Last Update 11 Dec 25

Fair value Increased 0.17%ADSK: AI And Execution Will Drive Margin Expansion And Share Gains

Analysts have nudged our Autodesk fair value estimate slightly higher to approximately $365 per share, up from about $365 previously. This reflects increased confidence in the durability of low teens revenue growth, AI and go to market execution, and consistently strong quarterly results that have supported a series of upward price target revisions on the Street.

Analyst Commentary

Bullish analysts are increasingly aligning behind a view that Autodesk can sustain low teens revenue growth while expanding its addressable opportunity through AI driven product enhancements and more efficient go to market execution. Recent quarters have been described as among the company’s cleanest in years, with strength visible across billings, subscription metrics, and forward looking guidance, reinforcing confidence in the multiyear earnings trajectory.

At the same time, there is recognition that expectations are moving higher alongside the stock, with some investors wary of macro sensitivity and the risk that outer year targets prove conservative or require further proof points. This creates a more balanced setup where execution remains the primary valuation driver, and commentary around fiscal 2027 and beyond will be critical for sustaining current multiples.

Bullish Takeaways

- Recent quarters are characterized as very healthy with broad based beats across key metrics. This supports the case for sustained double digit revenue growth and is cited by some analysts as a reason for higher price targets.

- Stronger conviction in AI capabilities and go to market initiatives underpins upward revisions to long term estimates, as some investors anticipate both higher monetization per user and improved customer acquisition efficiency.

- Stable demand conditions and strong billings guidance help alleviate concerns about growth durability, and are seen as suggesting that Autodesk can navigate a mixed macro environment while still compounding earnings.

- Out year confidence is described as improving as execution remains consistent. Bullish analysts argue that current valuation can be supported by a multiyear runway of margin expansion and cash flow growth.

Bearish Takeaways

- Some bearish analysts remain cautious on the macro backdrop, highlighting that a downturn in construction or capital spending could pressure new business activity and test the resilience of current growth assumptions.

- Outer year commentary, including early indications around fiscal 2027, is viewed by some as potentially conservative near 9 percent revenue growth. This raises questions about how much upside is already reflected in the share price.

- With multiple upward target revisions and expectations for continued outperformance, the risk of even a modest execution slip is described as elevated. This could drive a derating if growth normalizes faster than anticipated.

- The balance between long term product opportunity and valuation is viewed as becoming more finely tuned. This is leading to more neutral stances where some investors wait for additional evidence that AI and new initiatives can materially accelerate growth beyond current forecasts.

What's in the News

- Raised full year fiscal 2026 guidance, now expecting revenue of $7.15 billion to $7.165 billion and GAAP EPS of $5.16 to $5.33, citing strong business momentum (Corporate guidance).

- Issued new guidance for fourth quarter fiscal 2026, targeting revenue of $1.901 billion to $1.917 billion and GAAP EPS of $1.40 to $1.57 (Corporate guidance).

- Expanded AI led digital manufacturing capabilities through a new partnership with L&T Technology Services, integrating Autodesk cloud solutions into a Center of Excellence in India (Client announcement).

- Deepened presence in large capital programs via integration between Aurigo Primus and Autodesk Construction Cloud, linking long range capital planning with downstream project execution (Client announcement).

- Strengthened ecosystem through a strategic collaboration with Eaton to combine Autodesk Tandem with Eaton’s Brightlayer Digital Energy Twin for smarter, energy efficient building lifecycle management (Strategic alliance).

Valuation Changes

- The fair value estimate has risen slightly to approximately $365.14 per share from about $364.52, reflecting modestly higher confidence in long term assumptions.

- The discount rate has increased slightly to about 8.59 percent from roughly 8.51 percent, implying a marginally higher required return for Autodesk’s equity.

- Revenue growth has edged up to around 12.71 percent from about 12.70 percent, indicating a very small upward revision to long term top line expectations.

- The net profit margin has remained essentially unchanged at roughly 22.58 percent, signaling stable profitability assumptions in the model.

- The future P/E has fallen slightly to about 42.6x from roughly 43.3x, suggesting a modestly lower multiple being applied to forward earnings despite the higher fair value estimate.

Key Takeaways

- Expanding cloud and AI-driven solutions, plus SaaS models, are enhancing recurring revenue, margin stability, and differentiation in core AEC markets.

- Strategic acquisitions and focus on sustainability are growing Autodesk's product ecosystem, customer value, and positioning as a key enabler of digital transformation.

- Rising competition from open-source and alternative platforms, evolving customer preferences, and regulatory challenges threaten Autodesk's pricing power, market share, and long-term profitability.

Catalysts

About Autodesk- Provides 3D design, engineering, and entertainment technology solutions worldwide.

