Key Takeaways

- Global energy transition and tightening climate regulations threaten Sasol's fossil-fuel-based revenues, increase compliance costs, and raise risks of market restrictions.

- Persistent high emissions, intense competition, and balance sheet vulnerabilities increase exposure to earnings volatility and undermine profitability and future dividend stability.

- Operational transformation, decarbonization cost reductions, disciplined financial management, and asset optimization are driving stability, margin expansion, and renewed growth opportunities for Sasol.

Catalysts

About Sasol- Operates as a chemical and energy company in South Africa and internationally.

- The global acceleration of renewable energy adoption and stricter international climate regulations will reduce long-term demand for Sasol's fossil fuel-based products, directly pressuring future revenues and increasing compliance costs for emissions, which will further squeeze net margins.

- Sasol's core synthetic fuels and chemicals operations will continue to face high and persistent carbon emissions, resulting in ongoing carbon liabilities and the risk of market access restrictions, ultimately threatening both earnings predictability and revenue growth as carbon taxes and environmental standards tighten.

- The company's ability to transition to lower-carbon products remains highly uncertain, with execution risks around capital-intensive transformation projects and a danger of stranded assets, which could result in significant capital misallocation and further impairments, negatively impacting long-term return on equity and future earnings.

- Commodity chemicals oversupply and increased competition from low-cost global players, especially during periods of weak market demand, are likely to compress margins and undermine profitability in Sasol's chemical segments, as evidenced by recent structurally low margins in Chemicals Eurasia and continued volatility in feedstock costs.

- High leverage and a mismatched balance sheet, with over 90 percent of debt denominated in US dollars while earnings are largely in South African rand, magnifies earnings volatility and refinancing risks, threatening free cash flow generation and putting future dividend potential at risk unless substantial asset sales or further debt reduction can be achieved.

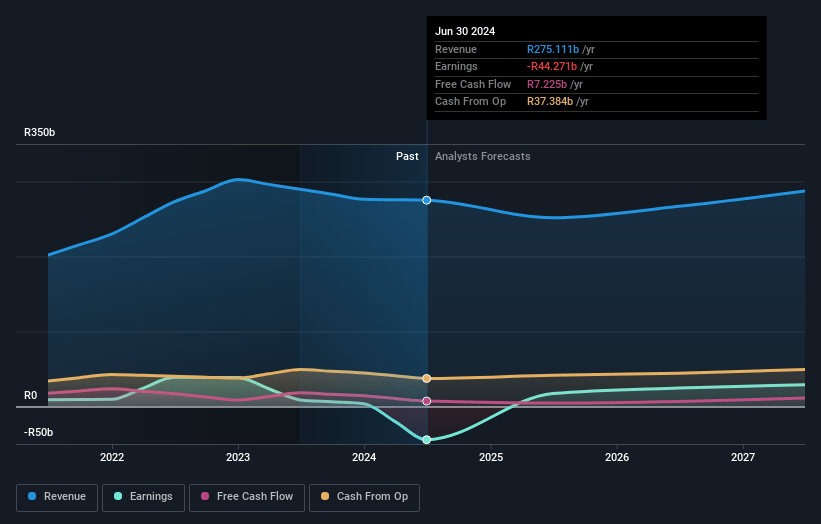

Sasol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sasol compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sasol's revenue will decrease by 1.1% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -18.9% today to 7.2% in 3 years time.

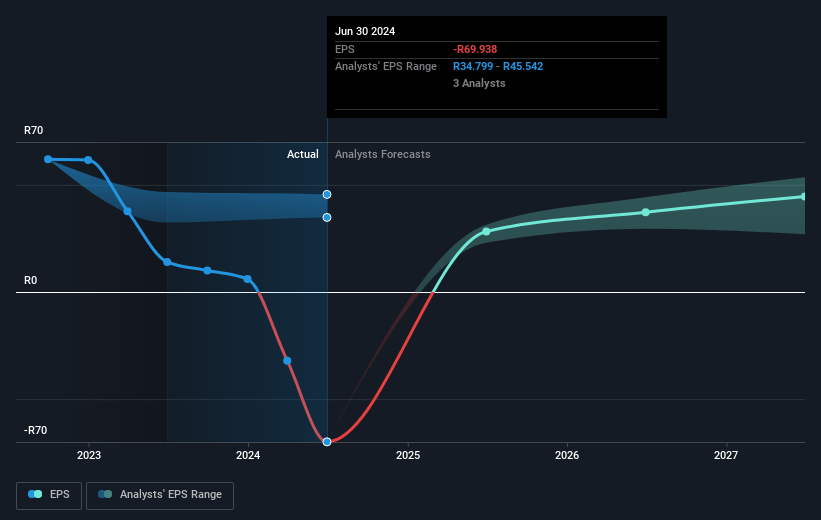

- The bearish analysts expect earnings to reach ZAR 18.1 billion (and earnings per share of ZAR 39.24) by about July 2028, up from ZAR -49.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 4.9x on those 2028 earnings, up from -1.1x today. This future PE is lower than the current PE for the US Chemicals industry at 11.5x.

- Analysts expect the number of shares outstanding to grow by 0.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 25.28%, as per the Simply Wall St company report.

Sasol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sasol has made significant progress on its operational transformation, including mothballing underperforming international assets, pursuing cost efficiencies, and shifting its International Chemicals business toward higher-margin solutions, which has already resulted in an 80% increase in international chemical EBITDA contributions; these trends may support margin expansion, earnings stability, and a potential EBITDA uplift of USD 100 million to USD 200 million from the FY24 baseline.

- The company's revised emission reduction roadmap (ERR) sharply reduces required capital for decarbonization efforts from a previous range of ZAR 15–25 billion to a new range of ZAR 11–16 billion, while maximizing production at key operations and leveraging renewable energy and efficiency gains, thus supporting free cash flow and reducing strain on net margins as regulatory and carbon tax risks are managed.

- Sasol's proactive balance sheet management, including a reduction in capital expenditure, prioritization of debt reduction, a targeted plan to bring net debt below USD 4 billion, and hedging against oil and currency volatility, directly enhances financial resilience and could enable a return to sustainable shareholder dividends, positively affecting long-term earnings and investor perception.

- Strategic asset portfolio reviews and flexibility in sourcing coal-balancing internal mining and market purchases as most cost-effective-alongside investments in destoning and quality improvement projects, offer potential to stabilize or even increase production volumes, improving revenue generation and supporting higher overall throughput at key facilities like Secunda.

- The International Chemicals segment is seeing not only cost synergies and improved asset utilization after the restart of key facilities (e.g., the US cracker), but management believes there is further upside in performance as asset reset, mothballing, and potential best-practice sharing drive additional margin improvement and cost savings, underpinning both growth prospects and improved group-level profit margins in the medium to long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sasol is ZAR70.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sasol's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of ZAR180.0, and the most bearish reporting a price target of just ZAR70.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be ZAR252.6 billion, earnings will come to ZAR18.1 billion, and it would be trading on a PE ratio of 4.9x, assuming you use a discount rate of 25.3%.

- Given the current share price of ZAR88.24, the bearish analyst price target of ZAR70.0 is 26.1% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.