Key Takeaways

- Accelerated adoption of diverse IoT applications and next-generation products is driving higher customer demand and expanded growth opportunities across new and existing segments.

- Focus on ecosystem compatibility, energy efficiency, and supply chain resilience is enhancing customer loyalty, supporting margin improvement, and positioning the company for sustainable long-term gains.

- Dependence on key new products, rising competition, and trade uncertainties heighten risks to revenue stability, margins, and inventory management for Silicon Labs.

Catalysts

About Silicon Laboratories- A fabless semiconductor company, provides various analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

- Rapid adoption of smart home and connected healthcare applications is fueling robust, broad-based demand for Silicon Labs' wireless solutions, resulting in meaningful design win ramps across new segments (e.g., blood glucose monitors, metering, electronic shelf labeling), which points to sustained above-market revenue growth over the next several years.

- Expansion and ramp of next-gen product families (Series 2 and Series 3 SoCs) are driving higher average selling prices (ASPs) and increased content per device, especially as customers seek features like advanced security, AI/ML capabilities, and longer battery life-supporting future gross margin expansion and higher earnings.

- Increased industry demand for energy-efficient and sustainable IoT devices is aligned with Silicon Labs' low-power technology leadership, positioning the company to benefit as global policy and corporate priorities drive greater IoT adoption and, in turn, long-term revenue and margin improvement.

- Continued progress in ecosystem compatibility (including support for standards like Matter, Bluetooth, and multi-protocol wireless) and strategic partnerships is deepening customer engagement and stickiness, which should translate to improved recurring revenue streams and stronger net margins over time.

- Execution on inventory management and supply chain diversification has stabilized operational costs and working capital, setting up the company to efficiently capture future demand surges and incremental revenue opportunities as global IoT adoption accelerates.

