Key Takeaways

- Growing regulatory, cost, and sustainability pressures threaten margins and demand, especially given reliance on leisure travelers and rising industry-wide expenses.

- High exposure to economic cycles and concentration in a single regional hub increases risks from competition, demand shifts, and local economic downturns.

- Expanding cargo partnerships, operational agility, and ancillary initiatives are driving stable revenues, margin strength, and financial flexibility, ensuring long-term competitiveness and growth.

Catalysts

About Sun Country Airlines Holdings- An air carrier company, operates scheduled passenger, air cargo, charter air transportation, and related services in the United States, Latin America, and internationally.

- The proliferation of environmental regulation and the growing likelihood of carbon taxes threaten to materially raise Sun Country’s future operating costs, which may compress net margins and erode long-term earnings, especially as the airline’s leisure-focused network is particularly exposed to regulatory scrutiny and cost increases.

- Accelerating shifts in consumer sentiment toward sustainability and a rise in flight shaming risk undermining discretionary leisure air travel demand, pressuring Sun Country’s passenger revenues over the long-term as the company depends heavily on price-sensitive travelers for growth.

- Sun Country’s business model remains highly exposed to cyclical downturns in discretionary travel, amplifying volatility in both revenue and earnings, and making the current valuation vulnerable to any weakening in economic or consumer conditions.

- The company’s concentrated exposure to the Minneapolis–St. Paul hub increases vulnerability to regional competition or economic downturns, with limited network flexibility that could result in disproportionate declines in revenue and profit if demand softens in its core market.

- Long-term upward pressure on labor and fuel costs—driven by industrywide pilot shortages and decarbonization mandates—will likely compress net margins, while rising competition from larger legacy or ultra-low-cost carriers could erode pricing power and result in slower-than-expected growth in both revenue and earnings.

