Last Update07 May 25Fair value Increased 0.41%

Key Takeaways

- Growing demand for Gartner's research and digital solutions, driven by complex technology adoption, boosts client retention, recurring revenue, and sustained top-line growth.

- Expansion into new markets and scalable operations positions Gartner for margin growth, reduced risk, and rapid revenue acceleration as conditions improve.

- Gartner faces threats from AI-driven self-serve tools, increased competition, shifting client preferences, and heavy reliance on large contracts, all pressuring growth and profitability.

Catalysts

About Gartner- Operates as a research and advisory company in the United States, Canada, Europe, the Middle East, Africa, and internationally.

- The shift towards increasingly complex technology, such as artificial intelligence, cybersecurity, and cloud computing, is creating a persistent need for Gartner’s expert research and advisory services, which leads to higher client retention and recurring revenue growth as enterprises rely more heavily on Gartner's insights to manage risk and implement digital transformation priorities.

- As more organizations accelerate their transition to data-driven decision-making, Gartner’s proprietary research and analytics become integral to their strategic planning, supporting price increases and expanding share of wallet, which feeds directly into sustained top-line growth.

- Continued expansion into new industry verticals and global markets, paired with robust pipelines despite current macro uncertainty, gives Gartner substantial runway to diversify revenue, reduce concentration risk, and accelerate revenue growth as the outside environment normalizes.

- Operational leverage from digital platform investments and scalable delivery models positions Gartner to grow margins over time, as evidenced by margin expansion even during slower top-line growth and management’s reaffirmed expectation for modest EBITDA margin improvement over the medium and long term.

- The coming rollout of advanced AI-driven client solutions—alongside ongoing improvements in sales force productivity and the ability to rapidly scale sales hiring when end-market conditions improve—supports the company’s projections for a sharp reacceleration to double-digit contract value and revenue growth, which in turn drives outsized gains in free cash flow and earnings per share.

