Key Takeaways

- Product innovation and AI-driven automation enhance operational efficiency, customer value, and support sustained revenue and margin growth.

- Expanding ecosystem, global reach, and high-profile marketing initiatives enable greater cross-selling, new user acquisition, and increased per-customer monetization.

- Shrinking core user base, SMB exposure, competitive threats, costly promotions, and high R&D needs combine to increase pressure on margins and threaten sustainable growth.

Catalysts

About Expensify- Provides a cloud-based expense management software platform in the United States and internationally.

- The company is benefiting from the accelerating enterprise shift away from manual to automated, cloud-based financial processes, as seen through continued product innovation (multi-language support, AI-powered features, ecosystem expansion with Card/Travel), which should drive increased adoption and higher ARPU, supporting long-term revenue growth.

- Expensify’s rapid rollout of automation and AI-powered enhancements (automated categorization, fraud detection, virtual CFO, advanced policy controls) is streamlining operations and improving efficiency, which is likely to reduce operating expenses and improve net margins as the platform scales.

- The expansion of the Expensify product ecosystem (notably the fast-growing Expensify Card and Travel offering) and successful cross-selling to existing customers provides multiple additional avenues for revenue beyond paid member growth, which can help offset churn and increase per-customer monetization, supporting both revenue and earnings growth.

- Global expansion initiatives, such as full Spanish support and more international/localized language options, position Expensify to access underpenetrated markets, particularly among SMBs and the global gig/freelance economy, which should drive new user acquisition and recurring subscription revenue growth.

- High-visibility marketing initiatives tied to the F1 partnership and upcoming movie release are likely catalysts for a significant upswing in brand awareness and customer sign-ups, with associated revenue impacts expected to ramp through the back half of the year and into subsequent periods.