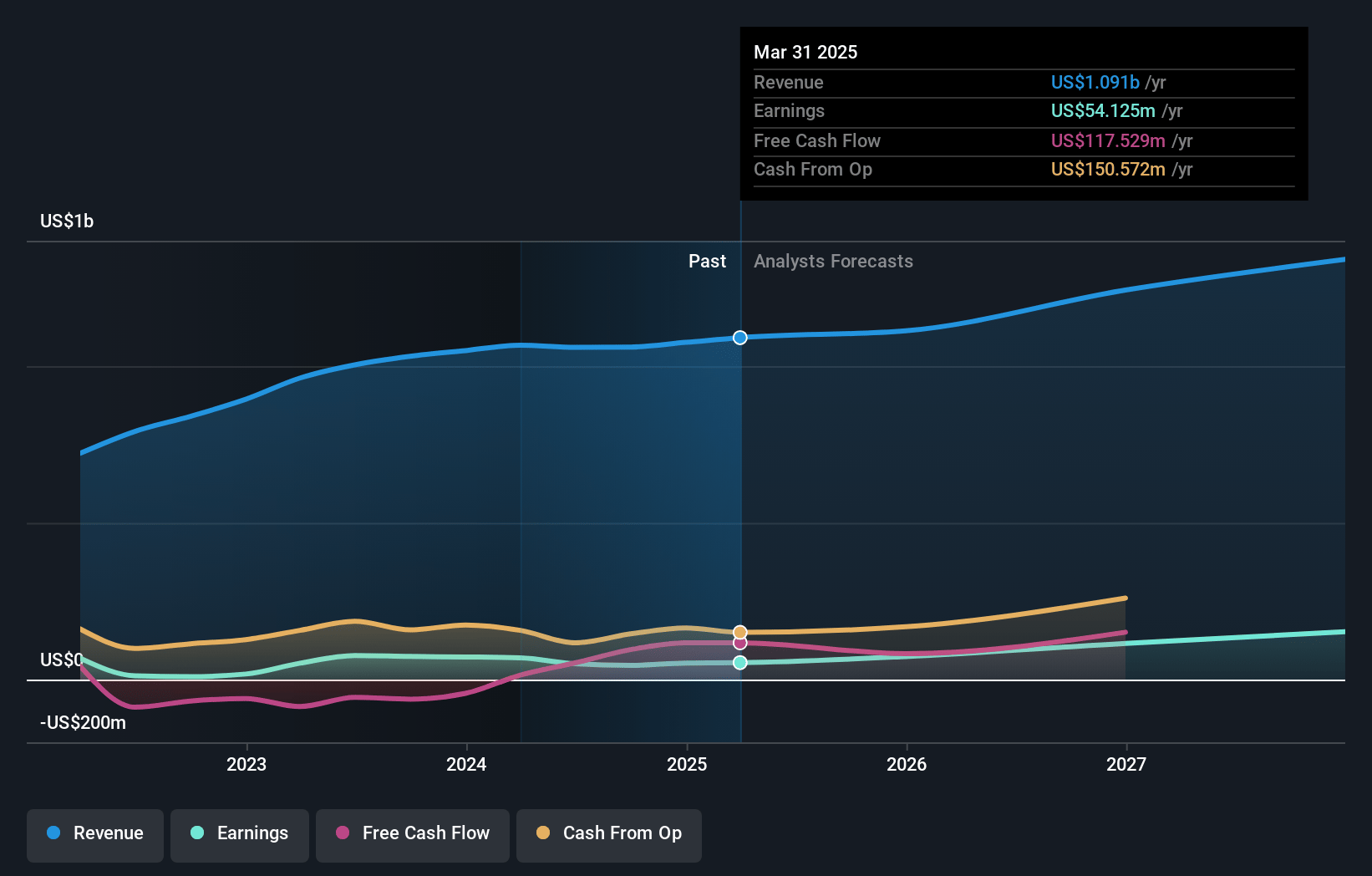

Sun Country Airlines Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Sun Country Airlines Holdings compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Sun Country Airlines Holdings's revenue will grow by 7.3% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 5.0% today to 11.3% in 3 years time.