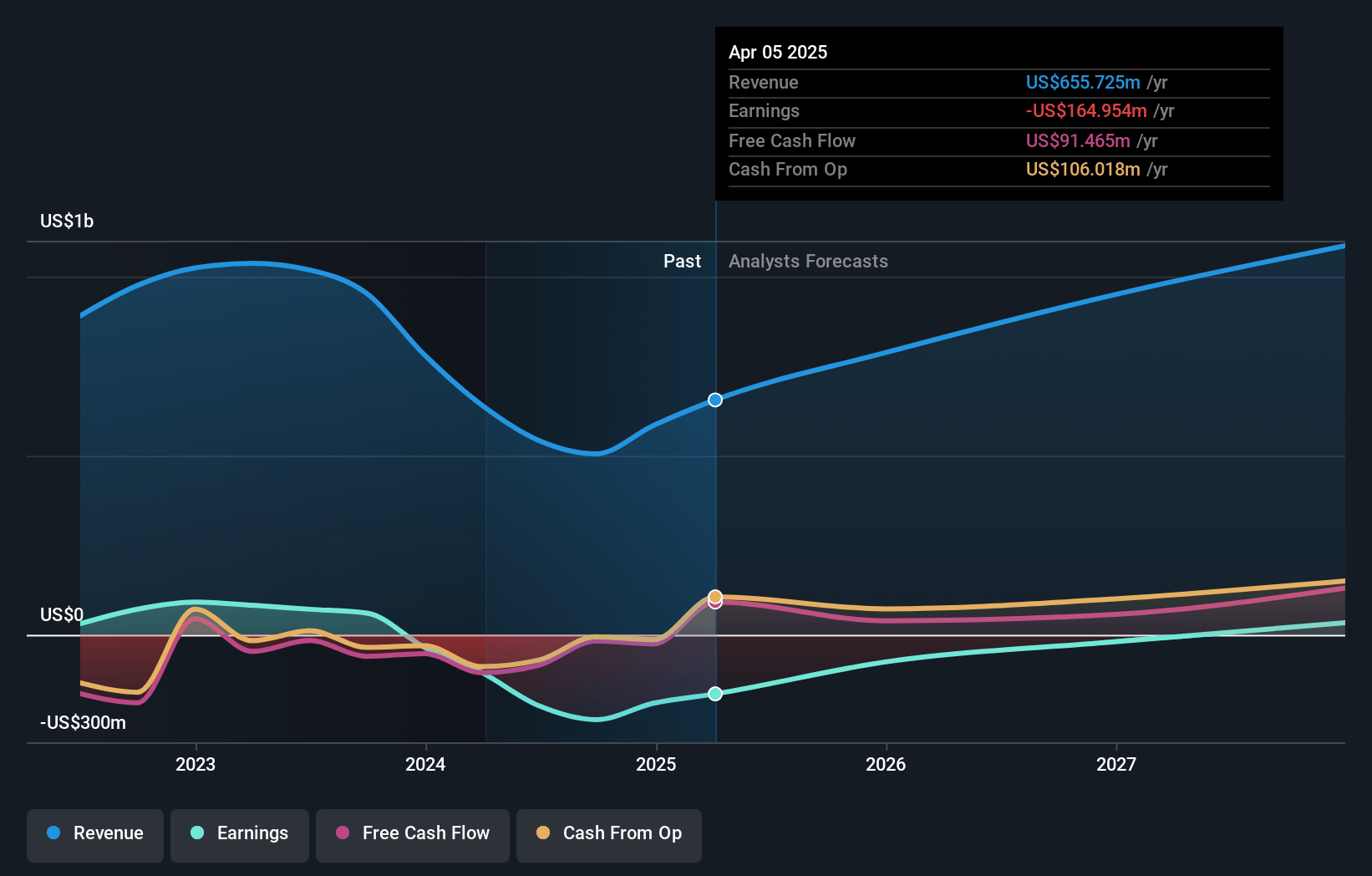

Silicon Laboratories Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Silicon Laboratories's revenue will grow by 21.3% annually over the next 3 years.

