Last Update 10 Dec 25

UGI: Ongoing Share Repurchases Will Support Future Cash Flow Stability

Analysts have nudged their price target for UGI slightly higher to approximately $43.00 per share, reflecting modestly lower discount rate assumptions and stable long term forecasts for revenue growth, profit margins, and future valuation multiples.

What's in the News

- Completed a multi year share repurchase program originally announced on May 8, 2018, totaling 4,650,000 shares, or 2.33% of outstanding shares, for $194.64 million (company filing)

- In the most recent tranche from July 1, 2025 to September 30, 2025, repurchased 500,000 shares, representing 0.23% of shares outstanding, for $16.53 million (company filing)

- Ongoing capital returns via buybacks signal management confidence in long term cash flow stability and balance sheet capacity (company commentary/market interpretation)

Valuation Changes

- Fair Value Estimate maintained at approximately $43.00 per share, indicating no material change to the central valuation outcome.

- Discount Rate edged down slightly from about 7.34 percent to roughly 7.33 percent, modestly increasing the present value of future cash flows.

- Revenue Growth effectively unchanged at around 3.42 percent annually, signaling stable long term top line expectations.

- Net Profit Margin essentially flat at about 9.75 percent, reflecting steady assumptions for long term profitability.

- Future P/E decreased marginally from roughly 14.41 times to 14.41 times, a negligible shift in the assumed exit multiple.

Key Takeaways

- Divestitures and regulatory wins fuel earnings quality, financial flexibility, and fund investments in grid modernization and renewable energy projects.

- Operational efficiencies and growing distributed energy solutions drive margin expansion, customer growth, and improved free cash flow.

- Structural shifts away from fossil fuels, rising costs, and regulatory pressures threaten UGI's margin stability, free cash flow, and long-term growth in core markets.

Catalysts

About UGI- Engages in the distribution, storage, transportation, and marketing of energy products and related services in the United States and internationally.

- Anticipated implementation of new, higher utility rates in Pennsylvania-pending regulatory approval-will provide substantial incremental revenue beginning in fiscal 2026, supporting continued investment in grid resiliency and modernization.

- Strategic investments in renewable natural gas (RNG) projects, bonus depreciation potential, and stronger regulatory incentives through recent legislation (e.g., the One Big Beautiful Bill Act) are expected to drive long-term EBITDA growth and improve net margins.

- Increased activity and demand for distributed energy solutions and on-site LNG/LPG infrastructure in key markets like Pennsylvania create robust medium-term growth opportunities, expanding both the addressable customer base and stabilized cash flows.

- Ongoing operational efficiency programs-including AmeriGas customer base high-grading, delivery optimization, and cost reduction efforts at UGI International-are set to expand net margins and enhance free cash flow conversion.

- Divestiture of non-core, low-margin LPG assets and redeployment of proceeds into higher-return, regulated utility and energy services businesses enable greater financial flexibility, prudent deleveraging, and improved overall earnings quality.

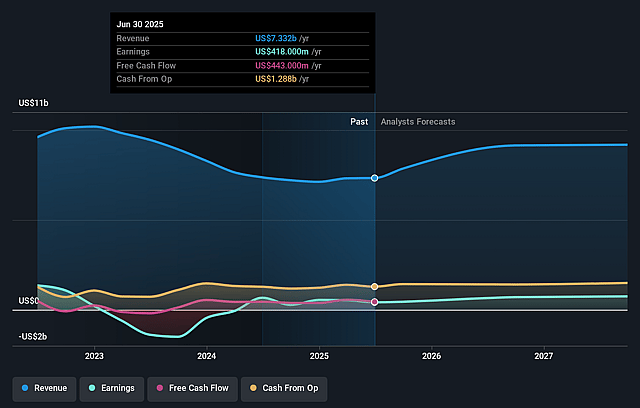

UGI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming UGI's revenue will grow by 7.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.7% today to 8.9% in 3 years time.

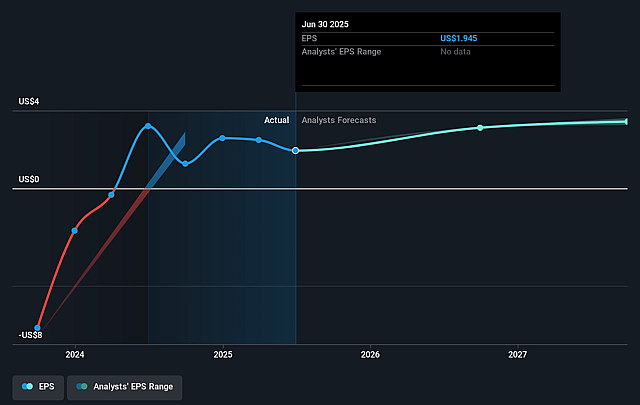

- Analysts expect earnings to reach $794.3 million (and earnings per share of $3.63) by about September 2028, up from $418.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, down from 17.6x today. This future PE is lower than the current PE for the US Gas Utilities industry at 17.6x.

- Analysts expect the number of shares outstanding to grow by 0.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.14%, as per the Simply Wall St company report.

UGI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- UGI International's 9% LPG volume decline, attributed to "structural conservation" and customer conversions from LPG to natural gas, highlights persistent long-term demand erosion for fossil-based fuels, which could lead to sustained revenue and margin pressure in core European operations.

- Continued customer attrition at AmeriGas-even if currently offset by weather or targeted retention initiatives-signals a fundamental, secular decline in the residential and small commercial propane market as alternatives like electrification and heat pumps become more widespread, potentially limiting long-term top-line and EBITDA growth.

- Rising operating and administrative expenses across core Utility segments, including costs related to aging infrastructure and increased personnel and maintenance outlays, threaten to outpace margin improvements and could compress net margins in the absence of significant rate increases or efficiency gains.

- UGI's increased capital allocation to regulated assets and energy infrastructure, while supporting near-term earnings stability, exposes the company to potential regulatory headwinds (e.g., rate case risk, stricter environmental mandates) and high capex needs, both of which could weigh on free cash flow and restrict future dividend growth or debt reduction.

- Declining profitability in Midstream & Marketing due to divestitures (such as the sale of power generation assets) and reduced margins from key contracts indicate a shrinking opportunity set, while continued climate-related conservation and regulatory uncertainty around natural gas may drive long-term volatility and constrain segment revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $41.0 for UGI based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.0 billion, earnings will come to $794.3 million, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 7.1%.

- Given the current share price of $34.23, the analyst price target of $41.0 is 16.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on UGI?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.