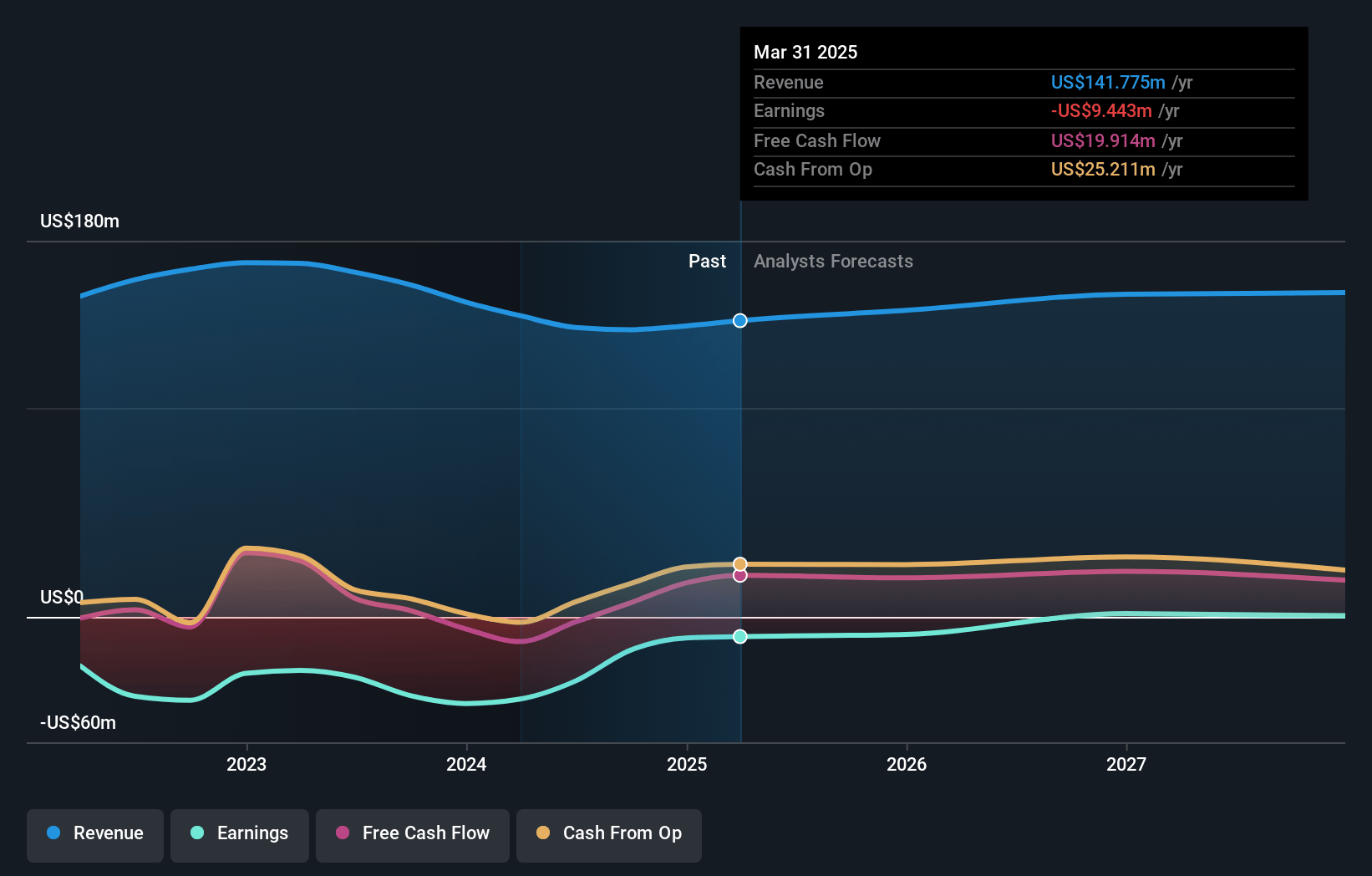

Expensify Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Expensify's revenue will grow by 4.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.7% today to 1.6% in 3 years time.