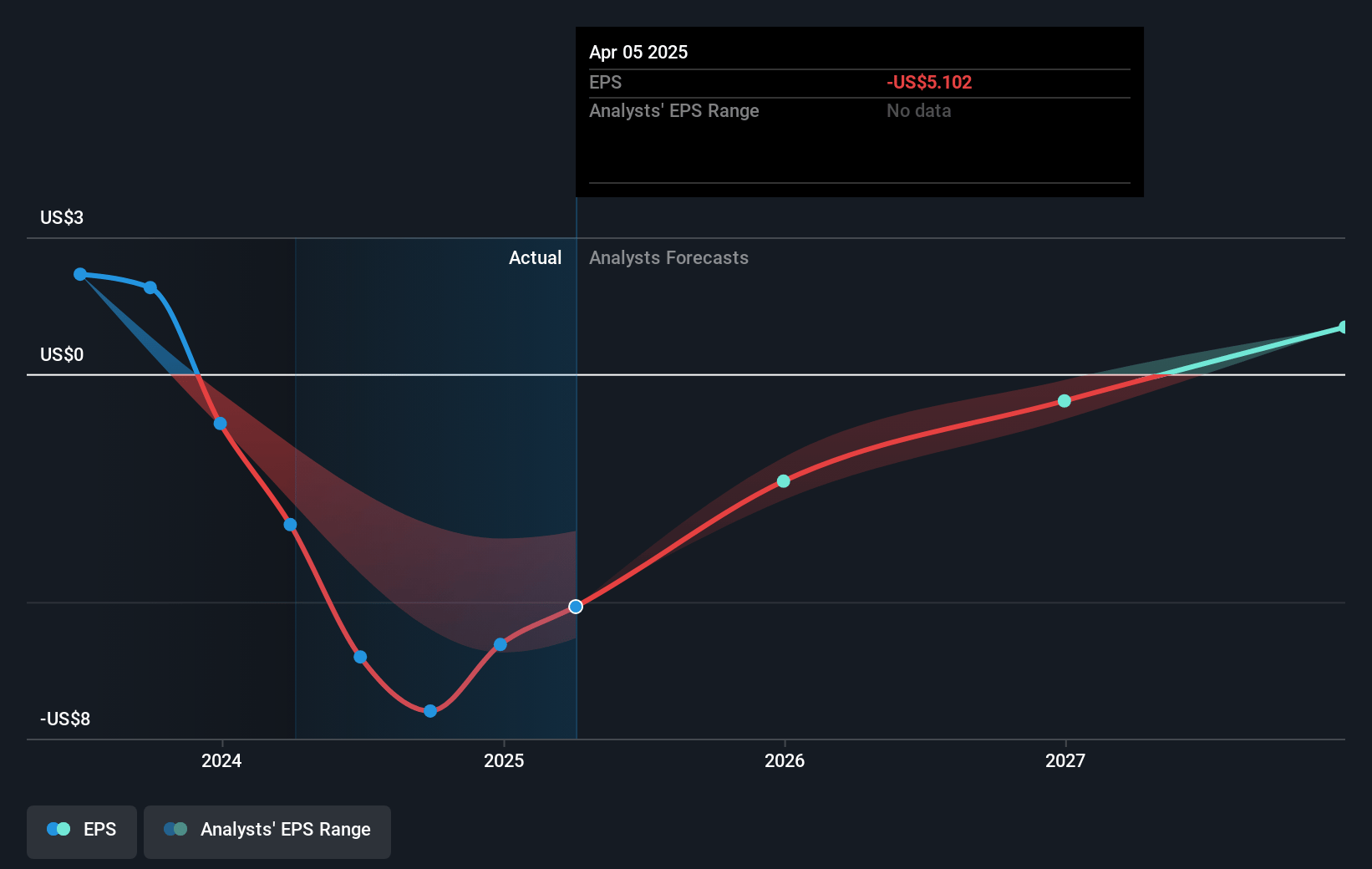

- Analysts are not forecasting that Silicon Laboratories will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Silicon Laboratories's profit margin will increase from -25.2% to the average US Semiconductor industry of 13.8% in 3 years.

- If Silicon Laboratories's profit margin were to converge on the industry average, you could expect earnings to reach $161.3 million (and earnings per share of $4.89) by about July 2028, up from $-165.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 38.3x on those 2028 earnings, up from -27.2x today. This future PE is greater than the current PE for the US Semiconductor industry at 31.1x.

- Analysts expect the number of shares outstanding to grow by 0.88% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.44%, as per the Simply Wall St company report.

Silicon Laboratories Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Ongoing trade policy uncertainty and potential changes to global tariffs create indirect risks to end-market demand, which could negatively impact revenue visibility and lead to volatility in Silicon Labs' top-line growth.

- Heavy reliance on design win ramps and new product introductions, rather than broad-based end-market recovery, exposes the company to concentrated risk-should these specific customer programs slow or fail to scale, both revenue and earnings could be adversely affected.

- Increasing competition within the connectivity and IoT semiconductor market, especially from larger players with more pronounced economies of scale, may place long-term pressure on pricing and gross margins as Silicon Labs' operational costs rise.

- Persistently low channel inventory levels require multi-quarter normalization, running the risk of revenue timing mismatches and working capital strain if there is weaker-than-forecasted end-market pull-through or unexpected changes in POS trends.

- Unpredictable shifts in customer inventory behavior due to geopolitical or macroeconomic uncertainty could translate into short-term over

- or under-ordering, causing revenue swings and impacting net margins as the company navigates potential destocking or double-ordering cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $142.778 for Silicon Laboratories based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $180.0, and the most bearish reporting a price target of just $100.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.2 billion, earnings will come to $161.3 million, and it would be trading on a PE ratio of 38.3x, assuming you use a discount rate of 9.4%.

- Given the current share price of $137.85, the analyst price target of $142.78 is 3.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.