Last Update 09 Apr 25

Key Takeaways

- Streamlined focus through rebranding and subscription models suggests improved operational efficiency and margin growth, attracting new and expanding existing customer capabilities.

- Significant contracts and large transactions in the pipeline indicate potential for immediate and long-term revenue growth and enhanced earnings.

- Delays and elongated sales cycles affect revenue recognition and growth, while revised guidance reflects challenges in meeting top-line targets and profitability pressures.

Catalysts

About Logility Supply Chain Solutions- Develops, markets, and supports a range of computer business application software products in the United States and internationally.

- The rebranding and transformation of Logility, including divesting non-core businesses and eliminating the dual-class share structure, suggests a streamlined focus and potentially improved operational efficiency, which could drive future revenue and margin growth.

- The company's focus on growing subscription revenue and its impact on the recurring revenue model signifies potential for consistent, predictable revenue streams and improved net margins as subscription-based models typically offer higher margins than one-time sales.

- Adoption and increasing interest in new solutions such as network optimization, the Decision Command Center, and Lea, the generative AI platform, indicate potential for future revenue growth as they attract new customers and expand existing customer capabilities.

- Expansion deals secured with existing clients, like the significant contract in Canada, provide both immediate revenue growth and further expansion opportunities within and across business units, which could enhance overall earnings.

- A robust and expanding sales pipeline with several large transactions at the contracting phase indicates potential for significant future revenue growth, affecting earnings positively as these deals are closed.

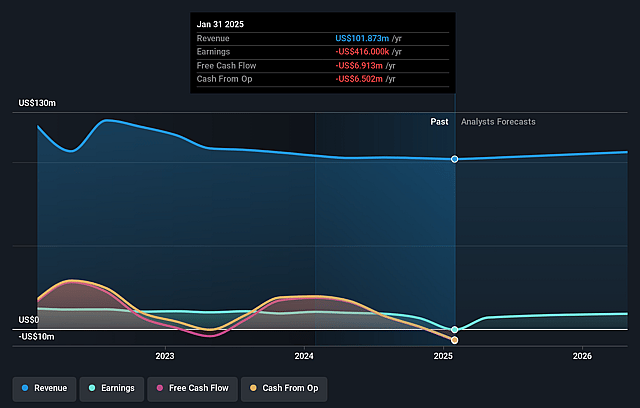

Logility Supply Chain Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Logility Supply Chain Solutions's revenue will grow by 3.3% annually over the next 3 years.

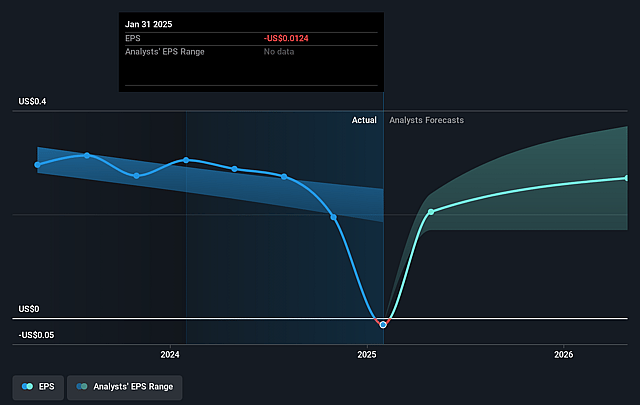

- Analysts assume that profit margins will increase from -0.4% today to 34.1% in 3 years time.

- Analysts expect earnings to reach $38.3 million (and earnings per share of $1.13) by about April 2028, up from $-416.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, up from -1157.3x today. This future PE is lower than the current PE for the US Software industry at 28.3x.

- Analysts expect the number of shares outstanding to grow by 1.23% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.0%, as per the Simply Wall St company report.

Logility Supply Chain Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Logility faced headwinds with delays in project starts, which affected their ability to recognize revenue and could impact future revenue recognition and cash flow.

- The company experienced elongated sales cycles, potentially due to global events and economic uncertainty, which could pose risks to securing timely revenue and meeting growth targets.

- Revenue from professional services decreased by 10% due to project delays, which could impact net margins and overall profitability if the trend continues.

- Uncertain timing of deal closures and potential deferrals into future periods create ambiguity regarding expected revenue, posing a risk to revenue forecasts.

- The revised revenue guidance for fiscal 2025, lowered while maintaining recurring revenue and adjusted EBITDA, indicates pressure on revenue growth and challenges in achieving top-line expectations.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $14.3 for Logility Supply Chain Solutions based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $112.3 million, earnings will come to $38.3 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 8.0%.

- Given the current share price of $14.29, the analyst price target of $14.3 is 0.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.