Key Takeaways

- Expanded product offerings and suite-based pricing are driving deeper customer integration, boosting upsell opportunities and supporting higher revenue growth and profitability.

- Evolving identity needs, digital transformation, and regulatory pressures are accelerating demand for Okta's unified platform, strengthening market position and customer retention.

- Persistent macroeconomic and competitive pressures, along with execution risks and declining net revenue retention, threaten Okta's growth, market share, and profitability.

Catalysts

About Okta- Operates as an identity partner in the United States and internationally.

- Okta's suite-based pricing and expanded product portfolio-including new offerings in Identity Governance, Privileged Access, Device Access, and Identity Threat Protection-are driving deeper integration into customer IT infrastructure, supporting cross-sell/upsell opportunities and accelerating average contract value, which should boost both top-line revenue growth and margins as adoption scales.

- The ongoing acceleration in AI agent proliferation and nonhuman identities (NHIs), combined with mounting cybersecurity concerns as remote/hybrid work becomes standard, is increasing the necessity for unified, AI-enabled identity platforms; this trend strongly positions Okta's new products like Identity Security Posture Management and Auth for GenAI as critical infrastructure-potentially creating multi-year tailwinds for revenue and stickiness.

- Specialization of the go-to-market organization (distinct Okta/Auth0 sellers, hunter-farmer model for SMB, focus on public sector) is showing early signs of increased productivity and new business wins, setting the stage for improved customer acquisition efficiency and long-term net margin improvement as rep focus drives larger deals and longer-term contracts.

- Large enterprises are increasingly migrating from legacy on-premise identity systems to modern, cloud-based, neutral providers amidst digital transformation and growing regulatory pressure regarding compliance and data privacy; Okta's breadth across governance, access, and privileged management, as well as its strong government certifications, should unlock significant addressable market expansion and long-term revenue growth.

- Customers' shift toward vendor consolidation around identity-in search of cost efficiency and comprehensive, independent platforms-plays to Okta's core value proposition, potentially sustaining higher retention, improved net retention rates, and better earnings visibility as Okta becomes more deeply embedded in critical IT and security architecture.

