Key Takeaways

- The end of ACP will lead to a short-term revenue decline.

- Predictive AI is providing more valuable customer service experiences.

- Cash flows and a low payout ratio can sustain dividends.

- Higher costs and capital expenses might prevent further debt reduction.

- AST SpaceMobile partnership could eventually spur new revenue growth.

Catalysts

Industry Catalysts

End of Affordable Connectivity Program Could Destabilize the Sector

The Federal Communications Commission is taking steps to wind down the Affordable Connectivity Program (ACP). This program provided most eligible households with a $30 per month subsidy toward fixed or mobile broadband service. Since 2021, the government has committed $14 billion to this popular program, helping over 23 million households.

However, as funding runs out this could be a negative catalyst for the bigger $42.45 billion Broadband Equity, Assess, and Deployment (BEAD) Program which promotes expanding high-speed internet access.

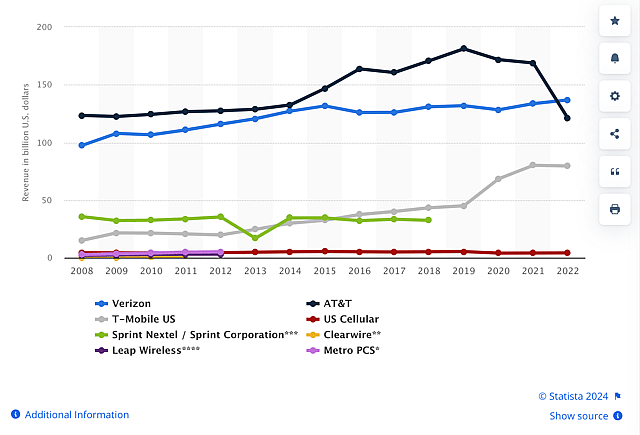

Revenue of Major US Telecommunication Companies, 2008-2022. Source: Statista

With just 4 months left of funding for ACP, domestic US providers should brace for revenue volatility and potentially lower margins as they grapple with adjustment to the new, unsubsidized reality where customer retention will be far less likely.

Predictive AI Can Unlock New Value For Providers

Artificial Intelligence (AI) has taken the world by storm, creating one of the strongest deflationary catalysts since the creation of the World Wide Web. This positive trend has not missed the telecommunications industry.

AI-driven personalized interactions have the potential to rapidly replace generic customer service, with companies like SoundHound offering turnkey solutions for small businesses that cannot afford dedicated customer services.

According to Gartner, telecom companies with integrated AI solutions have observed a 35% increase in customer satisfaction rates due to AI's ability to provide timely, relevant, and personalized service interactions.

Ultimately, AI integration would mean that companies like AT&T are able to offer higher-quality customer service with far less overhead.

Company Catalysts

Cash Flow Can Sustain A Strong Dividend

AT&T has lost its “Dividend Aristocrat” title, as it did not raise its dividend in 2021 after clocking 36 years of consecutive dividend hikes. Then, the company spun off its WarnerMedia into Discovery, cutting the payout almost in half.

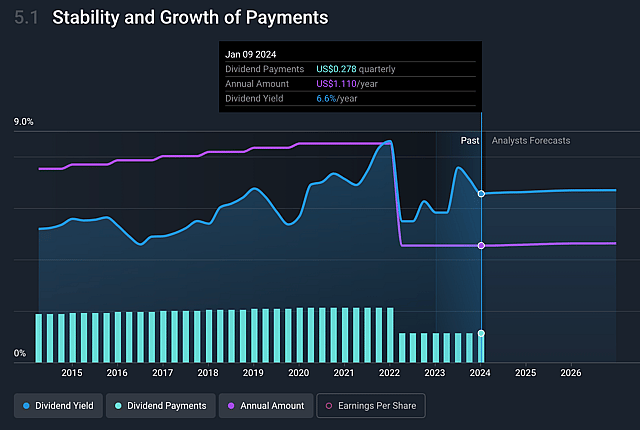

AT&T Dividend history payments, Source: Simply Wall St.

Still, owing to a significant yield and a strong cash flow, AT&T is still a good yield stock. It pays an above-average 6.4% yieldyield, or $8.1 billion in dividend payments. With a robust free cash flow of $22.9 billion on a trailing twelve-month basis, the cash payout ratio is less than 36%.

With the market expecting multiple rate cuts in 2024, the bond yields should go down, giving the yield-seeking investors an incentive to lock in such a safe and stable dividend.

AST SpaceMobile Partnership Could Secure New Growth

AT&T has been one of the largest supporters of AST SpaceMobile – a satellite manufacturer focused on building a space-based cellular broadband network with the goal of allowing existing, unmodified smartphones to connect to satellites in areas with coverage gaps.

