Key Takeaways

- Expansion in IoT, direct-to-device, and broadband services, along with resilient communications demand, is driving recurring revenue growth and sustained margin improvement.

- Strategic partnerships and rising defense spending strengthen market penetration, business resilience, and create long-term opportunities for earnings and cash flow growth.

- Growing competition and alternative connectivity technologies threaten Iridium’s pricing, margins, and long-term growth as high costs and regulatory risks challenge its core satellite business model.

Catalysts

About Iridium Communications- Provides mobile voice and data communications services and products to businesses, the United States and international governments, non-governmental organizations, and consumers worldwide.

- The rapid expansion of IoT and direct-to-device markets, now with standards-based chipsets (3GPP Release 19) and the upcoming launch of Iridium NTN Direct, positions Iridium to tap into a much larger addressable market and to drive material revenue growth in its IoT business starting in 2026 and accelerating through the end of the decade, contributing directly to both recurring service revenue and long-term margin expansion.

- Growing demand for resilient global communications in response to natural disasters, climate adaptation, and critical infrastructure needs is underpinning the surge in interest and adoption of Iridium's new Positioning, Navigation, and Timing (PNT) services, acquired through Satelles, which management expects to become a major driver of high-margin revenue growth in both civil and commercial sectors through 2030 and beyond.

- Sustained increases in global defense spending and heightened geopolitical risk are expected to drive further adoption of secure satellite communications, benefiting Iridium's government service segment revenue and improving business resilience, as evidenced by the multi-year EMSS contract step-up with the U.S. government and growing international interest in Iridium STL for secure, mission-critical connectivity.

- The commercialization and broadening deployment of Iridium Certus broadband services in maritime, aviation, and land-mobile sectors, particularly as more certified terminals are rolled out, are expected to not only stabilize but reinvigorate broadband ARPU and subscriber growth, driving higher recurring service revenues and improved overall net margins over time.

- Strategic execution around partnerships with device OEMs, logistics providers, and telecommunications carriers is deepening Iridium’s market penetration and integration, facilitating service adoption in industries previously challenged by satellite cost, and creating durable recurring revenue streams and the potential for sustained earnings growth and cash flow generation into the next decade.

