Key Takeaways

- Acquiring Enercon boosts Bel Fuse's diversification, strengthening growth in aerospace and defense, while shifting manufacturing from China to India optimizes margins.

- Cost reduction initiatives and growth in AI and defense markets enhance profitability, bolstering future revenue and earnings.

- Tariffs and geopolitical tensions threaten Bel Fuse's profitability and revenue, while declining sales and margin volatility signal potential challenges in maintaining growth.

Catalysts

About Bel Fuse- Designs, manufactures, markets, and sells products that power, protect, and connect electronic circuits.

- The recent acquisition of Enercon has diversified Bel Fuse’s end markets, especially in aerospace and defense (A&D), contributing $32.4 million to Power segment sales in Q1 '25. This diversification is poised to support future growth and revenue stability amidst market challenges.

- The company is strategically reducing its exposure to tariffs by moving some manufacturing operations from China to India, which could preserve or enhance net margins by mitigating increased costs associated with tariffs.

- Bel Fuse is implementing various cost reduction and efficiency programs, which have already improved gross margins in Q1 '25 by 110 basis points compared to Q1 '24. These operational efficiencies are expected to continue enhancing profitability.

- There is a strong growth trajectory in AI, defense, and space markets, with AI contributing $4.6 million in Q1 '25 sales. This trend is expected to drive revenue growth and bolster future earnings.

- The expansion of R&D and a proactive approach to supply chain adjustments amidst tariff concerns can enhance product competitiveness and operational resilience, potentially increasing future revenues and supporting long-term earnings growth.

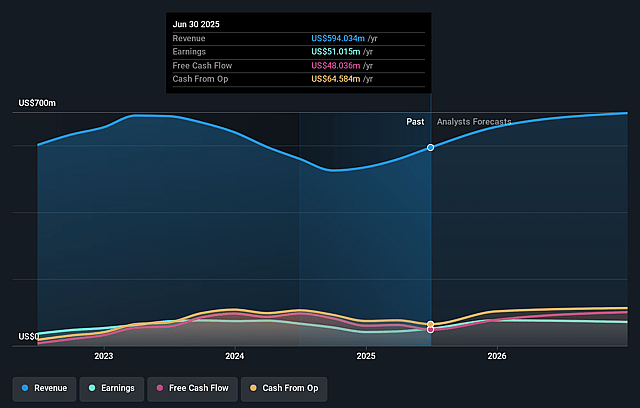

Bel Fuse Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Bel Fuse's revenue will grow by 10.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.7% today to 12.9% in 3 years time.

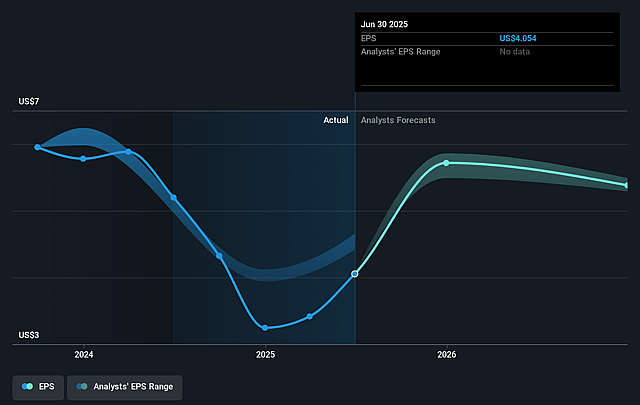

- Analysts expect earnings to reach $96.9 million (and earnings per share of $7.53) by about July 2028, up from $43.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, down from 26.3x today. This future PE is lower than the current PE for the US Electronic industry at 24.1x.

- Analysts expect the number of shares outstanding to grow by 0.95% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.22%, as per the Simply Wall St company report.

Bel Fuse Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Global tariffs are posing new challenges for Bel Fuse, potentially affecting the cost structure and profitability due to higher import costs on approximately 25% of their consolidated sales, impacting net margins.

- The company faces a decrease in sales in their networking, consumer, rail, and e-mobility markets, possibly indicating a declining demand in those segments, which could negatively impact revenue.

- A decline in gross margins within their Power segment, largely due to the absence of nonrecurring items recorded at a 100% margin in Q1 2024, suggests potential volatility in profit margins going forward.

- Tariff-related uncertainties are leading to customer hesitance on orders and potential revenue push-outs, particularly related to products imported from China, which could impact revenue in the near term.

- Increased geopolitical tensions and trade disputes are driving an urgent need for supplier diversification and regional sourcing strategies, adding execution risk to operations and potentially affecting earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $110.0 for Bel Fuse based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $750.6 million, earnings will come to $96.9 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 8.2%.

- Given the current share price of $89.16, the analyst price target of $110.0 is 18.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Bel Fuse?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.