Last Update 01 May 25

Fair value Decreased 1.61%Sunbelt Demographics And Re-tenanting Will Deliver Lasting Leasing Success

Key Takeaways

- Portfolio repositioning in high-growth Sunbelt markets and new tenant mix supports stronger rent growth, higher occupancy, and greater income resilience.

- Re-leasing strategies and disciplined asset recycling enable outsized rent spreads, improved cash flow, and ongoing reinvestment to drive sustainable earnings and dividend growth.

- Heavy exposure to Sun Belt retail, rising debt costs, and limited scale heighten vulnerability to economic shifts, retail headwinds, and leasing execution risks.

Catalysts

About CTO Realty Growth- A publicly traded real estate investment trust that owns and operates a portfolio of high-quality, retail-based properties located primarily in higher growth markets in the United States.

- The company's leasing momentum in high-growth Southeast and Southwest markets continues to deliver significant positive rent spreads (up to 27% year-to-date on comparable leases and projected 40–60% for key anchor spaces), positioning the portfolio to capture outsized revenue growth and enhanced property-level margins as new tenants commence rent payments in late 2025 and 2026.

- The proactive re-tenanting of anchor spaces, replacing vacated big-box and bankrupt retailers (e.g., Party City, JOANN's) with higher-traffic, necessity-based and experiential tenants like Burlington, Boot Barn, Bassett Furniture, and Bob's Discount Furniture, benefits from evolving consumer preferences for experiences and convenience-supporting stronger future occupancy, more resilient income streams, and sustained earnings growth.

- There is a clear embedded mark-to-market opportunity as CTO has acquired assets with below-market in-place rents, enabling outsized cash rent spreads (notably 86% at recent re-leased spaces) as leases are rolled over, which is likely to drive increases in both revenue and operating cash flow over the next several quarters.

- Ongoing demographic migration to Sunbelt and secondary markets, where CTO's portfolio is concentrated, continues to drive tenant demand and support long-term rent growth and occupancy, buffering revenue against broader retail headwinds and supporting higher valuations over time.

- CTO's disciplined capital recycling strategy (including potential non-core asset sales and redeployment into higher-yielding acquisitions) is expected to improve return on invested capital and generate incremental earnings and cash flow, further boosting the company's ability to grow dividends and fund future investments.

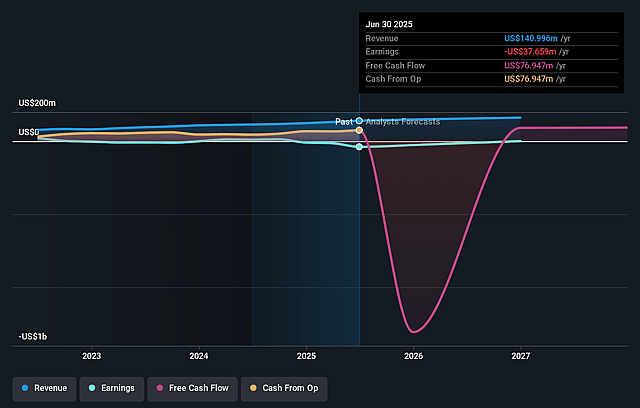

CTO Realty Growth Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CTO Realty Growth's revenue will grow by 9.7% annually over the next 3 years.

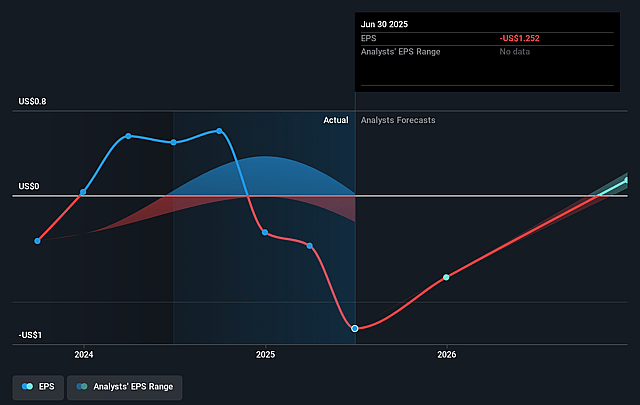

- Analysts are not forecasting that CTO Realty Growth will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CTO Realty Growth's profit margin will increase from -26.7% to the average US REITs industry of 19.7% in 3 years.

- If CTO Realty Growth's profit margin were to converge on the industry average, you could expect earnings to reach $36.8 million (and earnings per share of $0.92) by about September 2028, up from $-37.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, up from -14.9x today. This future PE is lower than the current PE for the US REITs industry at 29.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.44%, as per the Simply Wall St company report.

CTO Realty Growth Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- High geographic concentration in faster-growing MSAs within the Southeast and Southwest exposes CTO Realty Growth to potential localized economic downturns or demographic reversals in these Sun Belt markets, which could result in increased revenue volatility and pressure on net margins over the long run.

- Ongoing structural challenges in brick-and-mortar retail, such as bankruptcies (Party City, JOANN's, Conn's) and prolonged store closures, may continue to impact occupancy rates and limit the ability to achieve sustained rent growth, causing downward pressure on revenue and future earnings.

- Rising interest rates and the company's elevated leverage (net debt to EBITDA of 6.9x) increase refinancing risk and debt servicing costs, potentially reducing net margins and limiting flexibility for future accretive acquisitions or deleveraging efforts.

- Dependence on successful leasing of re-tenanting anchor spaces and realization of positive mark-to-market rent spreads is subject to execution risks and longer leasing cycles; delays or failed negotiations could result in prolonged vacancies, lost rental income, and shortfalls in projected earnings growth.

- Limited scale relative to larger, more diversified REITs may hinder CTO's bargaining power with tenants and access to low-cost capital, restricting operational efficiencies and potentially constraining competitive positioning and future revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.083 for CTO Realty Growth based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $23.0, and the most bearish reporting a price target of just $18.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $186.3 million, earnings will come to $36.8 million, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 8.4%.

- Given the current share price of $17.06, the analyst price target of $21.08 is 19.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.