Last Update 30 Nov 25

Fair value Decreased 2.18%LOW: Pro Segment Investments Will Drive Future Share Gains Amid Housing Market Tailwinds

Lowe's Companies saw its analyst fair value estimate decrease modestly to $272.50 per share from $278.56, as analysts cite cautious guidance and mixed sector signals. This comes despite some ongoing industry tailwinds.

Analyst Commentary

Analyst perspectives on Lowe's remain mixed following the latest earnings report and guidance update. The company's current positioning in the home improvement market, along with macroeconomic headwinds and tailwinds, has spurred both optimism and caution among Wall Street observers.

Bullish Takeaways

- Bullish analysts see the "lock-in" effect, where homeowners prefer investing in existing properties rather than moving, as a key demand driver for renovation products and services.

- Elevated levels of home equity are viewed as supportive of continued investments in home improvement projects. This could translate into incremental sales for Lowe's.

- Productivity improvements and investments in the professional ("Pro") segment are expected to help drive share gains, potentially narrowing the gap with competitors.

- Macro factors such as possible declines in interest rates, the end of government shutdown impacts, and increased tax refunds are seen as potential catalysts for improved results in the coming quarters.

Bearish Takeaways

- Bearish analysts emphasize that Q4 guidance was generally below market consensus, which signals some conservatism in management's near-term outlook.

- Comparable sales performance decelerated, partly due to challenging comparisons with last year's hurricane-driven demand and prevailing consumer uncertainty in a pressured housing market.

- Despite some positive demand drivers, a meaningful inflection in results may not materialize soon as consumer sentiment and housing turnover remain subdued.

- Persistent execution challenges, particularly in closing the productivity gap with competitors, continue to weigh on the company's long-term valuation outlook.

What's in the News

- Aqara introduces the Smart Lock B50, a Wi-Fi deadbolt lock for home security. The product is now available at over 500 Lowe's stores and online, featuring app-based access, PIN code management, and compatibility with Alexa and Google Home (Client Announcement).

- Lowe's Companies raises its full-year 2025 total sales guidance to $86.0 billion, up from previous guidance of $84.5 billion to $85.5 billion (Corporate Guidance).

- SenesTech’s Evolve Rat birth control product launches on Lowes.com, expanding its retail reach for humane rat population management solutions (Client Announcement).

- Alpha Modus Corp. files a patent infringement lawsuit against Lowe's, alleging that the company’s AI-enabled retail technology for inventory management and customer engagement violates several U.S. patents (Lawsuits & Legal Issues).

- Several major financial institutions, including U.S. Bancorp and Goldman Sachs, have been added as Co-Lead Underwriters for multiple Lowe's fixed-income offerings. This signals ongoing activity in the company's capital markets strategy (Public Offering Announcements).

Valuation Changes

- Fair Value Estimate: Decreased modestly to $272.50 per share from $278.56 per share.

- Discount Rate: Increased slightly from 8.96% to 9.14%.

- Revenue Growth: Lowered to 5.38% from the previous 5.71% projection.

- Net Profit Margin: Reduced from 8.60% to 8.24%.

- Future P/E Ratio: Increased from 23.29x to 23.98x.

Key Takeaways

- Expansion into the Pro contractor market and integration of new digital capabilities position Lowe's for sustained growth, operational efficiency, and greater customer wallet share.

- Market consolidation and scale advantages are set to enhance supplier bargaining power and cost efficiencies, supporting long-term margin improvement.

- Major acquisitions, debt-related risks, tepid sales growth, labor pressures, and digital competition together threaten Lowe's operational margins, revenue growth, and long-term earnings potential.

Catalysts

About Lowe's Companies- Operates as a home improvement retailer in the United States.

- The acquisition of Foundation Building Materials (FBM) sharply accelerates Lowe's access to the large Pro contractor market-especially in key underserved regions (California, Northeast, Midwest)-unlocking new revenue streams, greater ticket sizes, and a larger share of the $250 billion Pro market, which is expected to drive above-market sales growth and improved diversification of revenue over the coming years.