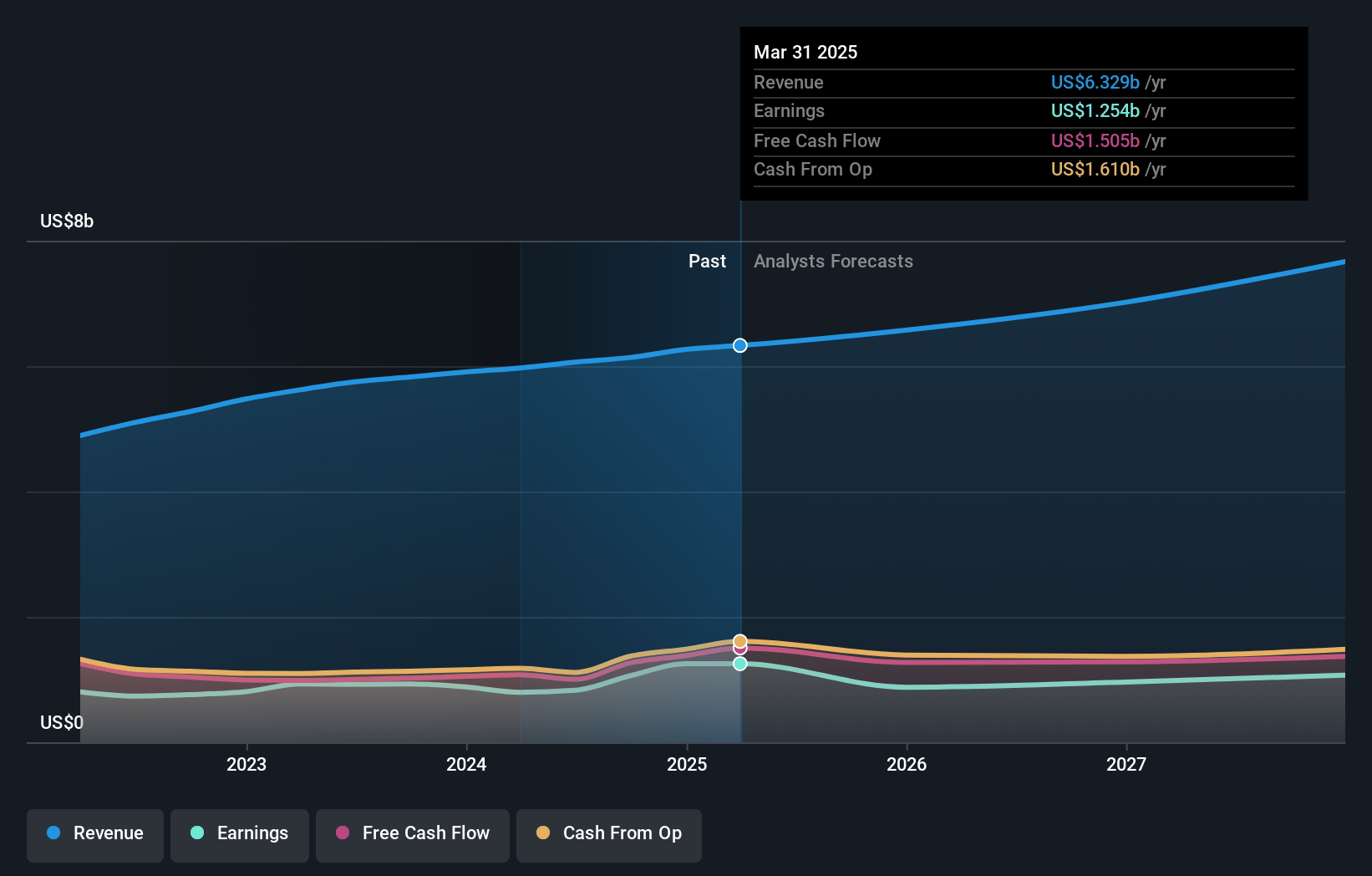

Gartner Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Gartner compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Gartner's revenue will grow by 8.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 19.8% today to 14.0% in 3 years time.

