Key Takeaways

- Margin expansion and profit growth may exceed expectations due to transformative initiatives, optimized strategies, and a strong position in specialty markets.

- Leadership in sustainability, renewables, and green technology supports revenue resilience, diversification, and enhanced long-term shareholder returns.

- Structural challenges from energy transition, high debt, and global competition undermine long-term profitability, asset value, and investor confidence in Sasol's core fossil-fuel-driven model.

Catalysts

About Sasol- Operates as a chemical and energy company in South Africa and internationally.

- While analyst consensus anticipates international chemicals strategic initiatives will deliver a $100 million to $200 million EBITDA uplift, recent first-half results-showing a near doubling of segment EBITDA and transformative self-help measures only just beginning-indicate that actual margin expansion and profit contribution could substantially exceed expectations, resulting in sustained EBITDA and net margin outperformance in both 2025 and beyond.

- Analysts broadly agree that ERR-driven capital expenditure reductions and increased renewable integration will improve free cash flow, but with a revised emissions roadmap and renewables target already exceeding 1,200 megawatts, Sasol's capital needs may fall even further, releasing significant additional cash for accelerated deleveraging and creating room for higher shareholder returns and organic investment, markedly boosting future earnings and capital efficiency.

- Sasol's optimized value-over-volume strategy in both chemicals and fuels-prioritizing higher-margin sales channels, capturing premium netback prices, and leveraging supply chain flexibility-positions the company to benefit disproportionately from rising global demand for specialty chemicals and transport fuels in emerging and urbanizing markets, supporting stronger top-line growth and structurally higher margins.

- As global industrial customers rapidly shift towards reliable, local supply and sustainable products, Sasol's unique value chain in Southern Africa, together with strategic resource management and proven social license, make it a preferred supplier for domestic and regional markets, ensuring resilient revenue streams and giving it potential pricing power through the cycle.

- Sasol's leadership in green hydrogen, sustainable fuels, and technology licensing-supported by deep technical expertise in Fischer-Tropsch and process integration-can unlock new high-margin revenue streams over the long run, capturing a significant share of low-carbon chemicals demand and translating into a step-change in long-term revenue diversification and margin uplift.

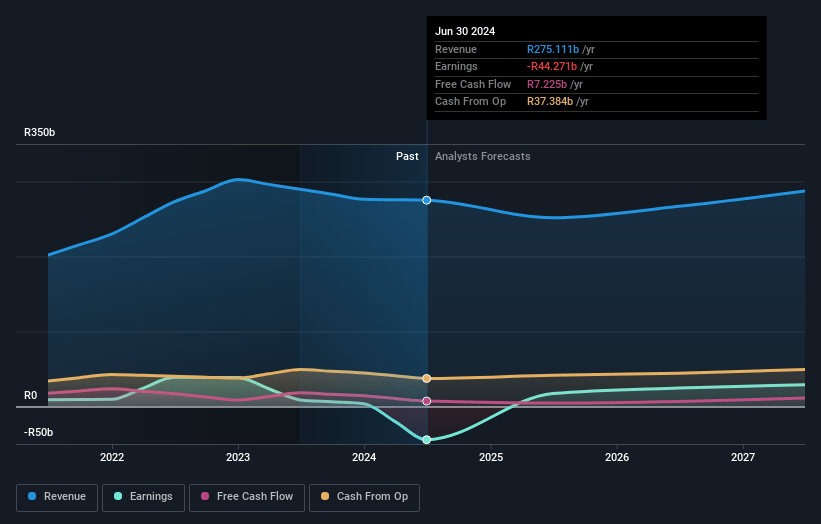

Sasol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Sasol compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Sasol's revenue will grow by 6.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -18.9% today to 16.0% in 3 years time.

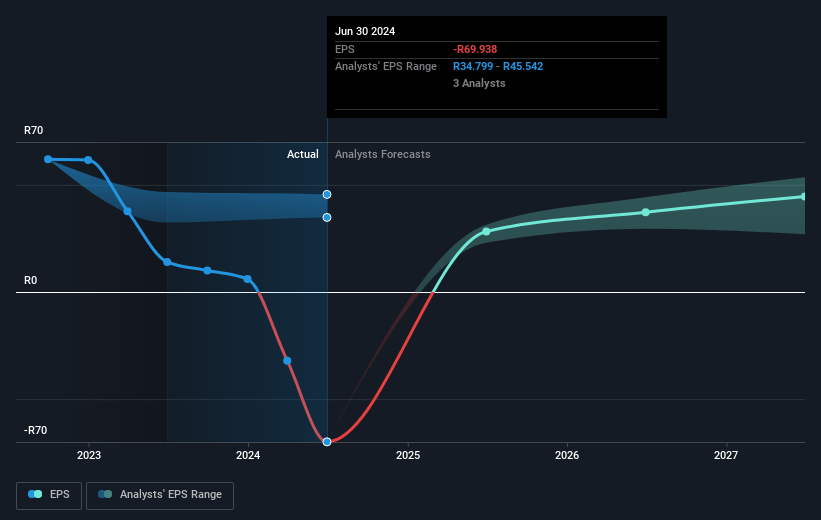

- The bullish analysts expect earnings to reach ZAR 50.1 billion (and earnings per share of ZAR 80.75) by about July 2028, up from ZAR -49.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 4.4x on those 2028 earnings, up from -1.2x today. This future PE is lower than the current PE for the US Chemicals industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.16%, as per the Simply Wall St company report.

Sasol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sasol faces persistent long-term risks from global decarbonization and a shift towards renewable energy, which continue to reduce long-term demand for their fossil fuel-based products. This negatively impacts future revenue growth and the sustainability of their core business model.

- Increasingly stringent environmental regulations, and the threat of higher carbon taxes, are likely to escalate both operational and compliance costs for Sasol, thereby placing downward pressure on net margins and long-term profitability.

- The company carries a significant high debt burden, with net debt exceeding USD 4 billion and most of it denominated in U.S. dollars, while nearly all earnings are generated in South Africa. This currency mismatch heightens financial risk, impacts free cash flow, and constrains the ability to invest in cleaner technologies or pay dividends, thereby affecting net earnings and shareholder returns.

- Sasol's chemicals segment remains exposed to global oversupply, particularly from new capacity in Asia and the Middle East, which drives down margins and makes it difficult for Sasol to sustain profitability and revenue in the face of heightened competition and weaker demand in Europe.

- Delayed execution and cost overruns in both operational upgrades and the energy transition-exemplified by ongoing impairment charges and mothballing of international assets-reflect structural difficulties in adapting to changing industry trends; repeated impairments and underutilized assets erode net asset value, damage investor confidence, and suppress long-term earnings potential.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Sasol is ZAR177.28, which represents two standard deviations above the consensus price target of ZAR119.33. This valuation is based on what can be assumed as the expectations of Sasol's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR180.0, and the most bearish reporting a price target of just ZAR70.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be ZAR312.9 billion, earnings will come to ZAR50.1 billion, and it would be trading on a PE ratio of 4.4x, assuming you use a discount rate of 25.2%.

- Given the current share price of ZAR92.28, the bullish analyst price target of ZAR177.28 is 47.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.