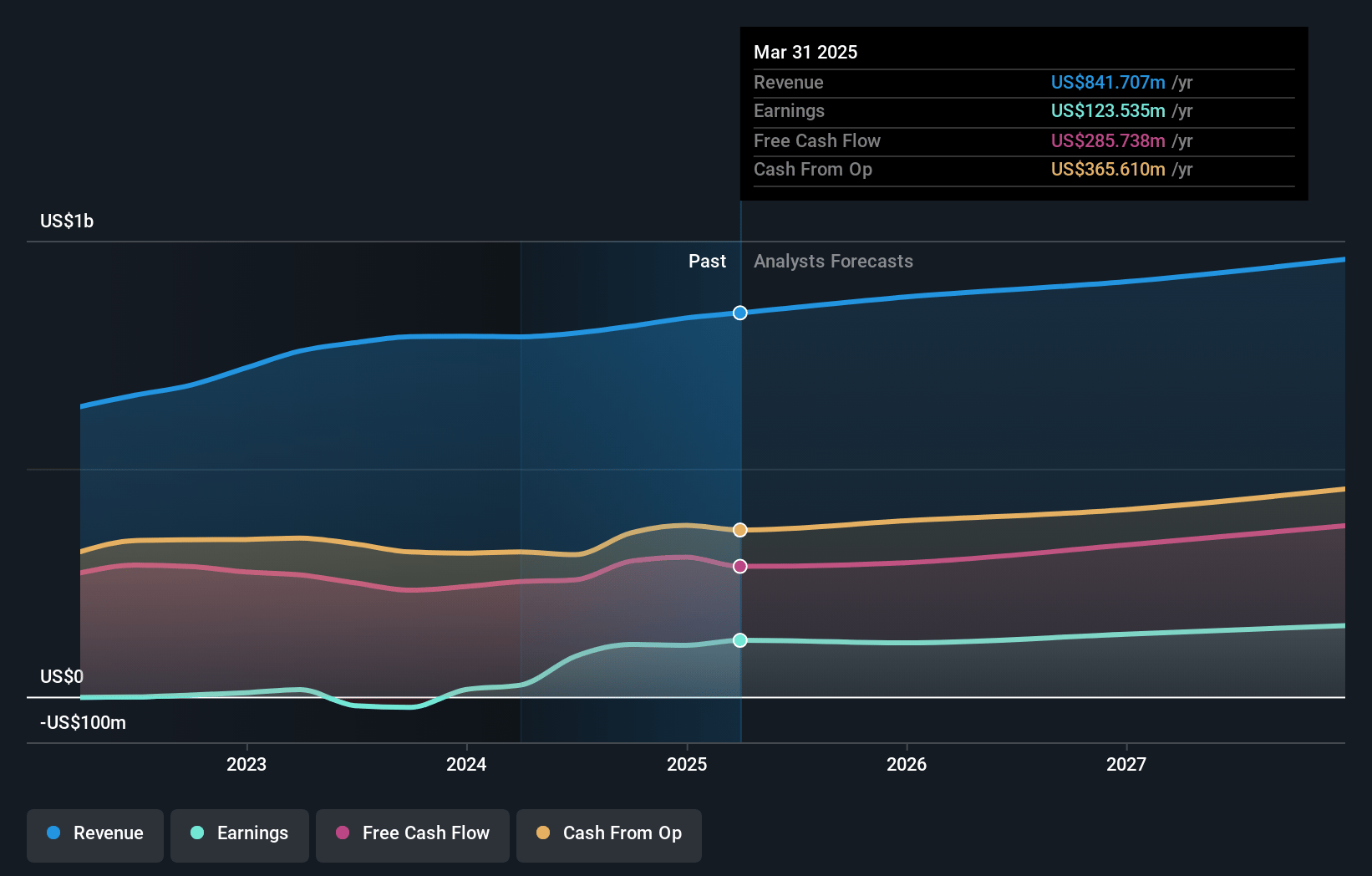

Iridium Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Iridium Communications compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Iridium Communications's revenue will grow by 5.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 14.7% today to 20.2% in 3 years time.

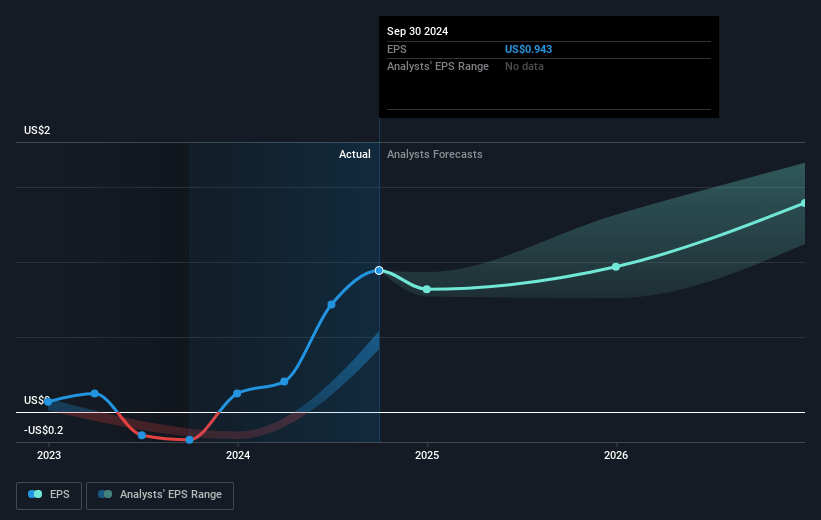

- The bullish analysts expect earnings to reach $201.7 million (and earnings per share of $2.15) by about May 2028, up from $123.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, up from 23.0x today. This future PE is greater than the current PE for the US Telecom industry at 16.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.21%, as per the Simply Wall St company report.

Iridium Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing proliferation of terrestrial networks such as 5G and eventual 6G, along with expanding fiber connectivity into remote regions, may reduce demand for Iridium’s core satellite-based voice and data services, leading to pressure on long-term revenue growth and limiting addressable market opportunities.

- Intensifying competition from LEO satellite operators like Starlink, OneWeb, and Amazon’s Kuiper—with their ability to offer high-capacity, lower-cost satellite communications—threatens to erode Iridium’s pricing power and could negatively affect both market share and net margins over time.

- Persistent declines in terrestrial data transmission costs and continued commoditization of basic satellite connectivity services are already creating downward pricing pressure in segments like maritime broadband, which may weigh on Iridium’s net margins and earnings as ARPU headwinds persist.

- Iridium’s business model requires significant ongoing investment in satellite replenishment and infrastructure upgrades; as its satellite network ages, upcoming capex needs could rise substantially, limiting free cash flow and constraining future dividends or share repurchase programs.

- Heightened geopolitical risk and evolving regulatory uncertainties, including unpredictable tariffs and spectrum allocation disputes, have already impacted costs and create longer-term risk for both international revenue and cost structure, particularly if trade tensions escalate or international access becomes restricted.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Iridium Communications is $47.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Iridium Communications's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $47.0, and the most bearish reporting a price target of just $25.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $201.7 million, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 6.2%.

- Given the current share price of $26.25, the bullish analyst price target of $47.0 is 44.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.