Key Takeaways

- Slowing growth and margin pressure by new tech will force low return reinvestment

- Buying Figma is cheaper than competing, but regulators may block

- Experience Cloud is a growth story, but not Adobe's strong suit

- High-quality business, but high-growth perception is unsustainable and will likely subside

Catalysts

Company Catalysts

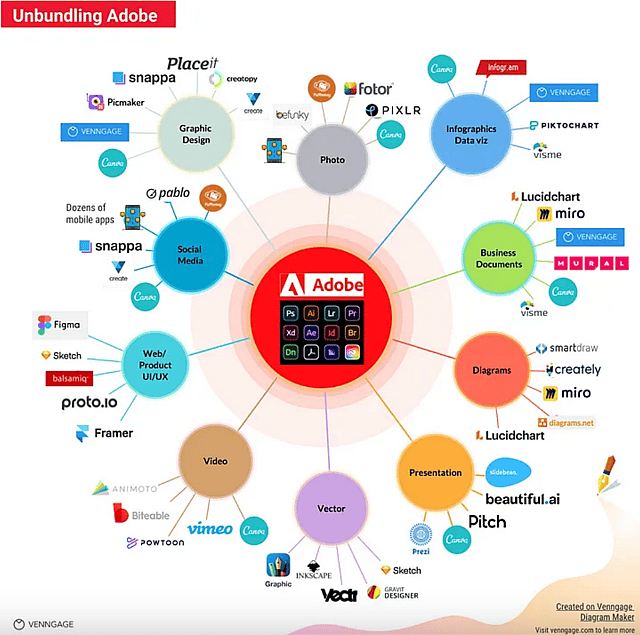

Margins compressing from AI-driven design

The adoption of AI-driven design - the $63B TAM can improve as more people utilize creative works, but the profitability of such projects may decline due to the higher availability of AI driven design. This may result in more revenue but lower profitability for Adobe. Unfortunately, this also gives competitors a leg up, and Adobe may have to cut down on the 40% EBITDA margin before it can regain its technological edge and I expect EBITDA margins to drop from 40% to 35%.

Reduced market share from increased competition

Noting increased adoption of competitive generative AI platforms which have grown incredibly quickly to 1.5M users in late 2022, I believe this will drive market share in the creative space to these platforms and away from Adobe.

Many mobile applications now offer similar functionality to Adobe’s Photoshop in terms of image augmentation. Before, you would have to export images taken on a phone or camera to a computer to begin image editing, but there are many applications these days that utilize AI to achieve the same results and allow people to edit, remove components or adjust images to their heart’s content without having the leave their phone/camera ecosystem. Why pay for a Photoshop subscription when you can do minor edits on the fly with one of the hundreds of free applications on the app store?

Not the first mover in Generative AI-design, so playing catch up

While Adobe is producing its own generative AI solution - Firefly (in partnership with NVIDIA), I believe it will have difficulties retaining pricing power if it fails to catch up with hyper-scalers like Midjourney and Dall-E2. These developments may have impact across the board and result in a general slump in growth and profitability for Adobe, which is why we may see decreasing margins to 35% for EBITDA and single digit revenue growth at 9%.

Lower earnings multiple due to lower growth prospects

Given the above challenges, I believe the stock will fall out of favor with the investment community, and thus investors will not be willing to pay the same earnings multiple as today. If revenue growth grows at sustainable single digits, I believe the earnings multiple will compress to 20x from the 33x PE multiple today given the lower growth prospects.

Figma acquisition is blocked adding to the competition for Adobe

If Figma's acquisition is unsuccessful due to being rejected by regulators. New information emerges that some countries like the UK will not be easily allowing Adobe to close the acquisition. This means that Adobe may have to compete for the revenues attributable to its Adobe XD product, and Figma’s current approach is better suited for smaller teams which would make new user acquisition even harder for Adobe. This will impact both market share and pricing power as Adobe’s margins come from the lack of product alternatives in the market, rather than the value they deliver to customers.

Assumptions

Diminishing returns are likely due to current market penetration

Adobe has already penetrated 43%+ of their digital media TAM, likely closer to 100% in western markets. This means that growth from the digital media segment may top off and have difficulties growing at historical 17% levels. That’s why I assume it will grow at an average of 9%.