Okta Future Earnings and Revenue Growth

Assumptions

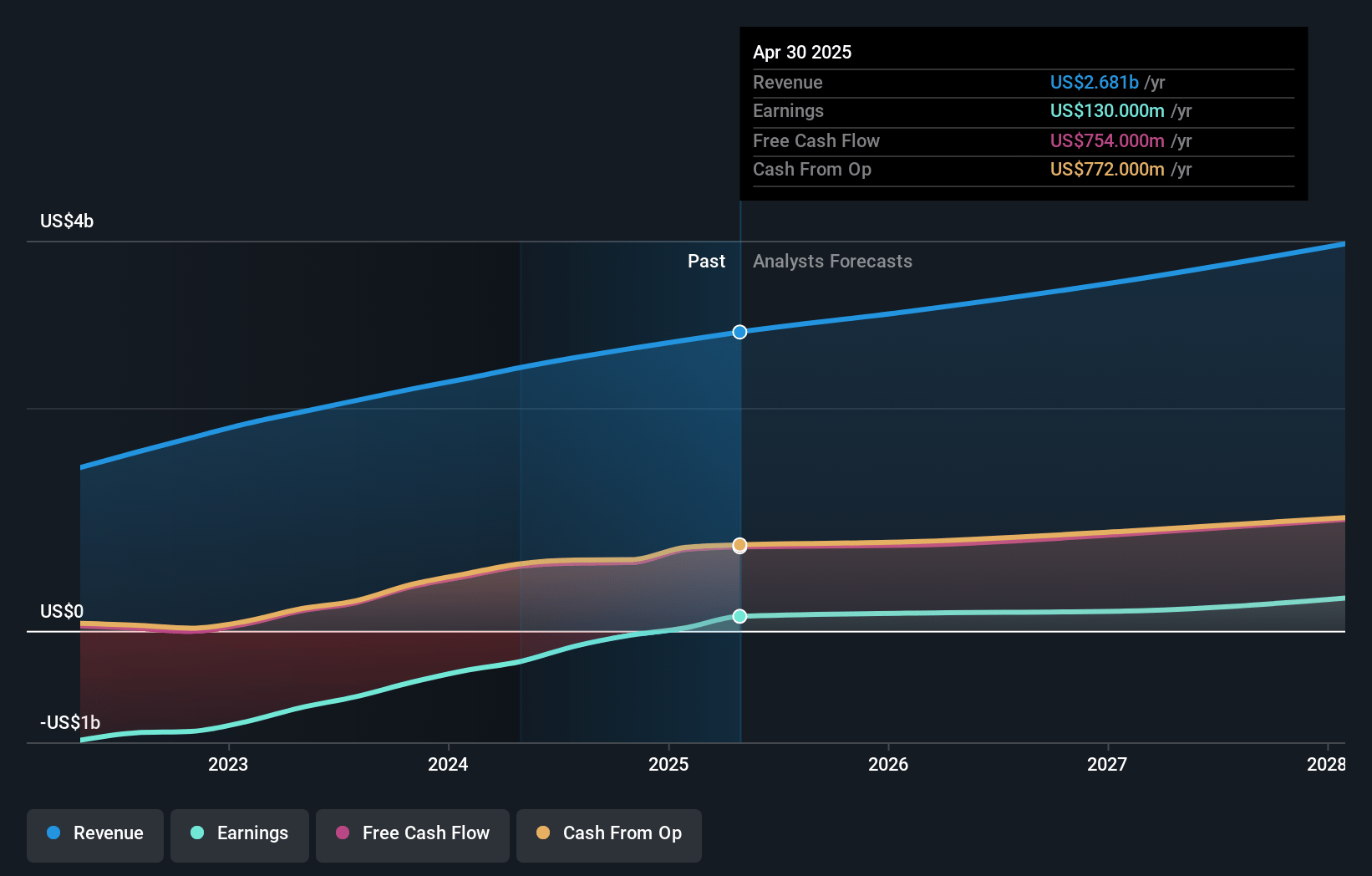

How have these above catalysts been quantified?- Analysts are assuming Okta's revenue will grow by 9.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 4.8% today to 10.0% in 3 years time.

