Last Update 10 Dec 25

PLXS: Shares Will Likely Trade Steadily As Execution Offsets Macro Caution

Analysts have modestly increased their Plexus price target to approximately $159 per share. This reflects confidence in the company’s robust execution and long term growth prospects, despite a more cautious stance on the macro environment and valuation.

Analyst Commentary

Recent Street research reflects a mixed but generally constructive stance on Plexus, with analysts weighing solid execution and improving fundamentals against a more uncertain macro environment and a full valuation.

Bullish Takeaways

- Bullish analysts highlight Plexus's strong Q4 performance, noting that sales and earnings exceeded expectations and underscored consistent operational execution.

- Several firms point to recent management meetings as reinforcing confidence in Plexus's long term growth trajectory and the potential for continued fundamental expansion.

- Positive revisions to price targets into the mid 150s to mid 160s are framed as recognition of both the quality of execution and the durability of the company’s strategic initiatives.

- Despite macro uncertainty, bullish analysts suggest Plexus is positioned to outgrow end markets over time, supporting a premium to historical valuation ranges.

Bearish Takeaways

- Bearish analysts emphasize that shares are trading near the upper end of historical valuation ranges, limiting upside even with solid execution.

- There is a growing focus on macro volatility, with some firms scaling back out year estimates to reflect a more cautious demand backdrop.

- Concerns persist that management’s own commentary on the environment signals potential moderation in growth, tempering enthusiasm for aggressive multiple expansion.

- As a result, some ratings have shifted to more neutral stances, with price targets clustered around current levels, reflecting a view that much of the near term good news is already priced in.

What's in the News

- Evolv Technologies enters a strategic contract manufacturing partnership with Plexus, leveraging Plexus design, supply chain, and global manufacturing capabilities to support Evolv's next phase of growth, capacity expansion, and cost savings (client announcement).

- The partnership with Evolv provides Plexus with incremental production volume tied to security screening products and enhances Plexus exposure to global expansion opportunities through its international production network (client announcement).

- Plexus issues fiscal first quarter 2026 guidance, projecting revenue of $1.050 billion to $1.090 billion and GAAP diluted EPS of $1.40 to $1.55, including $0.26 of stock based compensation expense (corporate guidance).

- Plexus completes a share repurchase tranche, buying back 160,364 shares, or 0.59% of shares outstanding, for $21.5 million under the previously announced May 14, 2025 buyback program (buyback update).

Valuation Changes

- The fair value estimate is unchanged at approximately $159.00 per share, indicating no material revision to the intrinsic value assessment.

- The discount rate has risen slightly from 8.50% to about 8.52%, reflecting a modest increase in the required return or perceived risk profile.

- Revenue growth is effectively unchanged at roughly 7.53% per year, suggesting stable expectations for top line expansion.

- The net profit margin is essentially flat at about 4.22%, indicating no meaningful adjustment to long term profitability assumptions.

- The future P/E has risen marginally from about 24.00x to 24.01x, implying a slightly higher multiple applied to forward earnings in the valuation framework.

Key Takeaways

- Focus on high-growth, complex sectors and value-added services is driving a shift toward higher-margin, long-term contracts and stronger revenue consistency.

- Global facility expansion and strong cash flow position Plexus to capitalize on sector trends, supporting sustained revenue growth and enhanced shareholder returns.

- Plexus faces revenue and margin volatility due to demand uncertainties, sector cyclicality, customer concentration, rising costs, and intensifying industry competition.

Catalysts

About Plexus- Provides electronic manufacturing services in the United States and internationally.

- Plexus is capitalizing on the growing demand for advanced electronics manufacturing fueled by digital transformation, IoT expansion, and emerging technologies like AI and connected vehicles, as reflected in a robust pipeline of new program wins across high-growth sectors-this is likely to drive sustained multi-year revenue growth and larger addressable markets.

- Strategic expansion and high utilization of global facilities, particularly the new Malaysia site (with initial focus on semicap and planned healthcare ramp), positions the company to meet increased demand both from reshoring/regionalization trends and sector-specific growth, which should support ongoing revenue gains and improved asset turnover.

- The company's increasing success in winning programs in high-margin, complex sectors such as healthcare/life sciences, aerospace, and defense (including strong defense pipeline in Europe and record sector wins), is shifting the revenue mix toward segments with higher pricing power and more stable, long-term contracts-this should positively impact both revenue consistency and net margin expansion.

- Continued investment and strong performance in high-value engineering and design services (now exceeding $100 million, growing, and diversified across more sectors), is allowing Plexus to move up the value chain, resulting in larger contract sizes, enhanced customer stickiness, and higher gross margins.

- Robust free cash flow generation and improved working capital efficiency have enabled greater returns to shareholders and provide Plexus with flexibility for further growth investments, supporting long-term earnings expansion.

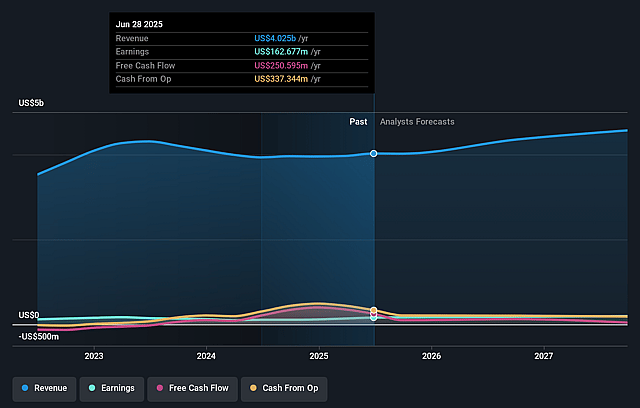

Plexus Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Plexus's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.0% today to 4.2% in 3 years time.

- Analysts expect earnings to reach $202.1 million (and earnings per share of $7.49) by about September 2028, up from $162.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.2x on those 2028 earnings, up from 22.6x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to decline by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.28%, as per the Simply Wall St company report.

Plexus Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing tariff-related uncertainties and rising protectionism lead customers to remain in a wait-and-see mode, which could dampen order activity and create unpredictability in revenue growth for Plexus over the long term (impact: revenue volatility and slower top-line growth).

- Customer-specific demand pushouts in high-growth verticals like semicap (now forecasting low double-digit growth instead of mid-teens), as well as flat outlooks in Aerospace, highlight Plexus's vulnerability to cyclical and program-driven fluctuations in its key sectors (impact: revenue instability and potential earnings variability).

- High customer concentration and a heavy reliance on large contract ramp-ups (notably in sectors such as healthcare and aerospace/defense) as well as the need for continuous new customer onboarding increase the risk that order reductions or delays from a few key customers could destabilize results (impact: revenue concentration risk and potential margin pressure).

- The anticipated margin drag from startup facilities (e.g., new Malaysian plant) and ongoing integration costs, combined with the long-term threat of margin compression from global competition and potential cost inflation in materials and labor, may erode profitability and limit sustained operating margin expansion (impact: net margin compression and lower earnings growth).

- The commoditization trend in the electronics manufacturing services industry, coupled with potential further consolidation among large OEMs, could increase price-based competition and bargaining power against mid-sized providers like Plexus, putting sustained pressure on both revenue and margins (impact: industry margin erosion and profit pressure).

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $154.6 for Plexus based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $202.1 million, and it would be trading on a PE ratio of 25.2x, assuming you use a discount rate of 8.3%.

- Given the current share price of $136.51, the analyst price target of $154.6 is 11.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Plexus?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.