Last Update 19 Nov 25

Fair value Increased 1.09%QLYS: Improving Execution Will Support Continued Outperformance Amid Market Opportunities

Analysts have raised their price target on Qualys, increasing it from $141.02 to $142.56. They cite improving execution and accelerating billings growth as key factors behind a more positive outlook.

Analyst Commentary

Analyst sentiment toward Qualys has shifted in light of its recent financial performance and business execution. While the latest upgrade reflects greater optimism, there remain nuances in perspective regarding the company's outlook.

Bullish Takeaways

- Bullish analysts highlight record operating margins and view this as a sign of effective management and operational efficiency.

- Sustained acceleration in billings growth has been seen as a key factor that underpins upward revisions to the price target and improved outlook.

- Consistent outperformance, with five consecutive quarters of results above guidance, suggests stronger execution and reliability in meeting targets.

- Improvement in execution is leading to increased confidence in the company's ability to capitalize on market opportunities and deliver better growth fundamentals.

Bearish Takeaways

- Some caution remains regarding the ability to sustain this accelerated growth trajectory in coming quarters.

- Although execution has improved, the valuation increase is moderate and reflects tempered expectations for further near-term upside.

- Certain analysts await more evidence of durable revenue expansion before adopting a more aggressive positive stance.

What's in the News

- Qualys has completed the repurchase of 10,384,802 shares, representing 27.19% of its outstanding shares for $1,194.7 million under its buyback program. The most recent tranche included 365,513 shares repurchased for $49.44 million (Key Developments).

- The company provided new earnings guidance for the fourth quarter and full fiscal year 2025, expecting Q4 revenues of $172.0 million to $174.0 million and full-year revenue growth of 8% to 9% over 2024 (Key Developments).

- Qualys raised its full-year 2025 earnings guidance, now projecting revenues between $665.8 million and $667.8 million, representing 10% growth, and net income per diluted share of $5.23 to $5.30, up from previous estimates (Key Developments).

- New capabilities in Qualys Enterprise TruRisk Management were unveiled, strengthening proactive risk management and identity security, especially against threats from agentic AI and non-human identities (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly from $141.02 to $142.56.

- Discount Rate has edged down marginally, moving from 8.42% to 8.41%.

- Revenue Growth expectation has decreased slightly, from 7.42% to 7.40%.

- Net Profit Margin estimate has increased modestly, from 25.21% to 25.45%.

- Future P/E ratio has decreased, moving from 30.71x to 30.01x.

Key Takeaways

- Cloud-native platforms, AI innovation, and flexible pricing drive expansion, retention, and strong margins through unified cybersecurity and broadening market opportunities.

- Strategic partner ecosystem and government wins accelerate growth, international reach, and integrate regulatory compliance, bolstering Qualys' leadership in proactive risk management.

- Rapid AI security evolution, shifting customer preferences, pricing model uncertainty, macroeconomic challenges, and costly growth investments threaten Qualys' revenue visibility, margins, and long-term growth.

Catalysts

About Qualys- Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

- Adoption of Qualys' new cloud-native risk operations center (ROC) and Agentic AI platform positions the company as a leading pre-breach risk management provider, offering unified orchestration, automation, and remediation across both Qualys and non-Qualys data; this opens incremental greenfield opportunities and should support higher ARPU and expanded TAM, leading to durable revenue and earnings growth.

- Persistent digital transformation, cloud adoption, and increased regulatory scrutiny (such as GDPR and FedRAMP High compliance) are driving organizations globally to invest in proactive, unified cybersecurity solutions; Qualys' platform-first approach and recent government sector wins (aided by exclusive FedRAMP High authorization) are expected to drive faster land-and-expand cycles and incremental long-term revenues.

- Flex (QLU) pricing and expanded module integration reduce adoption friction and incentivize larger initial commitments as well as multi-module expansion within existing accounts, directly supporting higher net retention and improving margins by leveraging the SaaS delivery model's operating leverage.

- Strategic investments in partner ecosystems (reseller channels, mROC, and technical alliances) have increased channel contribution to nearly half of total revenues, which is scaling faster than direct sales; this should accelerate new logo acquisition, international reach, and upsell activity, thus supporting both revenue growth and healthy margin expansion.

