Key Takeaways

- Transition to recurring, higher-margin cloud services and cybersecurity offerings is driving more predictable revenue and enhanced earnings stability.

- European expansion and reinvestment in AI and SaaS after asset sales position the company for international and long-term growth.

- Selling its main business will shrink operations, increase risk, and leave an uncertain path to replacing lost revenues in a rapidly evolving, competitive industry.

Catalysts

About Data Storage- Provides enterprise cloud and business continuity solutions in the United States and internationally.

- The continuing and accelerating shift of enterprise IT infrastructure to cloud-based and hybrid architectures is fueling steady demand for Data Storage's subscription-based cloud infrastructure and disaster recovery services, leading to recurring revenue growth and improved revenue predictability.

- Heightened compliance requirements and customer focus on cybersecurity and data protection are expanding baseline needs for advanced storage solutions; Data Storage's investments in cloud security and planned AI/cybersecurity verticals position the company to benefit from this rising demand, likely supporting topline growth.

- The company is strategically shifting away from lower-margin one-time equipment/software sales toward higher-margin, recurring subscription services, which is expected to support gross margin expansion and greater earnings stability over time.

- Strategic expansion into Europe, evidenced by new data center installations, partnerships, and expanded salesforce, opens new high-growth markets and avenues for international topline growth.

- Proceeds from the proposed CloudFirst sale will provide significant capital to return to shareholders and reinvest in long-term growth sectors, such as AI and SaaS verticals, which are likely to drive future revenue and earnings growth as the enterprise adoption of AI accelerates globally.

Data Storage Future Earnings and Revenue Growth

Assumptions

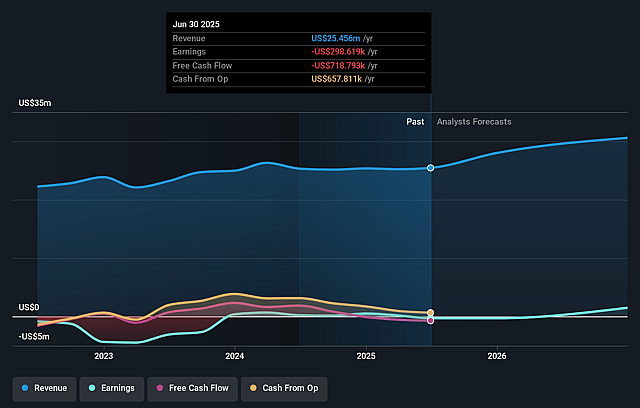

How have these above catalysts been quantified?- Analysts are assuming Data Storage's revenue will grow by 12.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from -1.2% today to 13.0% in 3 years time.

- Analysts expect earnings to reach $4.8 million (and earnings per share of $0.63) by about September 2028, up from $-298.6 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 19.5x on those 2028 earnings, up from -109.4x today. This future PE is lower than the current PE for the US IT industry at 32.4x.

- Analysts expect the number of shares outstanding to grow by 3.54% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.75%, as per the Simply Wall St company report.

Data Storage Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The proposed sale of CloudFirst, which currently represents approximately 95% of Data Storage's revenue and is a high-performing cash-generating business, would leave the company with a dramatically smaller operating base and create significant uncertainty about its ability to replace lost revenues, likely resulting in sharp declines in future revenue and earnings.

- Post-divestiture, the public company will be reduced to a very small team (three core employees plus Nexxis), effectively resetting Data Storage back to an early-stage structure and exposing it to execution risk in ramping new business lines, which could lead to further net margin compression and operating losses.

- Management's stated strategy after the sale relies on making acquisitions and investing in AI vertical software and other new technology verticals, but the absence of concrete plans, unclear time frames, and the need to identify and successfully integrate new businesses heighten the risk of capital misallocation and possible shareholder dilution, jeopardizing future earnings growth.

- With recurring SG&A expenses rising due to increased headcount and stock-based compensation, and with revenue sources narrowing after the sale, there is a significant risk of continued or worsened net losses if new revenue-generating operations are not timely and successfully implemented.

- In the context of long-term industry trends, Data Storage's shift away from a stable, high-margin recurring services segment (CloudFirst) toward unproven areas makes it vulnerable to ongoing secular trends such as further hyperscaler integration, rapid innovation in storage, and commoditization of traditional services, potentially eroding any ability to recover prior revenue and net income levels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $9.0 for Data Storage based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $36.6 million, earnings will come to $4.8 million, and it would be trading on a PE ratio of 19.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of $4.5, the analyst price target of $9.0 is 50.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Data Storage?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.