- Ongoing pent-up demand from delayed home improvement projects, combined with record-high aging U.S. housing stock and an estimated 18 million new homes needed by 2033, points to a significant runway for future growth in renovation, repair, and new construction; this will positively affect revenue and support sustained top-line expansion as the housing cycle recovers.

- Continued investment in digital and omnichannel capabilities-including AI-powered tools for associates and new digital solutions brought through FBM's technology (e.g., MyFBM app, digital blueprint takeoff)-is expected to enhance operational efficiency, improve service levels for Pro and DIY customers, and drive incremental margin expansion through productivity gains.

- Cross-selling opportunities arising from the integration of FBM and ADG (flooring, cabinets, countertops) enable Lowe's to offer comprehensive interior solutions to large builders, boosting wallet share per customer and supporting margin and earnings growth through higher attachment rates and bundled sales.

- Market consolidation trends and Lowe's growing scale in both retail and distribution are poised to strengthen its bargaining power with suppliers, optimize procurement, and improve cost efficiencies, helping to defend and potentially expand both gross and operating margins over the long term.

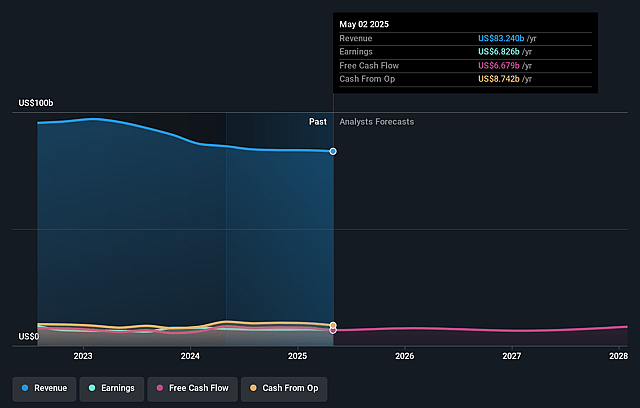

Lowe's Companies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Lowe's Companies's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.2% today to 8.9% in 3 years time.

- Analysts expect earnings to reach $8.4 billion (and earnings per share of $15.27) by about September 2028, up from $6.8 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as $7.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.5x on those 2028 earnings, up from 22.1x today. This future PE is greater than the current PE for the US Specialty Retail industry at 18.7x.

- Analysts expect the number of shares outstanding to decline by 1.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.8%, as per the Simply Wall St company report.

Lowe's Companies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The success of Lowe's major acquisitions (FBM and ADG) hinges on complex integration and execution; failure to effectively merge operations, technology, and cultures could lead to higher costs, operational disruptions, and lower-than-anticipated synergy realization, negatively affecting net margins and long-term earnings.

- The significant debt financing required for the $8.8 billion FBM acquisition will suspend share repurchases until 2027 and temporarily elevate leverage, increasing the company's exposure to interest rate changes and financial risk, which may weigh on earnings growth and shareholder returns.

- Flat to low single-digit comparable sales guidance and management's cautious commentary on a "flat home improvement market" signal that housing turnover and discretionary big-project demand remain suppressed by high mortgage rates and affordability concerns-potentially limiting revenue growth despite favorable secular trends.

- Persistent labor shortages and rising labor costs among both Pro customers and Lowe's workforce threaten to pressure operating margins and erode customer service advantages, possibly leading to margin compression and reduced earnings power long term.

- Ongoing market risk from digital disruption, large supplier bargaining power, and direct-to-consumer competition (including e-commerce channel rivalry and major brands bypassing retailers) may threaten Lowe's in-store and online sales growth, undermining both revenue expansion and margin improvement initiatives.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $281.839 for Lowe's Companies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $325.0, and the most bearish reporting a price target of just $221.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $94.0 billion, earnings will come to $8.4 billion, and it would be trading on a PE ratio of 23.5x, assuming you use a discount rate of 8.8%.

- Given the current share price of $269.03, the analyst price target of $281.84 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.