nearly 15% of Intel’s workforce”. While the extent of the layoffs haven’t been detailed further, it’s estimated that 12,000 non-fab positions and 3,000 manufacturing positions will face the chopping block. In another hit to employee morale, it seems that an internal memo detailed some unfavorable changes to employee leave, as well as a reduction in corporate services for gym and travel.

- Perhaps more concerning for investors is the announcement that Intel is suspending its dividend for the fourth quarter. A move which may be necessary, but very unpopular with the market, contributing to a 26% drop in the company’s share price.

- If we look back to last year, Pat Gelsinger, Intel CEO, received a 45% rise in total compensation from $11.61 million in 2022 to $16.86 million in 2023. It’ll be interesting to see if this remuneration is clawed back in response to cost-cutting measures.

The manufacturing issue - Via Oxidation

- Besides Intel’s absyssmal market performance, they have also been under fire for issues they’re having with their latest consumer CPU series.

- In late 2022, Intel became aware of a manufacturing defect that is being labeled as the ‘Via Oxidation’ issue. The issue is a defect in the CPU chip that causes significant instability in operation. This is a terminal issue for impacted chips and this isn’t something that can be fixed with any microcode updates. Impacted CPUs will slowly die off and the only remedy is for impacted customers to make an RMA claim for a defective chip. However, this is where things get difficult.

- Intel have not been transparent about which CPUs have been impacted by the manufacturing issue. The issue was first observed in late 2022 and Intel claims to have fixed it in early 2023. Concerningly, according to Gamers Nexus, it appears that Intel were aware of this issue well before informing retailers, and thus knowingly shipped out inventory with higher defect rates. Since their initial comments, Intel has now said that that the issue may still be present in hardware currently sitting on the shelves of retailing partners in 2024.

- To make matters worse, Intel have been tight lipped about the batch numbers impacted by the issue - something they’d be very aware of. So what was originally communicated as a ‘small issue, quickly fixed in early 2023’ now seems to be much larger. Why else wouldn’t Intel share the impacted batch numbers, unless the true extent of the defect is much larger than anyone thinks?

“Danger! High Voltage” - The Voltage/Instability Issue

- Completely separate from the previous manufacturing issue, is a persistent instability issue impacting Intel 13th and 14th Gen processors. The instability issue was initially reported in Feb, when Intel mentioned it was investigating excessive crashing and blue screens with 13th and 14th Gen ‘unlocked desktop processors’. Originally, it was thought that the issue was exclusive to Intel’s 13900K and 14900K flagship chips. However, as things developed, it became apparent that the issue was impacting all 13th and 14th Gen intel processors with a 65W or higher base power. This is a staggering 30/43 or 70% of all CPUs in Intel’s Gen 13 and 14 Intel Desktop processors.

- The issue itself seems to have been related to the microcode pushed to Intel chips several years ago. The issue meant that the processor was allowed to enter a higher performance state (read: more voltage) despite being at a higher operating temperature than was acceptable to do so (Enhanced Thermal Velocity Boost).

- The issue manifested itself in repeated crashes for users running Intel 13th and 14th Gen CPUs. The issue was particularly bad for gamers playing Unreal Engine 5 games.

- Now, Intel has pushed a fix to the microcode to fix the issue, but if CPUs that had issues prior to the fix are more than likely IRREPARABLY DAMAGED.

- In response to the spate of issues Intel has been having and their ‘failures to act’, there are now a series of class action lawsuits that may be brought against Intel to compensate impacted customers.

My Take

- The last month or two has been a disaster for Intel, and possibly some of the worst few months I’ve seen a company face in the last few years that haven’t been related to COVID-19 or illegal activities.

- I have been bearish on Intel for some time, and this latest news further reinforces my position. Funnily enough, the massive price drop now means my fair value is undervalued.

- I am going to drop my Client Computing forecasts from 7% annual growth to 3% annual growth, expecting these issues will drastically swing consumer sentiment towards AMD. Interestingly, AMD has had some issues of their own with their Ryzen 9000 CPUs, but their decision to delay the release of some SKUs seems to be the much more sensible thing to do. This sees me reduce my 2029 revenue forecast from $43.51 Billion to $35.96 Billion.

- Company-wide revenue falls to $66.59 Billion in 2029 in response to the lower revenue growth rate for the client segment. This is representative of a 3.81% revenue growth per annum for Intel as a whole.

- I believe the company will now be trading on a 22x PE multiple, as investor sentiment will be harmed from the suspension of the dividend and Intel’s reputation will be irreversibly damaged from the way they’ve handled this.

- With the new inputs, my fair value now sits at $19.70.

