Last Update 12 Nov 25

Fair value Decreased 5.42%GERN: Stronger Profit Margins Will Drive Share Price Momentum Ahead

Narrative Update: Geron Analyst Price Target Adjustment

Analysts have revised Geron's fair value estimate downward from $3.63 to $3.43. This change reflects updated assessments of revenue growth, profit margin, and forecasted price-to-earnings ratios.

Valuation Changes

- The Fair Value Estimate has decreased slightly from $3.63 to $3.43.

- The Discount Rate has risen modestly from 6.84% to 7.26%.

- The Revenue Growth projection has fallen from 56.21% to 52.98%.

- The Net Profit Margin is up significantly, increasing from 27.88% to 36.51%.

- The forecast for the future P/E ratio has decreased notably from 19.0x to 13.3x.

Key Takeaways

- Expanding patient pool, strong adoption, and premium pricing position Geron for sustained revenue growth and robust margins.

- Pipeline advances, regulatory progress, and industry partnerships create significant opportunities for multi-geography growth and shareholder value.

- Geron faces significant risk due to reliance on a single drug, limited launch experience, financial pressures, and dependence on successful partnerships and clinical developments for growth.

Catalysts

About Geron- A commercial-stage biopharmaceutical company, focuses on the development of therapeutics products for oncology.

- The expanding prevalence of hematologic diseases driven by an aging global population positions Geron for sustained revenue growth as the eligible patient pool for RYTELO and future indications increases, creating a long runway for top-line expansion.

- Strong early adoption signals, combined with execution of expanded commercial and medical affairs teams, are driving increased brand awareness and deeper market penetration, likely to accelerate both new patient starts and duration of therapy, positively impacting revenue and operating leverage.

- Broader acceptance of precision and targeted therapies, along with a differentiated clinical profile, has facilitated favorable payer coverage and premium pricing for RYTELO (90% of U.S. covered lives), which should support robust net margins and minimize reimbursement headwinds.

- The pipeline expansion into new indications like myelofibrosis (IMpactMF Phase III) and ongoing efforts to secure EU approvals represent medium-term catalysts, providing avenues for multi-geography and multi-indication revenue growth.

- Industry-wide trends toward partnerships and M&A-in conjunction with Geron's increased scale, launch progress, and experienced new CEO-enhance the potential for value-unlocking collaborations or acquisition interest, likely benefiting shareholder value and future earnings.

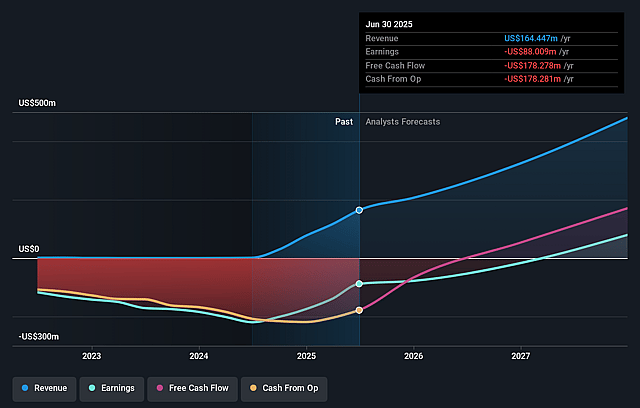

Geron Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Geron's revenue will grow by 56.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -53.5% today to 27.9% in 3 years time.

- Analysts expect earnings to reach $174.7 million (and earnings per share of $0.25) by about September 2028, up from $-88.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $268.1 million in earnings, and the most bearish expecting $-76.8 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.0x on those 2028 earnings, up from -10.1x today. This future PE is greater than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 5.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.84%, as per the Simply Wall St company report.

Geron Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Geron's commercial success remains heavily reliant on a single drug, RYTELO, for lower-risk MDS, exposing the company to significant risk if demand plateaus, competitive therapies gain traction (e.g., luspatercept or generics), or unforeseen safety or efficacy issues arise, which could meaningfully impact future revenue and growth projections.

- The company has only recently expanded its commercial and medical affairs infrastructure and lacks a proven track record in large-scale drug launches, introducing executional risk in terms of physician education, KOL advocacy, and patient retention, potentially translating to suboptimal revenue ramp and net margin pressure if uptake is slower than anticipated.

- Geron's EU commercialization strategy is contingent on securing favorable reimbursement rates and successful partnership agreements; delays, subpar pricing, or inability to independently launch in key European markets may materially reduce international revenue potential and earnings contribution.

- The company's ongoing clinical development pipeline is concentrated in telomerase inhibition with imetelstat, meaning any setbacks or negative data in the IMpactMF Phase III myelofibrosis trial, slow enrollment, or subsequent regulatory hurdles could curtail future label expansions and expected revenue diversification.

- Persisting high operating expenses, ongoing investments in commercialization and clinical development, and sequential declines in cash and marketable securities may necessitate further debt or equity financing, which could dilute existing shareholders and pressure earnings per share in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $3.625 for Geron based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $6.0, and the most bearish reporting a price target of just $1.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $626.8 million, earnings will come to $174.7 million, and it would be trading on a PE ratio of 19.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $1.4, the analyst price target of $3.62 is 61.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.