Last Update 14 Dec 25

Fair value Decreased 0.069%CWST: Easing Integration Progress Will Drive Free Cash Flow Compounding Through 2026

Analysts have nudged their price target on Casella Waste Systems slightly higher to approximately $113 per share from about $112.78, citing easing integration headwinds, a constructive 2026 growth outlook, and confidence in the company’s long runway for inorganic expansion and free cash flow compounding.

Analyst Commentary

Recent Street research on Casella Waste Systems reflects a more balanced, but still constructive, view as analysts reassess both the company’s growth runway and its execution risks.

Bullish Takeaways

- Bullish analysts highlight easing integration headwinds following recent acquisitions, supporting increased confidence in management’s ability to execute on its roll-up strategy and sustain earnings growth.

- Several notes emphasize a constructive 2026 outlook, with expectations that volumes, pricing, and synergies from prior deals can collectively drive mid to high single digit organic growth and support the raised price targets.

- Analysts point to Casella’s position as one of the smallest public solid waste players as a key advantage, arguing that its long runway for inorganic growth can underpin industry leading free cash flow compounding over the next five to seven years.

- Supportive research frames the current valuation as justified by a multi year compounding story, with upside potential if integration continues to improve and management delivers on its acquisition pipeline.

Bearish Takeaways

- Bearish analysts caution that execution risk around geographic expansion and integration remains elevated, and that the Street may still be underestimating the operational “growing pains” tied to Casella’s broader footprint.

- Some research notes argue that, despite the constructive industry backdrop, Casella’s valuation already embeds a meaningful premium for future acquisitions and synergy realization, leaving less room for missteps.

- There is concern that in a more risk on equity environment, low beta solid waste names like Casella could lag higher beta sectors, potentially limiting near term multiple expansion even if fundamentals remain solid.

- More cautious commentary stresses that while recent data points are reassuring, sustained execution on both integration and capital deployment will be needed to justify continued target price increases and prevent a de rating.

What's in the News

- Updated 2025 revenue guidance to a range of $1.830 billion to $1.840 billion, raising the lower end from $1.820 billion and reaffirming prior net income guidance of $8 million to $18 million (company guidance filing)

Valuation Changes

- Fair Value Estimate has edged down slightly to approximately $112.70 per share from about $112.78, reflecting a marginal recalibration rather than a material shift in outlook.

- Discount Rate has declined modestly to roughly 7.25% from about 7.27%, implying a slightly lower assumed cost of capital in the updated valuation work.

- Revenue Growth has ticked down fractionally to about 9.27% from roughly 9.27%, indicating no meaningful change in the long term top line growth assumptions.

- Net Profit Margin has fallen moderately to around 4.12% from about 4.45%, suggesting a more conservative stance on future profitability and cost efficiency.

- Future P/E multiple has risen meaningfully to approximately 90.7x from about 84.2x, indicating a higher valuation being applied to Casella’s expected earnings stream.

Key Takeaways

- Urban expansion, landfill integration, and acquisitions in key markets are enabling steady growth, increased pricing power, and long-term margin expansion.

- Investments in sustainability, automation, and operational efficiency are driving resilience, market share gains, and improved earnings amid evolving industry trends.

- Aggressive acquisitions, rising labor and capital costs, and limited geographic reach are straining margins, cash flow, and long-term earnings growth potential.

Catalysts

About Casella Waste Systems- Operates as a vertically integrated solid waste services company in the United States.

- Accelerating urbanization and growing population in the Northeast and Mid-Atlantic, along with Casella's increased landfill internalization and expanded vertical integration (including the operational ramp at McKean landfill), are creating steady volume growth and higher control over pricing, which should directly contribute to sustained revenue growth and margin expansion.

- The heightened focus among municipalities, universities, and commercial clients on sustainability and ESG-driven solutions is increasing demand for Casella's Resource Solutions segment, strengthened by recent investments in upgraded recycling facilities and innovative processing capabilities-supporting top-line revenue growth and resiliency against commodity price swings.

- Ongoing consolidation trends in the waste management sector, and Casella's robust acquisition pipeline in the under-penetrated Mid-Atlantic and select Northeast markets, allow the company to capture market share and drive earnings accretion through synergies, driving both revenue and long-term EBITDA improvements as integration challenges are resolved in 2026 and beyond.