Google, AT&T, and Vodafone invested $110 million in convertible debt, with the latter two committing to $45 million in prepayments for a future AST SpaceMobile commercial service.

According to AST, the market potential for such a venture is immense, with 3.7 billion users not subscribed to cellular broadband. Therefore, a successful commercial launch could help AT&T, the key telecommunications partner in this project, find new growth outside of the domestic market.

Assumptions

- I expect AT&T's revenues to further decline in 2024 at approximately 9% in line with current consensus expectations, before starting to recover in 2025 and beyond at a pace of approx. 4% annually.

- I expect the negative sentiment and short-term hurdles like the end of the $14.2 billion Affordable Connectivity program to cause a final revenue dip before positive catalysts like AI, space-based broadband, and foreign expansions like Mexico create positive growth.

- I believe that the management can execute further cost-cutting up to $2 billion annually.

- I expect the company to regain the upward trajectory of its dividend, keeping its position as a yield-oriented stock.

- I don't expect the company to make meaningful share buybacks, as the management prefers to return the value through dividends. Thus, I expect the number of shares outstanding to remain around 7.2 billion.\

- I expect the profit margins to stabilize in the low teens, driven by higher operational efficiency.

- I believe that the price-to-earnings ratio will return to its long-term averages at 11-12x.

Risks

Higher Costs Might Prevent Further Debt Reduction

AT&T experienced significant debt growth in the 2010s. However, since 2020, this indebtedness has been on a decline by about 5% per year. Furthermore, in 2023, the company recovered its profit margins and cash reserves from a 2022 slump and hit the target of $6b in run-rate cost savings.

However, the guidance for 2024 remains dimmed, with heightened capital expenses, which might obstruct the plans for further debt reduction. Currently, Fitch rates AT&T as BBB+, issuing a downgrade from A- in 2021. While the risk of default is extremely low, in an era of higher interest rates, any debt refinancing would add to the long-term financial burden.

Declining Expectations Could Hurt The Market Sentiment further

Even before the latest earnings, the market expectations for AT&T were arguably the worst in its recent past. Analysts made 12 EPS revisions, all to the downside, slowly trending from $0.64 to $0.56. Despite that, earnings per share still missed expectations by $0.02.

The guidance for 2024 includes an EPS lower than the consensus between $0.21-0.35. Although the management is optimistic about postpaid phone net additions this year, sector analyst Craig Moffett expressed skepticism about whether they're overestimating the market by 20%.

Despite negative sentiment, short interest remains low at less than 1.5%, indicating that the institutions aren't yet betting against the company.

If this next year of results falls short of expectations, AT&T is at risk of having its share price suppressed until meaningful growth is delivered.

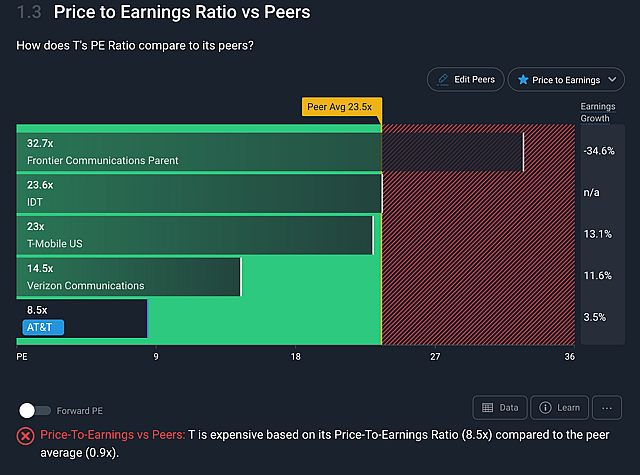

Discount To Peers Might Not Be Enough to Stimulate Interest

AT&T is currently trading at a significant discount, with a price-to-earnings (P/E) ratio of 8.7x, compared to its 20-year average of 12.91x and an industry average of 13.3x. Its closest peers are trading at even higher valuations, with Verizon at 15.3x and T-Mobile US at 23.3x.

AT&T P/E ratio vs telecommunications industry, Source: Simply Wall St.

Still, due to its questionable growth prospects, competitive industry, high capital investment requirements, and high levels of debt, the stock is often dubbed as a value trap. Furthermore, examining the ownership history shows that institutional ownership didn't oscillate much over the last few years despite a significant price drop.

AT&T has a surprisingly high level of retail ownership for a mature company, and it is unlikely to expect institutional cash infusions unless there are resolutions to the above-mentioned negative catalysts.

Have other thoughts on AT&T?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst StjepanK holds no position in NYSE:T. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.