Competition from apps reduces uptake in consumers

I assume that the increasing availability of design apps may make expanding the user base beyond professionals difficult for Adobe. The company’s market share will be undisputed in the coming years, but the lack of room for new user acquisition will make growing the digital media segment difficult.

Revenue growth and EBITDA margins to decline on balance of catalysts

Given all of the mentioned catalysts above, I estimate average revenue growth of 9% in the next 5 years, resulting in $28B of revenue in 2028. The 35% EBITDA margin yields $9.8B in 2028.

The need for ready-made and simplistic design flows could hinder user acquisition for Adobe

Changing customer needs are a possible hindrance for the company. Customers may increasingly expect to have ready-made, reusable designs for their creative and marketing needs. This is why advertising platforms like Meta already offer access to light design software integrated within the platform. While not as high-quality as Adobe products, these alternatives may streamline the design process and reduce the need for professional software for an increasing portion of the market. AI further reduces the barriers to entry for design, as customers can create design assets from prompts and Adobe may not have enough pricing power to retain a portion of professionals and amateurs.

Adobe’s previously rock-solid moat will begin to break down as browser based start-ups keep emerging

Adobe is now playing defense against new browser based startups such as Canva, Figma and smaller clones that may take market share. Given the nature of software, and the rapid advancements in creative media software capabilities, I believe Adobe's existing moat of switching costs and brand power will not hold the same weight they used to, and users will not need to use Adobe as the "industry standard".

Depreciation and amortization to drop

I assume that depreciation and amortization will drop to 10% of revenues, and that it will result in operating profit of $7B in 2023. By retaining the average tax rate of 21%, I estimate that Adobe will make a NOPAT of $5.5B.

Even without a $20B acquisition on the cards, the company will have to spend big to maintain its position in the market

Given all the developments mentioned in the industry, it is apparent that the company will have to reinvest capital into the business in order to maintain the leadership position. The only question is if it’s going to pay that up-front in a $20B favorable acquisition or if it’s going to have to invest on an annual basis. My assumption is that the company will have to maintain yearly capital expenditures including acquisitions around $1B net of depreciation. This pushes down the free cash flows to $4.5B in 2028.

Stock based compensation costs to remain high but buybacks will help reduce the shares outstanding

I assume the company will have a difficult time reducing the consistent stock based compensation - 20% of OCF in the last 12 months. While the company is issuing SBC, it is also buying back stock, so the share count is decreasing on net. Common shares outstanding decreased 2.96% in the last 12 months, and given the profitability of the company, I expect that Adobe will gradually increase its buybacks, bringing down the share count to 385M in 2028, from 459M today. This means that the company will keep returning around $5.2B annually on average as buybacks. As the company approaches stable growth, I assume that buybacks will converge to 5% of its market cap long-term, which is a return that marginal investors will be satisfied with on account of the size of the company and the reduced risk implications of the established brand, global presence, and being part of the software industry. The 5% required return corresponds to a 20x FCF multiple: 1/0.05=20x.

Risks

Figma acquisition is a success

If Adobe is able to circumnavigate the tricky regulatory waters and close out the Figma deal, it will invalidate one of the key catalysts in my narrative. If this eventuates, it means that Adobe will no longer have have to compete for the revenues attributable to its Adobe XD product, and it would allow Adobe to have a broader reach in the market, considering Figma’s current approach is better suited for smaller teams, meaning that Adobe would be able to acquire customers across different enterprise demographics. This will impact both market share and pricing power as Adobe’s margins come from the lack of product alternatives in the market, which will remain the case if it absorbs Figma into its business.

Economic downturn drives competition away

While an economic downturn would undoubtedly impact Adobe's business in that customers are likely to cut back on expenditure, it could actually prove beneficial to Adobe in improving market share. Much of my narrative hones in on the increasing competition from new entrants and start-ups to the design industry, but these firms are highly susceptible to market fluctuations. Adobe’s strength is that it is a long-established company in this industry. Many new start ups that are trying to implement generative AI or ready-made solutions to customers will inevitably be faced with rising costs and do not have the maturity of customer-base or of balance sheet to withstand a decline. A result which might see their comparatively thinner margins completely disappear and resulting in less competition for Adobe.

Have other thoughts on Adobe?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

Simply Wall St analyst Goran_Damchevski holds no position in NasdaqGS:ADBE. Simply Wall St has no position in any companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimate's are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.