Digital Transformation Specialist and IPO Consultant, HeartCore Enterprises

Catalysts-Products or Services that Could Move Sales or Earnings Meaningfully

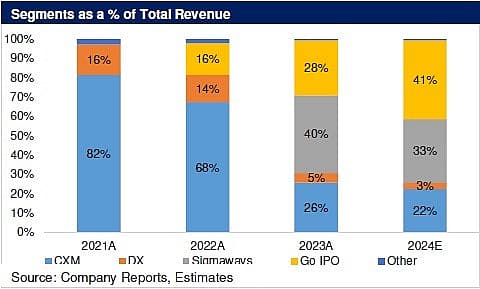

1. Growth: The global Customer Experience Management (CXM) market is expected to grow at a compound annual growth rate of 15.2% from 2024 to 2032, positioning HeartCore positively in this sector.

2. Diversity: HeartCore’s digital transformation (DX) which offers robotic process automation (RPA), task mining, and process mining is growing rapidly geared towards consumer behaviours.

3. IPO Consultation: HeartCore Go IPO consulting service helps Japanese companies list on U.S. securities exchanges.

4. U.S.Expansion: HeartCore’s AI software development via a wholly owned subsidiary Sigmaways in the U.S.

5. Medical: HeartCore and Heart-Tech partners to improve early detection of heart problems in women

6. AI Analysis: Development of an AI software solution for startups to determine if it is investment ready, analyzing strengths and areas for improvement

Tailwinds

1. A growing CMS and DX customer base, HeartCore’s increased 13% across the past two years

2. Japanese startups are considering U.S. stock exchanges for initial public offerings

3. Completed U.S. company acquisition, Sigmaways, for expansion purposes

Headwinds

1. USD to JPY exchange rate negatively impacted HeartCore’s 2Q24 revenue by 800 bps

2. Slowing U.S. listing momentum by Japanese companies

3. Highly competitive and fragmented digital transformation market

Financial Metrics

· Revenue: HeartCore’s total revenue for 2023 was $21.8 million

· EPS: HeartCore’s EPS for 2023 was -0.21

Assumptions

· In 5 years, HeartCore’s revenue will conservatively be $30.3 million because of possible expansion of the business units into other countries. Organic growth of the technology verticals and the consultation units will realize future revenue.

· In 5 years, HeartCore’s earnings will be $5.5 million. This will be affected by the company’s ability to continue streamlining all operation processes.

Risks and Mitigants

· Hedge for USD/JPY exchange rate volatility.

· HeartCore faces risks of declining subscription renewals, shorter contracts or lower tier-services, targeting businesses with CMS, DX, RPA and AI solutions should mitigate this threat.

· Reduced interest in U.S. exchange listing and success in the U.S. markets could deter new clients. Expand the offering outside of Japan.

Have other thoughts on HeartCore Enterprises?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user Ontological holds no position in NasdaqCM:HTCR. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.