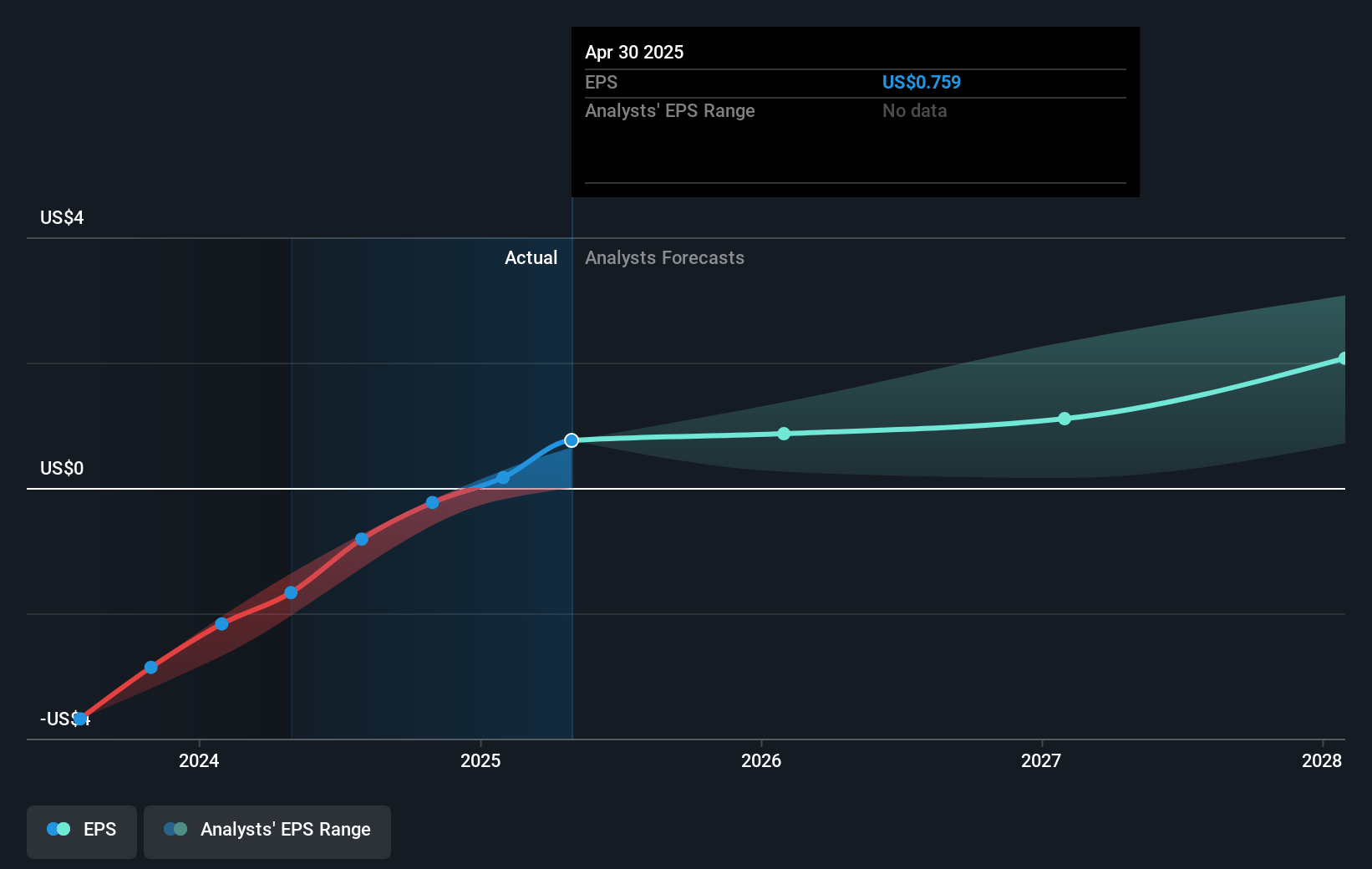

- Analysts expect earnings to reach $354.5 million (and earnings per share of $2.35) by about July 2028, up from $130.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $599.1 million in earnings, and the most bearish expecting $45.9 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 83.5x on those 2028 earnings, down from 122.7x today. This future PE is greater than the current PE for the US IT industry at 27.4x.

- Analysts expect the number of shares outstanding to grow by 3.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

Okta Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent macroeconomic uncertainty and Okta's increasingly conservative guidance-despite a solid current pipeline-imply that broader market headwinds or a downturn could dampen revenue growth and new business momentum, potentially impacting revenue and earnings.

- Okta's go-to-market specialization, while delivering early positive signals, introduces execution risk; lengthy ramp times and increased field change complexity could hinder near-term productivity and slow upsell/cross-sell, affecting net retention rates and operating margins.

- The recurring decline in net revenue retention (NRR) for four consecutive quarters, combined with seat upsell headwinds, signals slower expansion opportunities within existing accounts; should this persist or worsen, ongoing NRR softness would pressure recurring revenue and constrain growth.

- Intensifying competition in identity and access management, especially from bundled offerings by major cloud suites (Microsoft, AWS, Google) or specialized vendors in nonhuman identity and agentic workflows, threatens Okta's market share and could compress pricing power, impacting long-term revenue and margins.

- Increasing scrutiny and budget discipline in segments like the U.S. federal vertical, influenced by ongoing uncertainty and efficiency mandates, heightens the risk of deal delays or downsizing, exposing Okta to lumpy or pressured bookings in a key target market, negatively affecting earnings visibility and revenue growth rates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $122.36 for Okta based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $148.0, and the most bearish reporting a price target of just $75.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.5 billion, earnings will come to $354.5 million, and it would be trading on a PE ratio of 83.5x, assuming you use a discount rate of 8.2%.

- Given the current share price of $91.1, the analyst price target of $122.36 is 25.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.