- Strength in Autodesk's core AEC (Architecture, Engineering, Construction) markets is driven by sustained investment in infrastructure, data centers, and industrial buildings, underpinned by increased global urbanization and infrastructure buildout, which is likely to fuel ongoing growth in Autodesk's addressable market and support robust revenue expansion.

- Accelerating adoption of cloud-based platforms-such as Autodesk Construction Cloud and Fusion 360-and ongoing rollout of subscription and SaaS models are increasing recurring revenue, improving revenue visibility, and enhancing net margin stability due to higher operating leverage and sales efficiency improvements.

- Continued innovation and integration of AI-driven tools (e.g., generative design, AutoConstrain) and industry-specific foundation models are boosting customer productivity and differentiating Autodesk's offerings, supporting premium pricing and driving margin expansion and long-term earnings growth.

- Focused strategic tuck-in acquisitions and strong cross-sell activity are expanding Autodesk's product ecosystem, allowing deeper integration and higher customer lifetime value, raising the potential for long-term revenue acceleration and resilient net margin improvement.

- Rising importance of sustainability and regulatory-driven climate action, together with increased demand for digitally-enabled energy efficiency solutions, are positioning Autodesk as an essential technology provider for customers' sustainable transformation efforts, driving higher-value software adoption and supporting both topline growth and higher-margin service offerings.

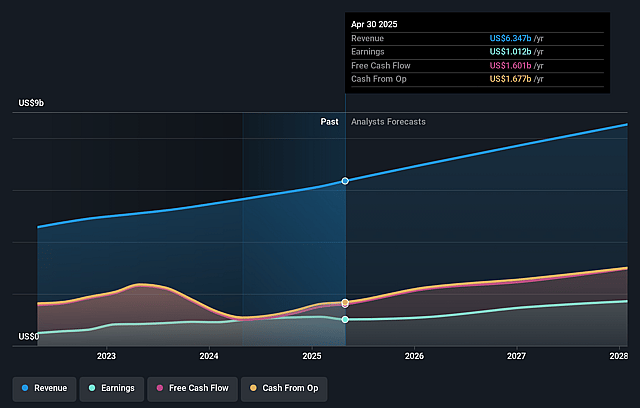

Autodesk Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Autodesk's revenue will grow by 12.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.8% today to 21.0% in 3 years time.

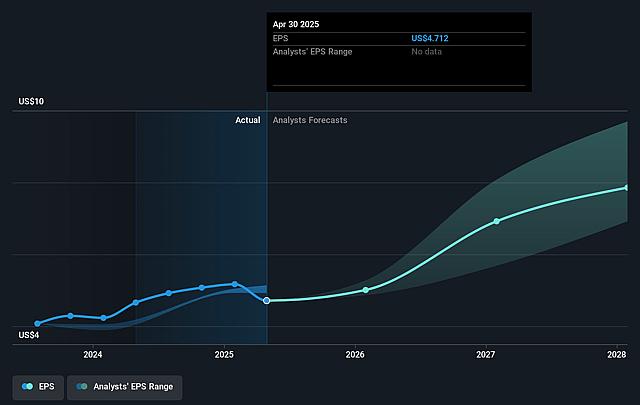

- Analysts expect earnings to reach $2.0 billion (and earnings per share of $9.29) by about September 2028, up from $1.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $1.5 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 48.4x on those 2028 earnings, down from 66.3x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to decline by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.51%, as per the Simply Wall St company report.

Autodesk Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing adoption of open-source and lower-cost software solutions globally could erode Autodesk's pricing power, as evidenced by customer examples switching from competitive solutions, potentially leading to price compression and pressure on long-term revenue growth.

- Ongoing customer adaptation to the new transaction model and frequent migrations may cause friction, slowing net new customer acquisition and risking higher churn rates, which can negatively affect recurring revenue streams and overall earnings.

- Rapid advances in AI and generative design-areas in which Autodesk is investing but where emerging competitors and start-ups are active-could enable new entrants to leapfrog Autodesk's technology if Autodesk's own innovation pace slows, threatening its competitive moat and long-term margins.

- Heightened data privacy and global regulatory requirements, as Autodesk continues its transition to cloud-based and AI-enabled solutions, may increase compliance costs and operational complexity, creating headwinds for operating margins over time.

- Accelerated adoption of alternative, agile, or in-house software platforms-particularly as the construction industry explores modular and industrialized construction methods-may bypass legacy Autodesk solutions, constraining Autodesk's total addressable market in its traditional AEC business and impacting future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $358.964 for Autodesk based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $430.0, and the most bearish reporting a price target of just $270.97.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $9.3 billion, earnings will come to $2.0 billion, and it would be trading on a PE ratio of 48.4x, assuming you use a discount rate of 8.5%.

- Given the current share price of $325.19, the analyst price target of $358.96 is 9.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Autodesk?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.