Last Update 17 Apr 25

Fair value Increased 0.066%Key Takeaways

- Expansion in solar projects and community solar enhances revenue through increased power generation, sales, and customer diversification.

- Incentives and innovative financing strategies optimize growth opportunities, capital structure, and earnings potential.

- Potential changes in incentives, interconnection delays, and rising costs pose significant risks to Altus Power's revenue, growth, and profitability projections.

Catalysts

About Altus Power- A clean electrification company, develops, owns, constructs, and operates roof, ground, and carport-based photovoltaic solar energy generation and storage systems.

- The company has surpassed 1 gigawatt of operating assets, and this scale provides a strong competitive edge, potentially improving operational efficiency and expanding revenue through increased power generation and sales.

- Continued federal and state-level incentives are reshaping the operating environment, expanding the total addressable market for solar projects and creating potential revenue growth as electricity prices rise and production costs decline.

- A renewed go-to-market strategy focused on early-stage project development and market-specific engagement aims to improve execution certainty and speed, potentially boosting revenue as these projects convert into revenue-generating assets.

- The rapid growth of the Community Solar portfolio, with significant customer base expansion, could enhance revenue through increased sales and a diversified customer base, while operational restructuring is expected to improve efficiency and margins.

- Innovative project financing strategies, such as a new tax equity partnership model, could unlock additional value and finances for growth, positively impacting earnings by optimizing capital structure and increasing investment returns.

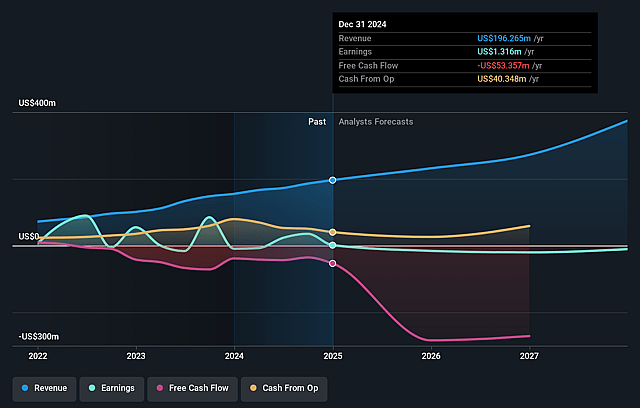

Altus Power Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Altus Power's revenue will grow by 24.0% annually over the next 3 years.

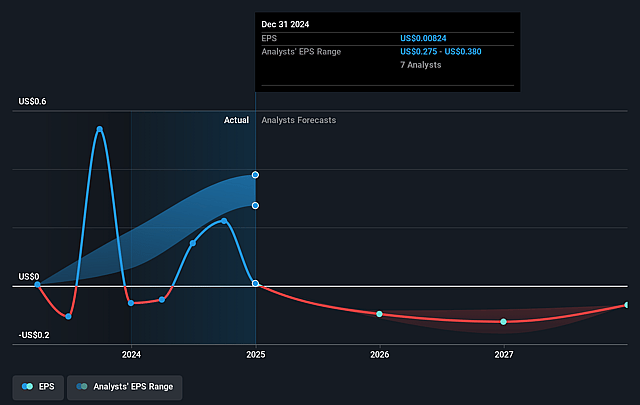

- Analysts are not forecasting that Altus Power will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Altus Power's profit margin will increase from 0.7% to the average US Renewable Energy industry of 9.2% in 3 years.

- If Altus Power's profit margin were to converge on the industry average, you could expect earnings to reach $34.4 million (and earnings per share of $0.21) by about April 2028, up from $1.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.7x on those 2028 earnings, down from 608.3x today. This future PE is lower than the current PE for the US Renewable Energy industry at 31.9x.

- Analysts expect the number of shares outstanding to grow by 0.34% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.66%, as per the Simply Wall St company report.

Altus Power Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Altus Power assumes various federal and state-level incentives will remain favorable. Any changes or uncertainty in these incentives, particularly related to the IRA or political shifts, could impact their revenue projections and growth plans.

- The company is dealing with ongoing interconnection delays with utilities, which could slow down the completion and monetization of new solar projects, potentially affecting revenue and cash flow.

- Although Altus Power's strategic review aims to unlock shareholder value, the absence of a guaranteed outcome could result in unchanged access to capital markets, potentially impacting future investment and growth in their asset base.

- Increasing operating expenses and interest costs, despite growing revenue, could put pressure on net margins and overall profitability if revenues do not continue to scale proportionately.

- Dependence on accurate weather predictions and market conditions for estimating ARR (annual recurring revenue) introduces risk. Variability can cause discrepancies in projected and actual revenue, impacting financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $5.083 for Altus Power based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $374.2 million, earnings will come to $34.4 million, and it would be trading on a PE ratio of 30.7x, assuming you use a discount rate of 8.7%.

- Given the current share price of $4.99, the analyst price target of $5.08 is 1.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Altus Power?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.