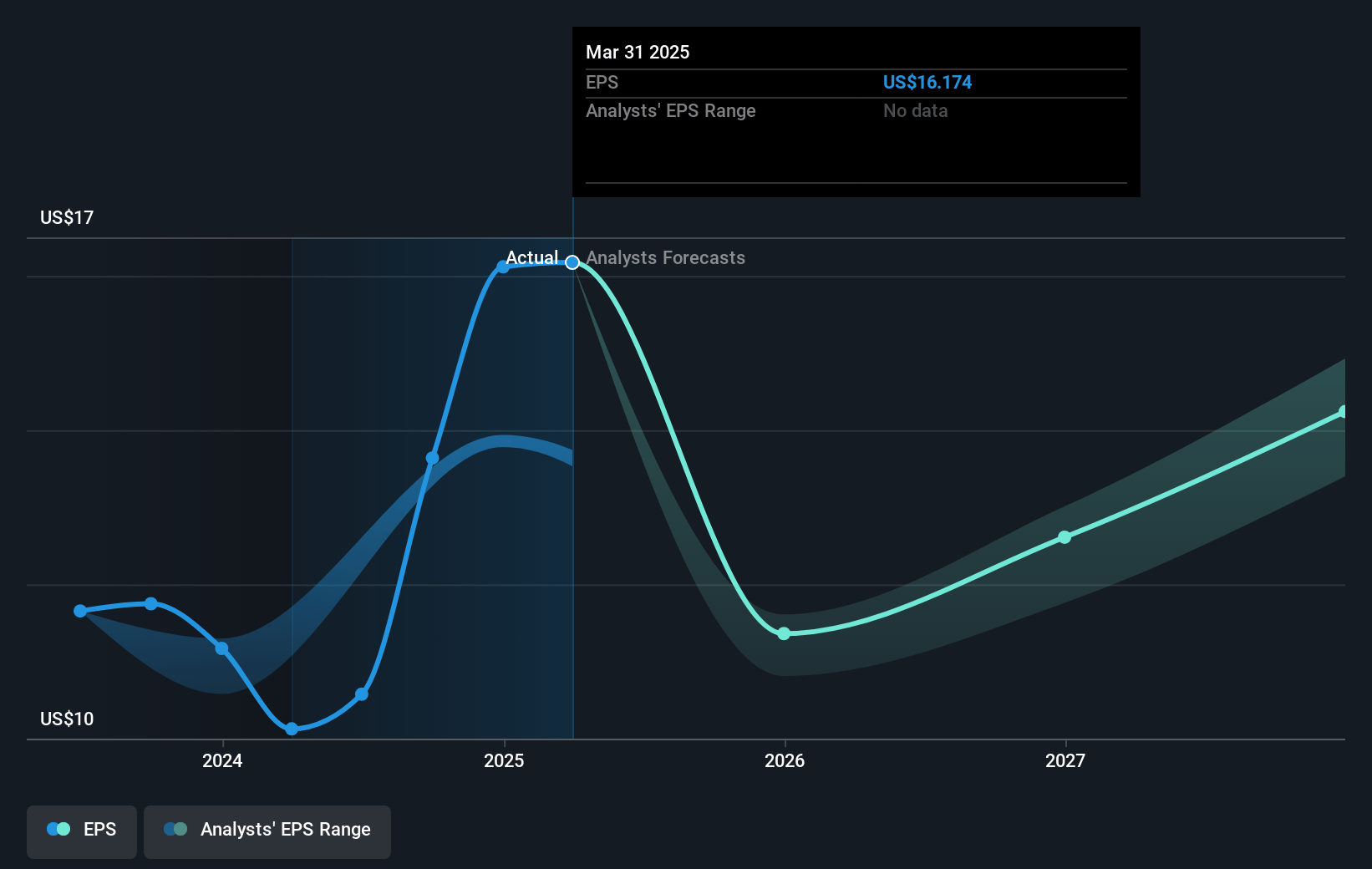

- The bullish analysts expect earnings to reach $1.1 billion (and earnings per share of $14.89) by about May 2028, down from $1.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 52.1x on those 2028 earnings, up from 26.6x today. This future PE is greater than the current PE for the US IT industry at 31.8x.

- Analysts expect the number of shares outstanding to decline by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.01%, as per the Simply Wall St company report.

Gartner Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Accelerating adoption of AI-driven analytics and automated research tools may prompt enterprises to seek lower-cost, self-serve alternatives to Gartner’s traditional research business, eventually reducing revenue growth and pressuring profit margins.

- Increased competition from digital-native and specialist research providers, coupled with the commoditization of IT research via freely available online resources and peer-to-peer knowledge-sharing platforms, could erode Gartner’s pricing power, negatively affecting both revenue and net margins.

- Slower IT spending and business uncertainty in major developed markets, along with lengthening sales cycles resulting from macroeconomic volatility and policy disruptions such as tariffs, could lead to muted or unstable growth in contract value, impacting future revenue generation.

- Greater client reliance on vendor-neutral or crowdsourced insights as secular industry confidence shifts away from analyst-driven models may weaken Gartner’s legacy value proposition, leading to declining renewal rates and lower long-term earnings.

- Heavy dependence on large, multi-year contracts—especially among enterprise and public sector clients—poses a risk; concentrated client exposure means that downturns, non-renewals, or policy-driven purchasing changes (as seen in the U.S. federal segment) can result in volatile quarterly revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Gartner is $608.05, which represents two standard deviations above the consensus price target of $483.02. This valuation is based on what can be assumed as the expectations of Gartner's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $622.0, and the most bearish reporting a price target of just $400.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $8.0 billion, earnings will come to $1.1 billion, and it would be trading on a PE ratio of 52.1x, assuming you use a discount rate of 8.0%.

- Given the current share price of $432.92, the bullish analyst price target of $608.05 is 28.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives