Last Update 30 Nov 25

Fair value Increased 0.60%GLW: Data Center Buildouts And Fiber Demand Will Support Robust Upside Potential

Analysts have raised their price target for Corning from $92.75 to $93.31. They cite continued improvements in revenue growth, profit margin, and robust demand in the Optical and Specialty Materials segments as key drivers for the upward revision.

Analyst Commentary

Recent Street research reflects a mix of optimism and lingering caution following Corning's latest financial and operational performance. Below, key bullish and bearish takeaways summarize the perspectives shaping analysts' price target revisions and stock recommendations.

Bullish Takeaways- Bullish analysts continue to raise price targets, citing stronger than expected revenue in the Display and Specialty Materials segments as key contributors to growth momentum.

- There is broad confidence that the Optical and Solar businesses will benefit from increased demand, particularly as supply chain constraints are resolved. This is expected to support an extended growth trajectory through at least 2027.

- Margin expansion is expected to persist, especially amid elevated spending by hyperscalers and robust demand for connectivity solutions related to artificial intelligence applications.

- Expectations for continued data center buildouts and the ongoing transition from copper to fiber reinforce a favorable outlook for Corning's long-term growth and market share in networking solutions.

- Bearish analysts highlight that recent earnings beats are primarily driven by select segments, while growth in Optical has been more modest. This tempers enthusiasm around overall execution.

- Some caution that portions of Corning's valuation reflect best case scenarios in margin expansion and demand, leaving less room for error should market conditions change.

- Concerns remain regarding external risks such as fluctuations in petrochemical profits and input costs, which could affect performance in chemical-focused business lines.

- While demand growth is notable, a neutral tone from certain analysts suggests that risk and reward may be balanced amid sector-specific headwinds and lingering supply chain challenges.

What's in the News

- Corning has entered a joint development and investment agreement with Ensurge Micropower to commercialize ultra-high performance solid-state microbatteries. The agreement includes up to USD 15 million in total potential investment and engineering support, which may be converted into shares and warrants. (Key Developments)

- The company completed the repurchase of 48.54 million shares, representing 6.12% of outstanding shares, under its ongoing buyback program. A recent tranche cost $25.05 million. (Key Developments)

- Corning is collaborating with All Weather Group to bring thin quadruple-pane window units with Corning® Enlighten™ Glass to the Canadian market. This initiative aims to advance efficiency and sustainability standards for window systems. (Key Developments)

- Corning provided fourth quarter 2025 guidance, projecting core sales of approximately $4.35 billion and core EPS in the range of $0.68 to $0.72. (Key Developments)

- Multiple new strategic alliances were announced, including partnerships with QuantumScape on ceramic separators for solid-state batteries and with GlobalFoundries to develop detachable fiber connector solutions for silicon photonics platforms. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from $92.75 to $93.31.

- Discount Rate increased marginally from 8.73% to 8.75%, which reflects a modest adjustment in perceived risk.

- Revenue Growth forecast has risen, moving from 13.91% to 14.12% year over year.

- Net Profit Margin has edged higher and is now at 14.80%, compared to the previous 14.76%.

- Future P/E multiple has declined fractionally and is now at 31.41x compared to the previous 31.51x.

Key Takeaways

- Strong demand in Optical and Solar sectors, along with U.S. manufacturing, boosts sales, margins, and aligns with energy policies for revenue growth.

- Share buybacks and innovations in data centers reflect confidence in cash flow and support earnings per share growth.

- Corning's strategic reliance on secular trends for growth, exposure to trade tensions, and competitive market pressures may challenge profitability and financial transparency.

Catalysts

About Corning- Engages in the optical communications, display technologies, environmental technologies, specialty materials, and life sciences businesses in the United States and internationally.

- Corning's Springboard plan aims to add more than $4 billion in annualized sales by 2026, driven by strong demand in Optical Communications and Solar sectors due to powerful secular trends, positively impacting revenue growth.

- The company sees substantial growth in Optical Communications, particularly in innovations for Gen AI data centers, which are expected to drive incremental revenue and accelerate operating margin improvements toward 20% by the end of 2026.

- Corning's significant U.S. manufacturing footprint provides a competitive edge and is expected to attract commercial agreements, enhancing sales and net margins despite tariff implications.

- In the Solar market, Corning plans to commercialize new U.S.-made products with committed customer capacity through 2025, aligning with government policies on energy independence, leading to higher revenue and earnings.

- The continued aggressive share buybacks reflect confidence in future cash flow generation and are expected to support earnings per share growth over the Springboard time frame.

Corning Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Corning's revenue will grow by 13.4% annually over the next 3 years.

- Analysts assume that profit margins will increase from 5.8% today to 12.6% in 3 years time.

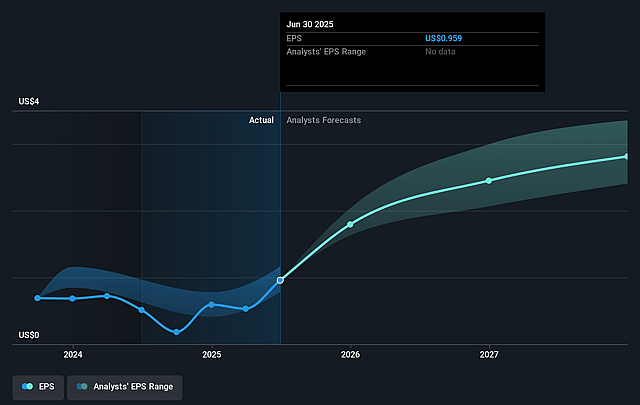

- Analysts expect earnings to reach $2.6 billion (and earnings per share of $2.98) by about September 2028, up from $819.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $3.1 billion in earnings, and the most bearish expecting $2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.3x on those 2028 earnings, down from 75.7x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

Corning Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Corning's reliance on non-GAAP core performance measures, as opposed to GAAP data, may obscure financial transparency, potentially leading to investor concerns regarding revenue and net margins.

- Exposure to tariffs, particularly from geopolitical tensions between the U.S. and China, although mitigated by Corning's local manufacturing strategy, still presents a potential risk that could affect net earnings.

- Corning's growth projections are highly reliant on secular trends like Gen AI and solar. Any slowdown or change in demand for these technologies could negatively impact revenue expectations and overall financial performance.

- The potential macroeconomic downturn, while adjusted for in Corning's risk analysis, still poses a threat as it could affect customer spending on big-ticket items like optical and automotive products, impacting revenue and net earnings.

- Increased competition in key markets such as Optical Communications and Solar, particularly from foreign manufacturers, could pressure pricing and margins, adversely affecting operating margins and overall profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $69.833 for Corning based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $84.0, and the most bearish reporting a price target of just $47.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $20.7 billion, earnings will come to $2.6 billion, and it would be trading on a PE ratio of 29.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of $72.39, the analyst price target of $69.83 is 3.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Corning?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.