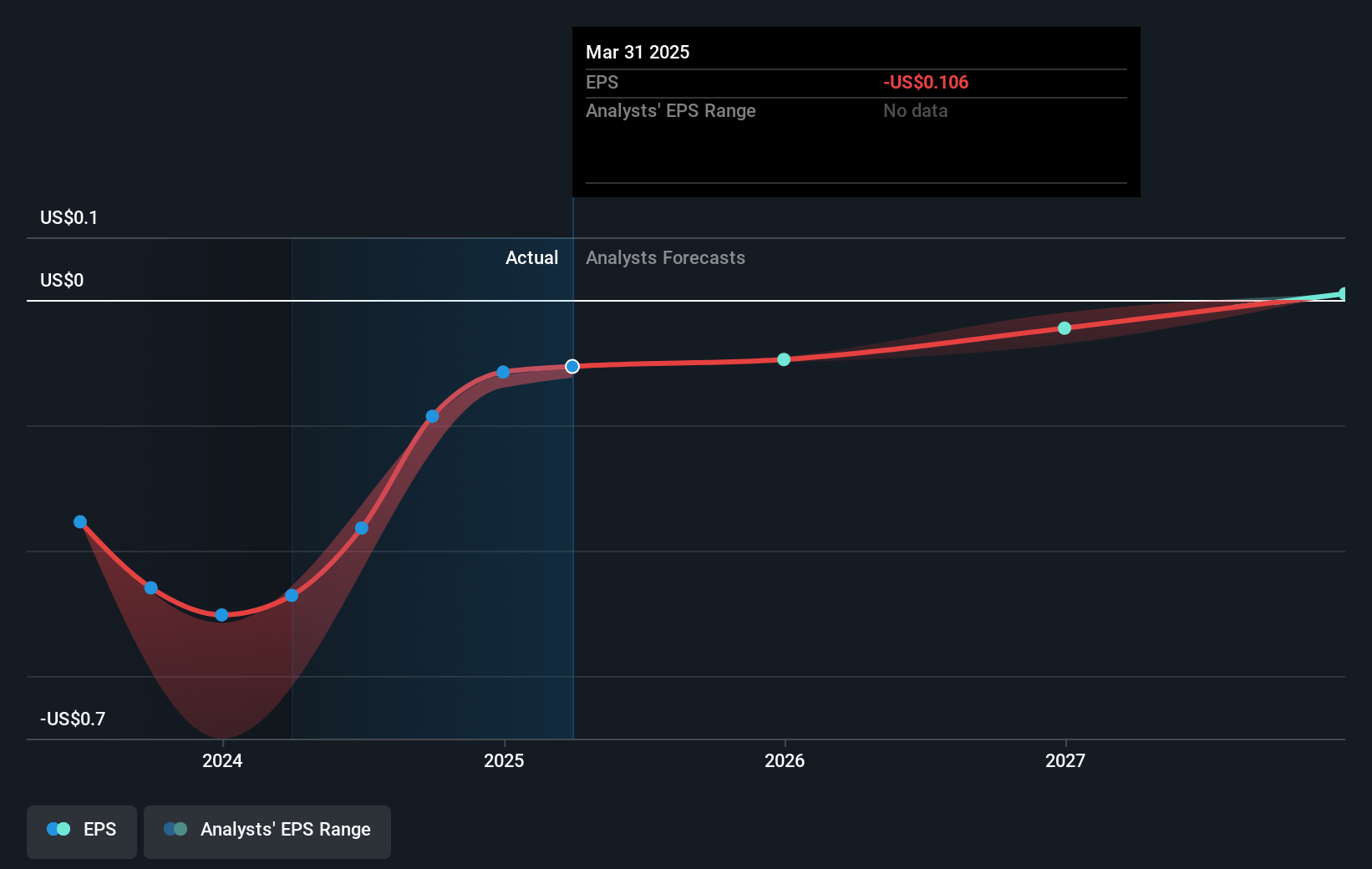

- Analysts expect earnings to reach $2.5 million (and earnings per share of $-0.0) by about July 2028, up from $-9.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 205.5x on those 2028 earnings, up from -24.6x today. This future PE is greater than the current PE for the US Software industry at 43.8x.

- Analysts expect the number of shares outstanding to grow by 4.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.92%, as per the Simply Wall St company report.

Expensify Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Although revenue grew 8% year-over-year, paid members declined slightly, highlighting a possible plateau or contraction in Expensify’s core user base; if this trend persists, it could threaten long-term revenue stability and growth.

- The company’s heavy focus on SMBs—a segment noted to be sensitive to economic uncertainty and currently in a “wait-and-see” hiring and spending pattern due to macro headwinds and tariff concerns—exposes Expensify to demand volatility and elevates revenue and earnings risk in downturns.

- Ongoing industry-wide pressures from all-in-one financial software providers and larger platforms may erode Expensify’s competitive position, likely forcing lower pricing or elevated sales and marketing (S&M) spend to maintain customer acquisition, thus compressing net margins.

- The expense and high upfront commitments for major promotional efforts (e.g., the F1 movie and related branding), combined with accounting recognition of large S&M expenses concentrated in future quarters, may put downward pressure on reported net income and increase short-term earnings volatility if revenue lift from such efforts fails to materialize as expected.

- While Expensify touts significant new AI and automation features, the need for continuous R&D investment to keep pace with rapid innovation and evolving customer expectations in the expense management sector could strain operating margins if incremental revenue or user growth does not accelerate accordingly.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $4.0 for Expensify based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $5.0, and the most bearish reporting a price target of just $3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $160.4 million, earnings will come to $2.5 million, and it would be trading on a PE ratio of 205.5x, assuming you use a discount rate of 7.9%.

- Given the current share price of $2.51, the analyst price target of $4.0 is 37.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.