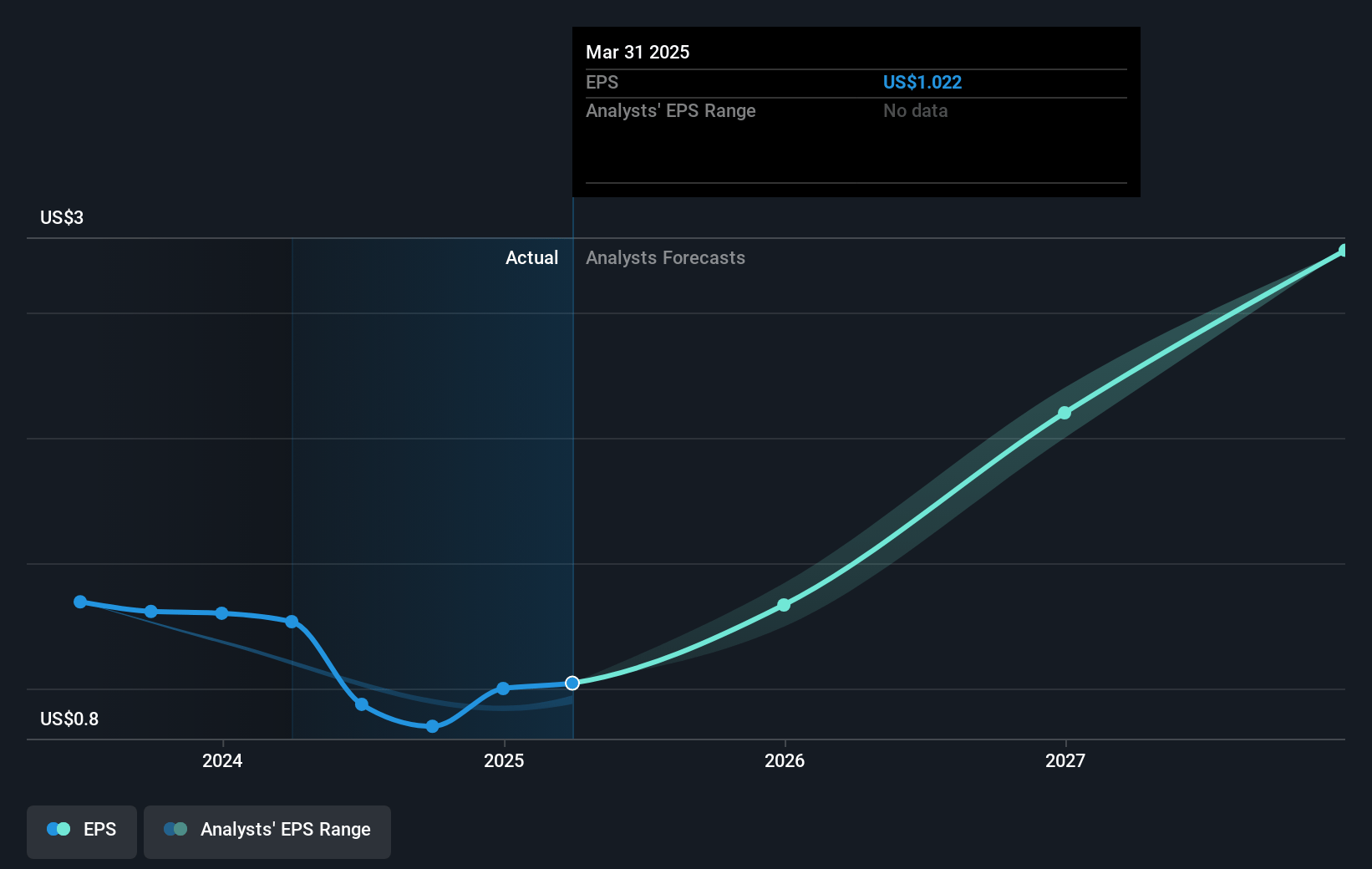

- The bearish analysts expect earnings to reach $152.8 million (and earnings per share of $2.75) by about May 2028, up from $54.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 5.5x on those 2028 earnings, down from 11.9x today. This future PE is lower than the current PE for the US Airlines industry at 11.4x.

- Analysts expect the number of shares outstanding to grow by 0.75% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.83%, as per the Simply Wall St company report.

Sun Country Airlines Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Significant expansion in the cargo segment, particularly through the Amazon partnership, is creating a large, contracted and predictable revenue stream that is set to double cargo revenue by September and remain a strong contributor to company-wide earnings stability for several years.

- Operational flexibility, especially the ability to rapidly reallocate aircraft and pilots between scheduled service, cargo, and charter, enables Sun Country to optimize utilization and capture ad hoc, high-margin revenue opportunities, which supports outperformance in both revenue growth and margin resilience.

- Strong brand and network position in underserved Midwest markets—backed by exclusive use of a dedicated terminal at Minneapolis and new gate additions—provide Sun Country with an entrenched, defensible market share that underpins steady passenger demand and helps maintain high load factors, thereby supporting net margins and revenue.

- Ongoing investment in ancillary revenue streams, like the new Synchrony co-branded credit card initiative, promises incremental, high-margin revenue growth that will begin to positively affect the bottom line starting in 2026 and help offset potential volatility in core ticket sales.

- The company’s balance sheet is improving rapidly, with robust liquidity and a clear path toward a net cash (debt-free) position by 2028, affording Sun Country both resilience during downturns and capital flexibility to pursue share repurchases or strategic M&A—factors that are supportive of long-term earnings growth and potential share price appreciation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Sun Country Airlines Holdings is $12.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Sun Country Airlines Holdings's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $21.0, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $152.8 million, and it would be trading on a PE ratio of 5.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of $12.1, the bearish analyst price target of $12.0 is 0.8% lower. The relatively low difference between the current share price and the analyst bearish price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.