Key Takeaways

- Strategic focus on automation and partnerships enhances scalability, market reach, and incremental profitability, improving margins by reducing costs.

- Anticipated double-digit growth, driven by traceability demand and strategic initiatives, signals substantial earnings improvement and increased shareholder value.

- Uncertainty in FDA laws, rising expenses, and intense competition may hinder ReposiTrak's revenue growth and strategic investment potential.

Catalysts

About ReposiTrak- A software-as-a-service provider, designs, develops, and markets proprietary software products in North America.

- ReposiTrak is poised to benefit from the accelerating need for end-to-end traceability in the grocery industry, driven by both regulatory mandates and market forces, which is expected to significantly increase top-line revenue.

- The company’s deferred revenue growth of 70% indicates a strong increase in future subscription revenue, expected to contribute an additional $1.7 million incrementally over the next 12 months, significantly improving earnings and profitability.

- The strategic focus on automation and onboarding via the Wizard platform improves scalability and customer acquisition efficiency, potentially increasing margins by reducing human interaction costs and boosting incremental profitability.

- ReposiTrak’s position as the largest operational traceability network attracts partnerships with key industry players like Upshop, expanding market reach and potentially driving additional revenue streams.

- Anticipated double-digit revenue growth in the second half of the fiscal year, with a target of 10% to 20% annual growth, indicates substantial upcoming improvements in earnings and shareholder value.

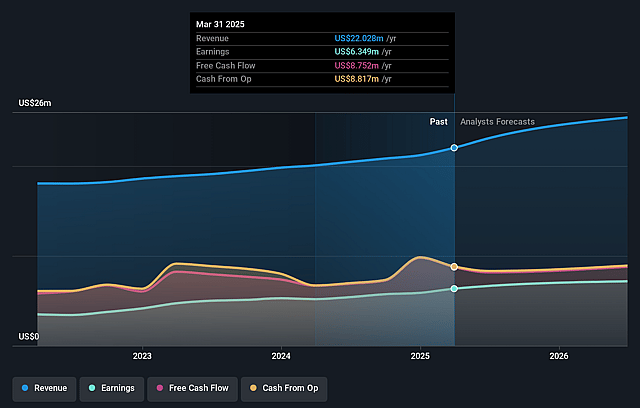

ReposiTrak Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ReposiTrak's revenue will grow by 11.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 28.8% today to 27.4% in 3 years time.

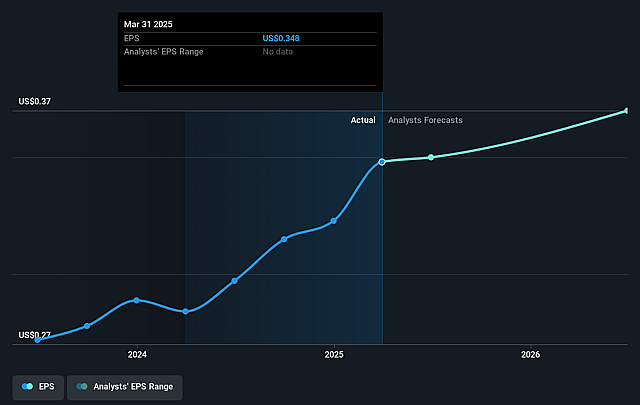

- Analysts expect earnings to reach $8.4 million (and earnings per share of $0.4) by about September 2028, up from $6.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.3x on those 2028 earnings, up from 48.9x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

ReposiTrak Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The uncertainty surrounding the FDA's enforcement of traceability laws could delay the adoption of ReposiTrak's services, impacting future revenue growth.

- An increase in operating expenses, such as sales and marketing expenses and employee benefit costs, may squeeze net margins if not managed alongside revenue growth.

- The growth in cash reserves is commendable, but a focus on preferred share redemption and dividends might limit the funds available for strategic investments, potentially affecting long-term earnings growth.

- Intensive competition from large retailers managing traceability internally or through other partnerships could limit ReposiTrak's market share and negatively affect revenue.

- Heavy reliance on technology investments like the Wizard platform for onboarding could pose risks if implementation delays occur, potentially impacting revenue recognition and cash flow projections.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $29.0 for ReposiTrak based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $30.6 million, earnings will come to $8.4 million, and it would be trading on a PE ratio of 79.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $17.0, the analyst price target of $29.0 is 41.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on ReposiTrak?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.