Last Update 17 Dec 25

Fair value Increased 1.23%APP: Share Repurchases And Index Additions Will Support Future Measured Upside

Analysts have raised their price target on AppLovin by about 9 dollars to roughly 737 dollars per share, citing slightly stronger long term revenue growth assumptions and a modest uptick in expected valuation multiples, despite a marginally lower projected profit margin.

What's in the News

- AppLovin completed a major share repurchase tranche, buying back 1,187,000 shares in the third quarter of 2025. This brought total repurchases under the February 2022 authorization to 76,639,556 shares, or 21.42 percent of shares outstanding, for about 4.18 billion dollars (company filing).

- The company increased its equity buyback authorization by 3.2 billion dollars in October 2025, lifting the total program size to approximately 7.94 billion dollars (company announcement).

- AppLovin issued fourth quarter 2025 guidance, projecting revenue between 1.57 billion and 1.6 billion dollars (earnings guidance).

- AppLovin was added to the S&P Global 1200 and the S&P 500 Equal Weighted Index, which may enhance its visibility and potential ownership among global and U.S. equity index investors (index provider).

- The stock was removed from the Russell Small Cap Comp Growth Index as the company graduated into larger cap benchmarks (index provider).

Valuation Changes

- The fair value estimate has risen slightly from about 728 dollars and 25 cents to roughly 737 dollars and 21 cents per share, reflecting a modestly higher intrinsic valuation.

- The discount rate has edged down very slightly from about 8.47 percent to approximately 8.47 percent, implying a nearly unchanged cost of capital assumption.

- Revenue growth has increased marginally from roughly 24.62 percent to about 24.70 percent, indicating a slightly stronger long term growth outlook.

- Net profit margin has ticked down slightly from about 63.96 percent to roughly 63.91 percent, pointing to a small reduction in long run profitability assumptions.

- The future P/E multiple has risen slightly from about 39.52 times to roughly 39.97 times, suggesting a modestly higher valuation multiple applied to forward earnings.

Key Takeaways

- Broader platform access and international expansion are driving increased advertiser numbers, diversified revenue streams, and accelerated global growth opportunities.

- Technology enhancements and category diversification are improving operational efficiency, reducing risk, and supporting long-term earnings momentum.

- Heightened regulatory, platform, and competitive pressures threaten AppLovin's ad monetization, margins, and diversification efforts, increasing vulnerability to shifts in digital advertising and mobile gaming trends.

Catalysts

About AppLovin- Engages in building a software-based platform for advertisers to enhance the marketing and monetization of their content in the United States and internationally.

- Expanded rollout of the self-service AXON ads manager and Shopify integration is expected to open AppLovin's platform to a massive new base of small and mid-sized advertisers globally, dramatically increasing advertiser count and driving sustained uplift in topline revenue.

- Opening up access to international markets for web-based advertising (beyond the U.S.) will allow AppLovin to tap into significant, underpenetrated audiences and new advertiser cohorts-positioning the company to accelerate global market share gains and topline revenue growth.

- The proliferation of mobile devices and growing internet usage, especially in emerging markets, is rapidly expanding the addressable audience for in-app advertising, creating a structural demand tailwind for AppLovin's platform and supporting long-term revenue growth.

- Continuous advancements and adoption of the AXON machine learning platform are improving ad targeting, campaign ROI, and automation-enhancing advertiser outcomes and enabling higher net margins through increased operating efficiency.

- Diversification beyond gaming into e-commerce and other categories is creating a more balanced and recurring revenue stream, expanding the TAM while reducing dependency risk, and supporting future compound earnings growth.

AppLovin Future Earnings and Revenue Growth

Assumptions

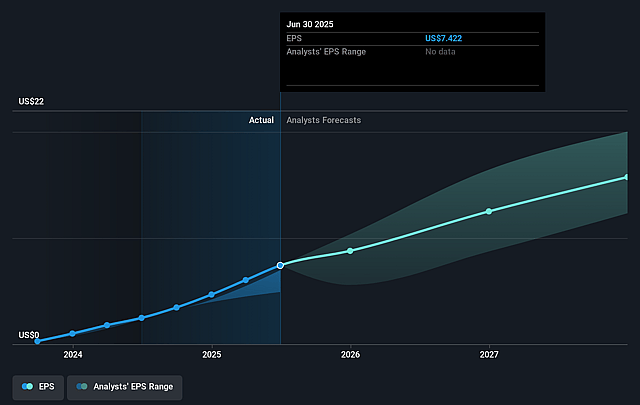

How have these above catalysts been quantified?- Analysts are assuming AppLovin's revenue will grow by 22.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 43.8% today to 59.3% in 3 years time.

- Analysts expect earnings to reach $6.2 billion (and earnings per share of $18.94) by about September 2028, up from $2.5 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $7.2 billion in earnings, and the most bearish expecting $4.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 35.5x on those 2028 earnings, down from 65.6x today. This future PE is lower than the current PE for the US Software industry at 36.6x.

- Analysts expect the number of shares outstanding to grow by 0.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.46%, as per the Simply Wall St company report.

AppLovin Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing regulatory scrutiny and anticipated tightening of global data privacy laws (such as GDPR, CCPA, and potential new US federal regulations) could materially limit AppLovin's ability to collect user data, personalize ads, and maintain premium CPMs-potentially reducing both revenue growth and net margins over the long term.

- AppLovin remains heavily dependent on the mobile gaming vertical for the majority of its revenue; any plateauing or decline in mobile gaming user engagement or spending would slow top-line growth, especially if expansion into e-commerce or other verticals experiences slower adoption than anticipated.

- The company is highly reliant on third-party mobile platforms (iOS/Apple and Android/Google) and is thus exposed to significant platform risk-policy changes (such as further privacy or anti-tracking measures, e.g., continued IDFA deprecation or analogous Android restrictions) could sharply diminish ad targeting precision, hurting advertiser ROI, demand, and net profit margins.

- Competitive intensity from entrenched players like Meta, Google, Unity, and others could drive down take rates, force increased sales/marketing spend-especially as AppLovin tries to move beyond gaming into e-commerce-compressing EBITDA margins and earnings growth, particularly if features or automation lag behind larger incumbents.

- As digital advertising budgets become more cyclical and susceptible to macroeconomic swings, revenue streams tied to performance marketing could become more volatile; additionally, the risk of advertising fatigue and diminishing ROI in saturated gaming and app markets could lead to lower client retention, diminished monetization rates, and pressure on long-term LTVs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $499.143 for AppLovin based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $650.0, and the most bearish reporting a price target of just $250.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.5 billion, earnings will come to $6.2 billion, and it would be trading on a PE ratio of 35.5x, assuming you use a discount rate of 8.5%.

- Given the current share price of $487.35, the analyst price target of $499.14 is 2.4% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AppLovin?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.