Key Takeaways

- Poor thermal and energy efficiency will see Intel lose out to AMD in the server CPU market

- AMD and ARM will take market share from Intel in the consumer CPU segment

- Intel will see Notebook OEMs switching to AMD and ARM based chips for their efficiency gains

- Intel’s Arc GPUs won’t be able to catch up to Nvidia, leaving them without the scope to focus on AI

Catalysts

Struggling in the Data Center Market: Xeon SP CPUs Losing Ground As AMD Steps Up

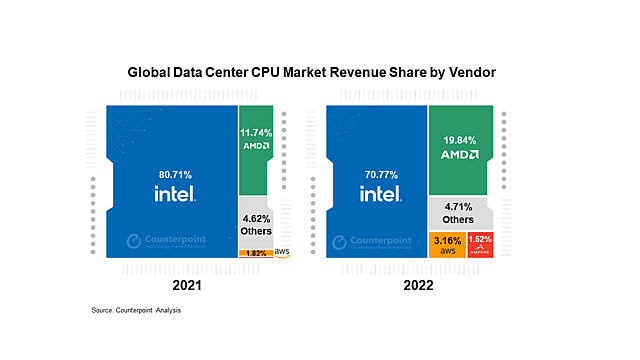

Intel's dominance in the data center CPU market has been a significant pillar of its success over the years, contributing around 30% to the company’s total sales.

INTC Revenue & Earnings Breakdown - Simply Wall St

However, recent trends suggest a concerning shift. The Xeon Scalable Performance (SP) CPUs, once a flagship product for Intel in this segment, have seen declining sales. This decline is not just a reflection of market saturation but an indication of competitors like AMD making significant inroads. AMD's EPYC CPUs have been lauded for their performance, offering up to 4x more performance per watt compared to Intel’s Xeon processors.

This efficiency is crucial for data centers, which prioritize power consumption and performance. The equation here for customers is simple. If AMD CPUs can offer similar performance for much less power consumption, then they can cut operating expenditure by switching to AMD. Intel's premium pricing strategy, which was once justified by its superior products, is now being questioned as competitors offer similar or better performance at competitive prices.

Stiff Competition and Innovation From AMD and ARM Could See Intel Lose Vital Market Share

The consumer CPU market, a segment where Intel enjoyed significant market share, is now rife with challenges. AMD's Ryzen series has not only matched Intel's offerings but, in some cases, surpassed them in terms of performance and price.

PassMark: Price to Performance ratio for the CPU Mark benchmark on single CPU systems

The competition is now beginning to extend beyond the traditional Intel VS AMD battle, with ARM beginning to make a name for itself with architecture that differs from the traditional x86 used by Intel. ARM's energy-efficient architecture, which has been adopted by tech giants like Apple for its Mac lineup, could pose a significant threat in the future.

Intel's delay in transitioning to smaller nanometer processes, a key factor in CPU performance and efficiency, has further eroded its competitive edge. While Intel has been able to keep up by extracting every ounce of performance out of older processes, there could be a point where their slow adoption could manifest itself as them falling far behind the likes of AMD.

Recent data has highlighted that Intel has conceded sub-single-digit percentage points of market share across three major categories. This loss is indicative of the escalating competition from rivals like AMD and ARM, further aggravated by Intel's delay in transitioning to smaller nanometer processes. As consumers become more tech-savvy and demand better performance, Intel's challenges in this segment could lead to a shrinking market share - potentially worsened if laptop OEMs like HP, Dell and Acer begin preferring AMD or ARM CPUs for their laptops (the market where Intel is by far the strongest).

Intel’s Lag In GPU Innovation Could See Them Fall Behind In The Uptake Of AI

Intel's belated entry into the discrete graphics processing unit (GPU) market and its struggle to match the innovation pace of Nvidia and AMD has not only meant that it will struggle to gain ground in the consumer GPU market, but it also potentially hinders its position in the AI sector.

GPUs are central to AI processing, and with the consumer GPU market being absolutely dominated by Nvidia - and to a lesser extent AMD - Intel's lag in GPU innovation could lead to a significant setback as AI begins to take off.

While a distinction must be made between consumer GPUs (which are primarily used for gaming or small scale workstation work) and Data Center GPUs (the ones that AI models like ChatGPT run on and the primary driver in Nvidia’s journey to a trillion dollar company), it can be said that the two segments are have a mutually beneficial relationship. Developments in gaming have led to new pathways being explored in GPU architecture, which has benefitted the Data Centre market.

Intel’s entrance into the GPU market with the Arc series was initially met with skepticism from the tech community. While Intel’s Arc GPUs actually offer some incredible hardware for the price, their software implementation and driver support left some things to be desired.

In the benchmarks below from Puget Systems, you can see this exact scenario play out. In some workloads, the Intel Arc GPUs are able to compete with much more expensive hardware.

But in other applications, their software and driver shortcomings mean they fall well behind competitors.

