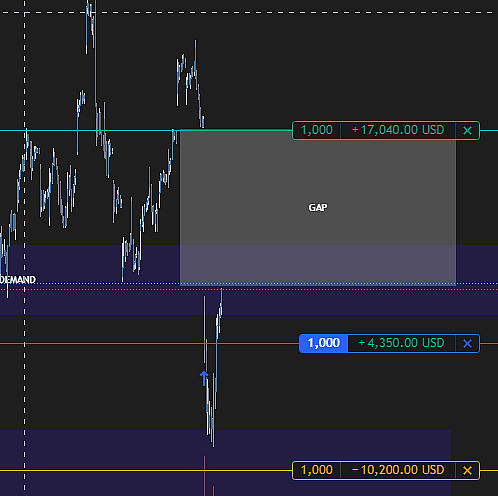

NVIDIA's stock price has recently declined to $116, which I perceive as an overreaction by the market. I have entered a position from to $128 and executed a swing trade from $128 to a TP of $141, based on technical analysis indicating a potential rise to close the gap at $141.

This downturn appears to be a response to news about DeepSeek.ai's latest AI model, R1, which was reportedly trained at a cost of approximately $5.6 million. It's important to note that this figure represents only the training costs and excludes other significant expenses, such as infrastructure and development. Additionally, DeepSeek utilized NVIDIA's H800 GPUs in their model development, underscoring NVIDIA's continued relevance in the AI sector.

I believe that many investors view this price drop as an opportunity to invest in NVIDIA stock, given the ongoing interest in AI technology. From a technical perspective, the stock has reached a historically strong demand zone and is showing signs of recovery. My target price is set at $141, corresponding to the closure of the gap that occurred during the sudden price decline.

Have other thoughts on NVIDIA?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

The user CHP holds no position in NasdaqGS:NVDA. Simply Wall St has no position in any of the companies mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The author of this narrative is not affiliated with, nor authorised by Simply Wall St as a sub-authorised representative. This narrative is general in nature and explores scenarios and estimates created by the author. The narrative does not reflect the opinions of Simply Wall St, and the views expressed are the opinion of the author alone, acting on their own behalf. These scenarios are not indicative of the company's future performance and are exploratory in the ideas they cover. The fair value estimates are estimations only, and does not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that the author's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives