Last Update 28 Nov 25

APPF: Expanded Resident Experience And AI Integration Will Drive Significant Upside

Analysts have modestly increased their price target for AppFolio to $317, citing ongoing business strength and expanding growth opportunities despite recent share price volatility.

Analyst Commentary

Recent street research has offered a mix of perspectives on AppFolio, highlighting both notable strengths and areas of uncertainty as the company pursues further growth in its sector.

Bullish Takeaways- Bullish analysts see ongoing business strength and expansion into new growth opportunities, especially through monetizing the resident experience and rolling out new AI-driven services.

- Recent upgrades and raised price targets reflect confidence in the underlying fundamentals of the business, including strong trends in new customer acquisition and expansion of existing accounts.

- Several analysts argue that recent share price weakness is not reflective of the company’s actual performance. They point to solid business health and ongoing revenue growth that is expected to surpass 20% due to new product launches.

- Some analysts note that AppFolio's valuation now sits at the lower end of its historical range. This is seen as an appealing opportunity for long-term investors in anticipation of further growth and possible positive surprises from upcoming corporate initiatives.

- Bearish analysts express concern related to the lack of long-term financial guidance at recent investor events. This has introduced some uncertainty regarding the company’s ability to consistently meet heightened growth expectations.

- Some point to the recent underperformance of AppFolio’s share price as a sign that investors remain cautious about execution risks and the timeline for realizing value from new product launches.

- There are questions about whether the company’s positive business fundamentals and growth potential are fully appreciated or will be quickly reflected in share price, particularly if competitive pressures increase or macroeconomic conditions change.

- Valuation, while currently more attractive, could remain under pressure if anticipated growth drivers such as AI and resident services fail to deliver on expectations in the near term.

What's in the News

- KeyBanc upgraded AppFolio to Overweight from Sector Weight with a $285 price target following insights from the company's annual Future user conference, noting renewed confidence in momentum around Plus and Max product lines and significant opportunities in monetizing the resident experience (KeyBanc research note).

- AppFolio unveiled Real Estate Performance Management, a new AI-native platform aimed at helping property managers transition from efficiency-focused operations to outcome-driven performance, with new Resident Onboarding innovations introduced at the Future conference (Product Announcement).

- SnapInspect integrated with AppFolio Stack Marketplace, enabling property managers to automate property inspections, work orders, data syncing, and streamline operational oversight (Client Announcement).

- AppFolio raised annual revenue guidance for 2025 to $945 to $950 million, reflecting a projected 19% midpoint growth rate driven by increased adoption of Plus and Max tiers and new products and services (Corporate Guidance).

Valuation Changes

- Consensus Analyst Price Target remains steady at $317, reflecting no adjustment since the last update.

- Discount Rate has decreased marginally from 8.43% to 8.41%.

- Revenue Growth forecast is unchanged at 18.16%.

- Net Profit Margin projection remains stable at 13.68%.

- Future P/E ratio estimate has fallen slightly from 69.19x to 67.18x.

Key Takeaways

- Rising AI adoption and digital transformation in property management strengthen AppFolio's customer acquisition, platform engagement, and long-term revenue prospects.

- Integrated ecosystem partnerships and investment in high-margin services increase platform stickiness, recurring revenue, and operational efficiency.

- Competitive pressures, regulatory risks, reliance on domestic growth, rising innovation costs, and exposure to third-party threats could constrain future revenue, margins, and differentiation.

Catalysts

About AppFolio- Provides cloud-based platform for the real estate industry in the United States.

- Accelerating adoption of AI-powered workflow automation within property management-demonstrated by a 46% increase in industry intent to use AI and 96% of customers engaging with AI solutions-positions AppFolio to continue expanding unit counts, drive top-line revenue growth, and support future increases in net margins through productivity gains.

- Expansion of integrated ecosystem partnerships (e.g., AppFolio Stack, fintech solutions, and third-party partner integrations) provides customers with more seamless, end-to-end experiences, increasing the platform's stickiness, ARPU, and recurring revenue potential.

- Elevated labor shortages and ongoing economic pressures in real estate are driving property management customers to adopt technology for cost reduction and efficiency, supporting consistent customer acquisition and minimizing churn, which will have a positive impact on revenue and retention rates.

- The growing shift toward digital transformation and cloud-based SaaS across the industry expands AppFolio's addressable market, fueling sustained customer growth, higher subscription sales, and potential long-term earnings expansion.

- Sustained investment in high-margin, value-added services-such as advanced screening (FolioScreen), payment processing, and insurance-alongside continued operational efficiency is expected to further increase net margins and support profitable revenue growth.

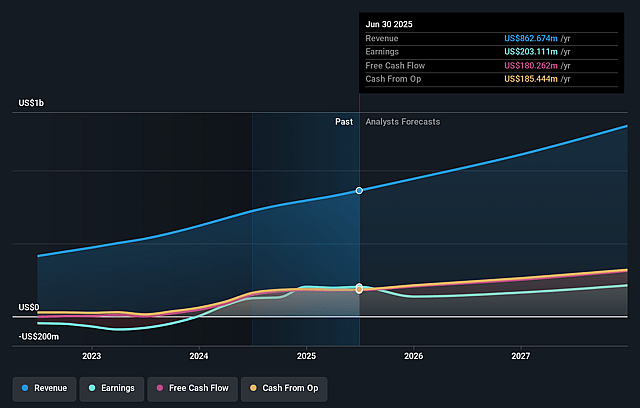

AppFolio Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AppFolio's revenue will grow by 17.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.5% today to 13.7% in 3 years time.

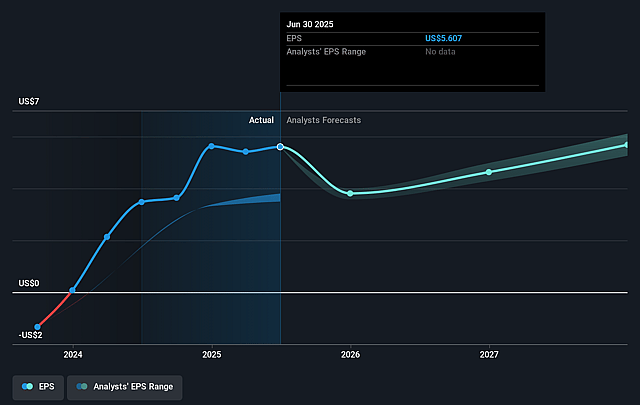

- Analysts expect earnings to reach $192.0 million (and earnings per share of $5.68) by about September 2028, down from $203.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.3x on those 2028 earnings, up from 49.4x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to decline by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

AppFolio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Customer growth primarily comes from new business wins and increased adoption of premium tiers within an already competitive property management segment, which may face commoditization and pricing pressure as more providers develop similar AI-powered SaaS offerings-risking future revenue growth and margin expansion as customers gain greater bargaining power.

- The company's focus remains overwhelmingly domestic, with no mention of international expansion initiatives, implying a limited addressable market; if industry growth slows or saturates in the U.S., future revenue and earnings growth could be capped as the core customer base matures.

- Heavy investment in product innovation (especially AI features) requires continually rising R&D and go-to-market spend; if competitors develop or offer comparable automation and agentic technologies, AppFolio's differentiation could erode, leading to margin pressures and slower operating leverage improvements.

- Major revenue drivers like screening, payments, and risk mitigation services rely on increasing compliance complexity and data handling; rising regulatory scrutiny and new privacy legislation could require expensive platform overhauls and increase compliance costs, directly impacting net margins.

- Partnerships with fintech and third-party integrations are becoming central to the platform's value proposition, exposing AppFolio to third-party risk (including data security) and greater competitive overlap; any significant cybersecurity incident or loss of integration partners could negatively impact customer trust, retention rates, and long-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $341.5 for AppFolio based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $192.0 million, and it would be trading on a PE ratio of 79.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $279.59, the analyst price target of $341.5 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AppFolio?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.