Last Update 15 Nov 25

Fair value Decreased 0.26%JBHT: Earnings Momentum And Cost Discipline Will Offset Freight Market Uncertainty

J.B. Hunt Transport Services’ analyst price target was slightly reduced by less than $1 per share. Analysts point to ongoing operational cost improvements and higher profit margins supporting the company’s valuation, despite continued freight market uncertainty.

Analyst Commentary

Recent analyst updates on J.B. Hunt Transport Services present a mix of optimism and ongoing caution, reflecting the company's operational improvements and industrywide challenges. The following summarizes the main takeaways:

Bullish Takeaways- Bullish analysts highlight that cost-led margin improvements are driving upside, with several updating their earnings forecasts higher for 2025 and beyond.

- Strong Q3 performance, described as a “meaningful earnings beat,” is seen as evidence of improved operational execution and early benefits from cost initiatives.

- Improvements in intermodal and dedicated contract services margins are noted as key contributors to recent profitability gains, supporting higher price targets.

- Optimistic outlooks project that continued cost efficiencies and the potential for a freight market rebound could enable J.B. Hunt to benefit from strong operating leverage in the future.

- Bearish analysts express concerns regarding persistent freight demand uncertainty and note that inflation will continue to pressure the company’s cost structure into 2026.

- Some believe that visibility in the freight cycle remains low, which may lead to continued volatile or muted results in the near term.

- Price targets were trimmed in several cases, citing weak industrial growth and supply imbalances in the sector.

- Downgrades and target reductions are also attributed to doubts about pricing power in the truckload segment and a perceived lack of demand catalysts for rate increases reflected in consensus estimates.

What's in the News

- The U.S. government halted the issuance of worker visas for commercial truck drivers, raising concerns about labor supply and competition in the trucking industry (Periodical).

- J.B. Hunt announced a new share repurchase program authorizing up to $1 billion in common stock buybacks, with no stated expiration date (Key Developments).

- The company completed the repurchase of over 6.1 million shares, representing 6.18% of outstanding shares, under a previous buyback program (Key Developments).

- Brad Delco was named Chief Financial Officer of J.B. Hunt, effective September 1, 2025. He will succeed John Kuhlow, who will remain as Chief Accounting Officer (Key Developments).

- J.B. Hunt issued earnings guidance for 2025, expecting operating income to remain approximately flat compared to 2024 (Key Developments).

Valuation Changes

- Fair Value: Adjusted marginally lower from $166 to $165.57 per share.

- Discount Rate: Decreased slightly from 8.19% to 8.13%.

- Revenue Growth: Projected to increase modestly from 5.30% to 5.40%.

- Net Profit Margin: Expected to rise from 5.99% to 6.15%.

- Future P/E is forecast to decline from 20.0x to 19.3x.

Key Takeaways

- Improved equipment utilization and cost optimization efforts enhance operational efficiencies, positively affecting net margins and profitability.

- Strategic investments in technology and capacity expansion support long-term revenue growth by accessing large addressable markets.

- Inflationary pressures, competitive rates, and muted demand in key segments challenge margins and earnings amidst an uncertain macroeconomic and policy environment.

Catalysts

About J.B. Hunt Transport Services- Provides surface transportation, delivery, and logistic services in the United States.

- Record first quarter intermodal volumes could indicate an ability to capture more market share, contributing to potential revenue growth.

- Efforts to improve equipment utilization and reduce empty move costs may enhance operational efficiencies, positively impacting net margins.

- Strategic investments in technology and capacity expansion may provide a platform for long-term revenue growth by better serving large addressable markets.

- Successful bid season outcomes, including modest rate increases and filling costly empty lanes, could drive better revenue and profitability metrics.

- The focus on reducing and optimizing costs, combined with a disciplined capital allocation strategy, suggests improvements in earnings as the company scales operations.

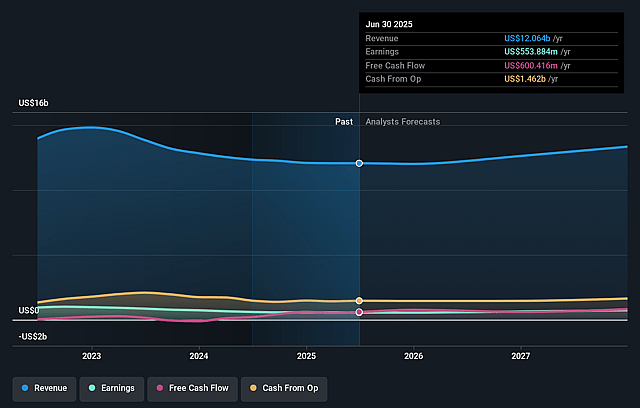

J.B. Hunt Transport Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming J.B. Hunt Transport Services's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.6% today to 5.9% in 3 years time.

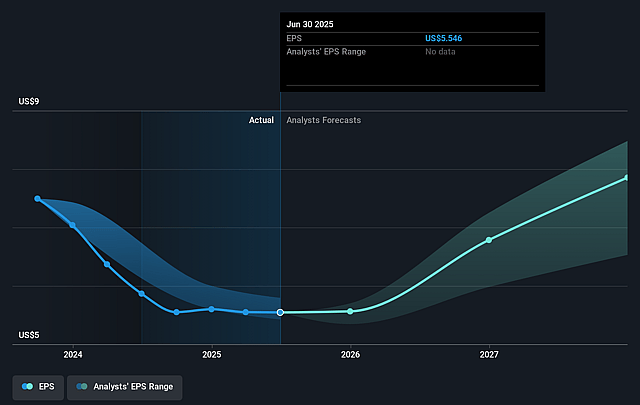

- Analysts expect earnings to reach $830.2 million (and earnings per share of $9.07) by about September 2028, up from $553.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.7x on those 2028 earnings, down from 24.6x today. This future PE is lower than the current PE for the US Transportation industry at 24.6x.

- Analysts expect the number of shares outstanding to decline by 4.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.17%, as per the Simply Wall St company report.

J.B. Hunt Transport Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company faces a challenging operating environment with inflationary cost pressures more than offsetting productivity improvements, affecting margins and earnings.

- Lower yields and increased insurance premiums have been weighing on operating income, indicating potential pressure on net margins and earnings.

- Seasonally lower volume and rate pressure coupled with competitive truckload rates, especially in the Eastern network, may limit the ability to achieve desired price increases and hurt revenue and margins.

- Demand for Final Mile services such as furniture and appliances remains muted, potentially impacting revenue and margin growth in this segment.

- The uncertain macro environment and changing trade policies, including tariffs, pose risks to supply and demand dynamics, which could impact revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $159.375 for J.B. Hunt Transport Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $180.0, and the most bearish reporting a price target of just $133.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $14.0 billion, earnings will come to $830.2 million, and it would be trading on a PE ratio of 20.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of $141.0, the analyst price target of $159.38 is 11.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.