- Infrastructure investments-such as automation in fleet (with 55 new and mostly automated trucks coming in late 2025), upgraded ERP systems, and route optimization-are expected to unlock significant operational efficiencies, capturing previously delayed cost synergies in the Mid-Atlantic region, which should materially boost net margins and EBITDA starting in 2026.

- Strong pricing power in core solid waste operations (evidenced by consistent 4.9%-5.9% price increases), coupled with a favorable, more stringent regulatory environment that raises barriers to entry for competitors, is positioning Casella to command premium contracts, supporting both revenue visibility and sustainable net margin growth over the long-term.

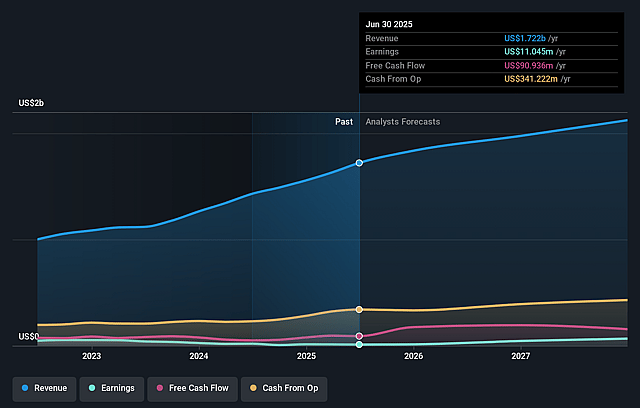

Casella Waste Systems Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Casella Waste Systems's revenue will grow by 10.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.6% today to 4.1% in 3 years time.

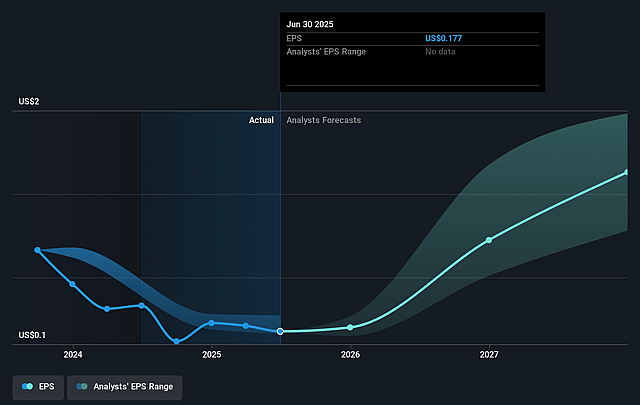

- Analysts expect earnings to reach $94.9 million (and earnings per share of $1.13) by about September 2028, up from $11.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 102.0x on those 2028 earnings, down from 533.3x today. This future PE is greater than the current PE for the US Commercial Services industry at 25.7x.

- Analysts expect the number of shares outstanding to grow by 0.28% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.19%, as per the Simply Wall St company report.

Casella Waste Systems Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Casella's aggressive acquisition strategy, while driving revenue growth, exposes the company to ongoing integration risks, as demonstrated by slower-than-expected synergy realization and persistent operational inefficiencies in the Mid-Atlantic region; this increases the likelihood of margin compression and diluted earnings accretion over time.

- Higher labor costs-particularly in newly acquired and less automated markets like the Mid-Atlantic-and industry-wide wage inflation are proving difficult to rapidly offset with productivity gains, putting sustained pressure on operating margins and potentially limiting future net income growth.

- Significant capital expenditure requirements, especially driven by bringing acquired asset bases up to company standards and expanding landfill/rail infrastructure, continue to push capital intensity higher; this could constrain free cash flow and reduce returns on invested capital if acquisition pace remains elevated.

- The company's limited geographic focus on the Northeast and Mid-Atlantic could restrict its ability to capitalize on faster-growing waste and recycling markets elsewhere in the U.S., thereby capping sustainable long-term revenue and earnings expansion relative to more geographically diversified peers.

- Volatility in recycling commodity prices and persistent contamination rates, combined with the need for expensive facility upgrades, threatens the profitability of the Resource Solutions segment, potentially leading to lower EBITDA contribution and exposing Casella to earnings downside during periods of weak recyclables demand.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $122.873 for Casella Waste Systems based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $140.0, and the most bearish reporting a price target of just $109.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $94.9 million, and it would be trading on a PE ratio of 102.0x, assuming you use a discount rate of 7.2%.

- Given the current share price of $92.77, the analyst price target of $122.87 is 24.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Casella Waste Systems?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.