So while Intel actually has the hardware, their position in the market might have them playing a perpetual game of catch up rather than actually competing and stealing meaningful market share from Nvidia and AMD. Ultimately, this could result in them “missing the bus” on the AI revolution as they focus their R&D on joining the club, rather than setting themselves apart from their competitors.

Assumptions

Client Computing Growth To Slow As AMD Catches Up In The Notebook Segment

In the consumer CPU market, I expect that Intel will face market share and margin pressures due to increased competition. I believe that AMD’s more energy efficient CPUs will see them gain significant ground on Intel in the Notebook segment, which has continuously been Intel’s best performing market.

Intel’s Client Computing segment has seen a noticeable dip in revenues due to factors various factors like high inventory levels and macro-economic pressures slowing consumer expenditure. I anticipate these things will begin to slowly resolve themselves over the next 2 years, but Intel will still continue to struggle in a tightly fought battle against competitors. On the balance of these factors, the continual growth in computing devices, new GPU segment and the widespread issues Intel faced in mid-2024, I forecast a 3% annual growth in revenues over the next five years for the Client Computing segment, resulting in $35.96 Billion in revenues for 2029 (based off of $31.02 Billion in revenue for the last 12 months).

Inefficient Xeon CPUs And A Shift To AI Will See Intel Lose Ground In The Data Center Market

I believe Intel will face some notable challenges in the data center market over the next few years. Naturally as data becomes more plentiful and more companies need data center space, operational costs will begin to climb, and so I could see companies shifting away from using Intel Xeon CPUs, turning to more efficient AMD processors which will be cheaper to run.

To further complicate things, as commercial AI utilization ramps up, GPU expenditure will become a more important focus for data center customers. I believe that much of the capital allocated towards data center hardware will be for GPUs, leading to fewer CPU sales in the segment.

Ultimately, I envision this segment of the business to essentially stagnate over the next 5 years, culminating in only 4% annual growth over the years from 2024 to 2029. This would result in $19.05 Billion in revenue for 2029.

All Other Segments To Perform Quite Well Due To Strong Network And Edge Performance

Intel’s business is quite diverse and accounts for, including Network and Edge, Mobileye (which IPOed but I shall include here seeing as Intel control 88% and I will assume to remain this way until 2029), Intel Foundry Services and various other smaller ventures. I believe these parts of the business will grow quite well over the next 5 years.

I had previously grouped these other parts of Intel’s business together and elected to run with an 8.5% annual growth with a 40% uplift on top of that due to rapid growth expected for the Networking and Edge segment. It seems I may have overstated things here, and Networking and Edge has actually declined over the last 12 months. Moving forward, I am going to assume a 6% growth for the combined ‘other’ businesses, with Intel’s Foundry offsetting some of the weaker performance in Networking and Edge. Using a base of $8.67 Billion in revenue and a 6% growth rate, I forecast the other segments of the business to contribute $11.60 Billion in 2029.

Shares Outstanding To Decrease Over The Next 5 Years

Over the last 15 years, Intel were authorized to repurchase up to $110.0 billion in shares and as of July 1st 2023, $7.2 billion remains available for future buybacks. However, I believe Intel’s increased R&D costs and intermittent profitability will mean that this is put on hold for the next few years.

Intel currently have 4.196 Billion shares outstanding on a fully diluted basis, up 2.3% from the same quarter last year. While I believe this rate of dilution will continue, I will account for some buybacks closer to 2028. For valuation purposes, I will assume that Intel’s shares outstanding will increase by 1% per annum to 2029, resulting in 4.45 Billion total shares outstanding.

Price To Earnings Will Be The Preferred Valuation Metric Due To Greater Earnings Certainty

My narrative previously used a P/S multiple to assess Intel’s future value as Intel had experienced a level of volatility in earnings, briefly falling back into loss-making territory. I have now adjusted my narrative and I am now electing to use a P/E multiple instead, as I now feel more confident in forecasting Intel’s future earnings. I believe Intel command a far lower premium that it does now. I'll opt to use a 22x PE ratio for my narrative.

Risks

Strategic Acquisitions Could Help Intel Catch Up And Overtake

Intel could make strategic acquisitions to bolster its position in key markets - particularly with respect to AI and data center hardware, potentially altering its growth trajectory.

Intel’s R&D Expenditure Could Be Fruitful

Intel's vast R&D capabilities could lead to breakthrough innovations that change the narrative. While they’re arguably behind some of their biggest competitors like ARM and AMD when it comes to CPU efficiency, Intel far outspends these companies when it comes to research and development.

Global Market Dynamics

Geopolitical tensions, trade dynamics, and global supply chain challenges could impact all players in the semiconductor industry, potentially leveling the playing field.

How well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Bailey holds no position in NasdaqGS:INTC. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.