- Rapid, continuous innovation-embedding AI-driven automation into remediation workloads and launching identity security posture management (ISPM)-is tightly aligned with industry shifts toward integrated, cloud-based, and continuous security, which strengthens Qualys' competitive position and increases the potential for higher customer retention, elevated margins, and sustained multi-year revenue growth.

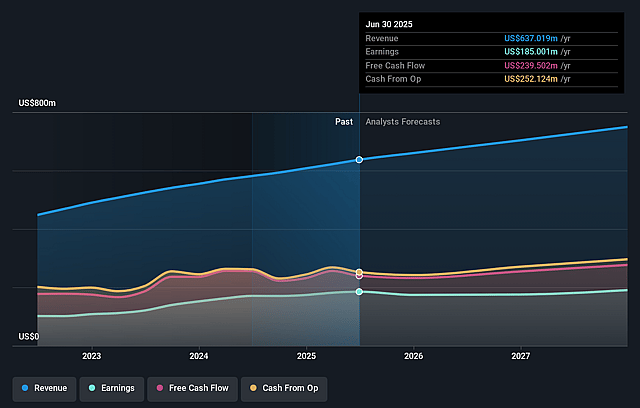

Qualys Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Qualys's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 29.0% today to 25.2% in 3 years time.

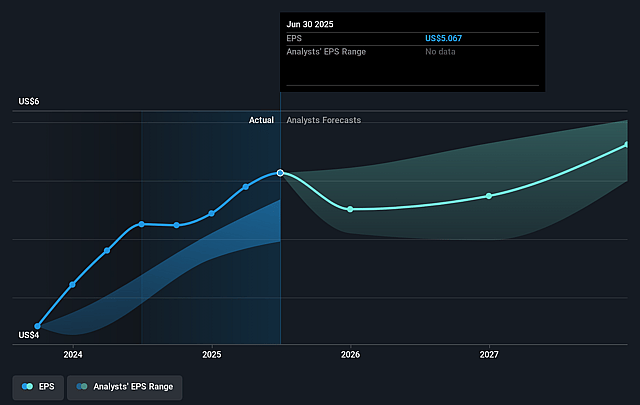

- Analysts expect earnings to reach $199.0 million (and earnings per share of $5.46) by about September 2028, up from $185.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.7x on those 2028 earnings, up from 26.0x today. This future PE is lower than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to decline by 1.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.42%, as per the Simply Wall St company report.

Qualys Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The pace of innovation in AI security is described as "rapid" and "dynamic," raising the risk that Qualys' internally developed AI agents and platform could quickly fall behind competitors or more agile upstarts, potentially resulting in increased R&D expense, product obsolescence, or customer attrition that would negatively affect revenue growth and net margins.

- Qualys acknowledges that customers increasingly prefer to consolidate certain security tools but often retain other vendors for key functions like identity or endpoint security, suggesting that vendor consolidation (especially with large platforms or hyperscalers) could eventually squeeze Qualys out of "all-in-one" enterprise deals, leading to slower revenue expansion or market share erosion.

- The newly introduced Flex pricing and QLU model, while designed to drive upsell and larger initial commitments, introduces uncertainty around usage patterns and may result in customers optimizing spend and using fewer Qualys units than anticipated, potentially impacting average revenue per customer and revenue visibility.

- Despite strong margins, the financial guidance and management's comments highlight continued macroeconomic uncertainty and "challenging environment for new business growth," indicating persistent headwinds that could prolong slower bookings, limit billings/revenue acceleration, and constrain near-term and potentially long-term earnings growth.

- The company's significant recent investments in go-to-market, public sector, and sales and marketing initiatives (including new executive hires) are intended to drive future growth, but if these investments do not lead to expected pipeline conversion, increased competition and operating expense growth could put pressure on free cash flow and EBITDA margins over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $141.023 for Qualys based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $160.0, and the most bearish reporting a price target of just $97.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $789.6 million, earnings will come to $199.0 million, and it would be trading on a PE ratio of 30.7x, assuming you use a discount rate of 8.4%.

- Given the current share price of $133.11, the analyst price target of $141.02 is 5.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.