Key Takeaways

- Expansion into AI-driven risk management and compliance solutions positions Qualys for accelerated growth and a larger role in securing advanced enterprise technologies.

- Partner-focused sales strategy and entry into government markets are driving sustainable, high-margin recurring revenue and greater cross-selling opportunities.

- Intensifying competition, operational risks from partner channel expansion, and slow adoption of new solutions threaten revenue growth and margin stability despite ongoing platform diversification.

Catalysts

About Qualys- Provides cloud-based platform delivering information technology (IT), security, and compliance solutions in the United States and internationally.

- The upcoming deployment of Enterprise TruRisk Management (ETM), which acts as a vendor-neutral risk analytics and quantification platform layered atop existing cybersecurity tools, positions Qualys to capitalize on businesses' urgent need to quantify, prioritize, and remediate risks amid a rapidly growing and more complex global attack surface. As organizations adopt AI and cloud services in their digital transformation, this should drive significant new demand and expand total addressable market, accelerating revenue growth.

- The introduction of TotalAI, offering unique AI security discovery and risk assessment leveraging Qualys' existing footprint, addresses the emerging requirement to secure generative AI applications and large language models. As enterprise AI use moves from pilot to production, Qualys' early market lead and “first scanner” approach can generate a new high-growth revenue stream over the next several years.

- Qualys is set to benefit from a heightened global regulatory environment, with mandates such as GDPR and CCPA pressuring organizations to adopt robust vulnerability assessment and compliance tools. The expanded capabilities of Qualys’ platform—now including risk scoring, compliance workflows, automated remediation, and asset discovery—are well positioned for cross-sell and upsell to existing and new clients, supporting higher average revenue per user and long-term increases in net margins.

- The pivot to a “partner-first” go-to-market strategy is increasing new logo wins, accelerating channel-driven growth, and positioning Qualys to sell bundled and managed services (such as mROC) through MSSPs and global partners. This shift should deliver sustainable, high-margin recurring revenue streams and improve cost efficiencies, which will be further amplified as partners build managed services on top of the Qualys platform.

- Pending FedRAMP High certification and ongoing investments in the federal business open Qualys to a large, underpenetrated market as US federal agencies and other government entities migrate from legacy on-premises security to efficient cloud-based risk management. Winning in this segment could provide multi-year tailwinds for revenue and cash-flow growth, particularly as contract sizes are typically large and renewal rates are high.

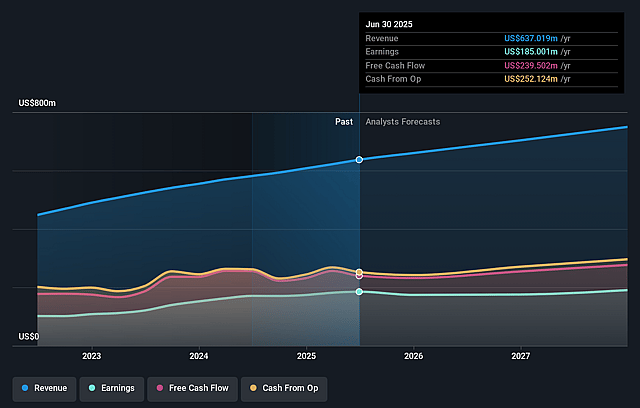

Qualys Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Qualys compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Qualys's revenue will grow by 8.3% annually over the next 3 years.

- The bullish analysts assume that profit margins will shrink from 28.6% today to 24.5% in 3 years time.

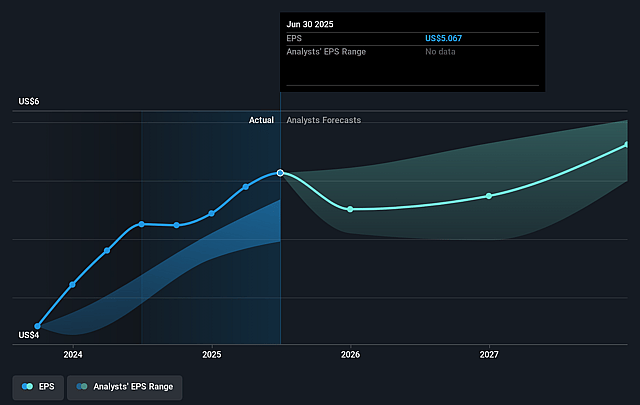

- The bullish analysts expect earnings to reach $188.7 million (and earnings per share of $5.18) by about April 2028, up from $173.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 40.0x on those 2028 earnings, up from 26.6x today. This future PE is greater than the current PE for the US Software industry at 32.0x.

- Analysts expect the number of shares outstanding to decline by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.66%, as per the Simply Wall St company report.

Qualys Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Qualys’ revenue growth guidance for 2025 has moderated to a range of 6% to 8%, which reflects persistent pressure on net dollar expansion rates and disappointing new customer bookings that signal slowing top-line growth in the context of a shift toward a partner-led sales strategy.

- The company is experiencing heightened competition and margin pressure from industry consolidation, with large cybersecurity and cloud providers integrating security features, which could erode Qualys’ pricing power and negatively affect both revenue and gross margins.

- The transition to broader partner channel sales introduces operational complexity and execution risk, potentially slowing deal cycles, diluting customer relationships, and delaying the translation of channel investment into top-line earnings growth.

- Despite recent platform diversification, vulnerability management and a related security product suite remain core revenue drivers, so any failure to accelerate the adoption of its newer integrated cloud-native and API-based solutions could lead to market share loss and stagnating revenues.

- Continued investments in federal markets are subject to unpredictable regulatory dynamics and certification delays, which could limit the anticipated expansion in this vertical and constrict long-term earnings and revenue upside.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Qualys is $172.92, which represents two standard deviations above the consensus price target of $137.69. This valuation is based on what can be assumed as the expectations of Qualys's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $175.0, and the most bearish reporting a price target of just $90.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $770.7 million, earnings will come to $188.7 million, and it would be trading on a PE ratio of 40.0x, assuming you use a discount rate of 7.7%.

- Given the current share price of $126.75, the bullish analyst price target of $172.92 is 26.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.