Last Update23 Apr 25Fair value Decreased 2.94%

Key Takeaways

- Expansion into resilient, recurring-revenue segments and high-growth asset classes supports predictable earnings growth, margin expansion, and revenue diversity.

- Strategic acquisitions, tech enhancements, and sustainability initiatives consolidate leadership and position the company for high-margin consulting income and global market expansion.

- Reliance on traditional office and retail sectors, technological disruption, and regulatory pressures may erode CBRE’s margins, hamper revenue diversification, and constrain long-term growth.

Catalysts

About CBRE Group- Operates as a commercial real estate services and investment company in the United States, the United Kingdom, and internationally.

- CBRE’s rapid expansion in resilient, recurring-revenue businesses such as Facilities Management, Project Management, and Building Operations & Experience is unlocking sustained double-digit organic revenue growth and operating leverage, which is poised to drive margin expansion and predictable earnings growth for the long term.

- The company’s significant exposure and leadership in high-growth asset classes like data centers, logistics, and life sciences is capturing accelerated demand tied to digital transformation and urban migration, with data center sector profits now contributing nearly 10 percent of core EBITDA and growing more than 2.5 times over the past three years, supporting top-line growth and outsized development profits.

- Growing client focus on sustainability and green building initiatives is resulting in robust demand for energy-efficient property solutions and consulting, allowing CBRE to secure high-margin advisory and project management contracts, which enhances both revenue diversity and net margin over time.

- Strategic acquisitions, such as Industrious and Turner & Townsend, along with technology-led platform enhancements, are consolidating CBRE’s leadership in integrated workplace solutions and positioning the company to benefit as corporations optimize global real estate portfolios in response to evolving work models, which should support rising recurring fees and high-margin consulting income.

- The company’s strong balance sheet, track record of large-scale capital deployment, and ongoing share repurchases position CBRE to accelerate EPS growth through opportunistic M&A, continued expansion in underpenetrated markets, and aggressive buybacks, all of which can magnify earnings per share and justify a higher valuation multiple.

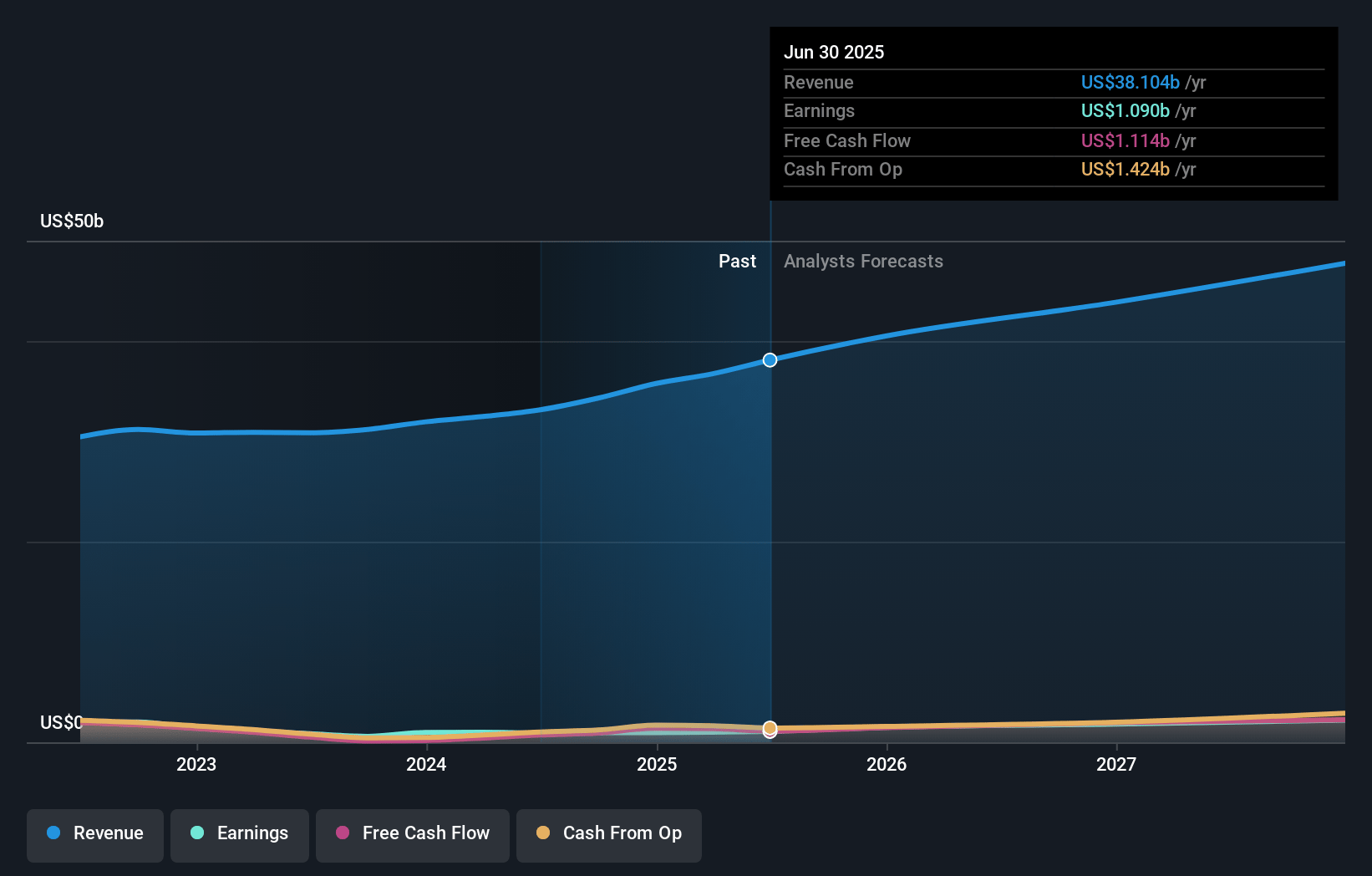

CBRE Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on CBRE Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming CBRE Group's revenue will grow by 10.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.7% today to 4.6% in 3 years time.

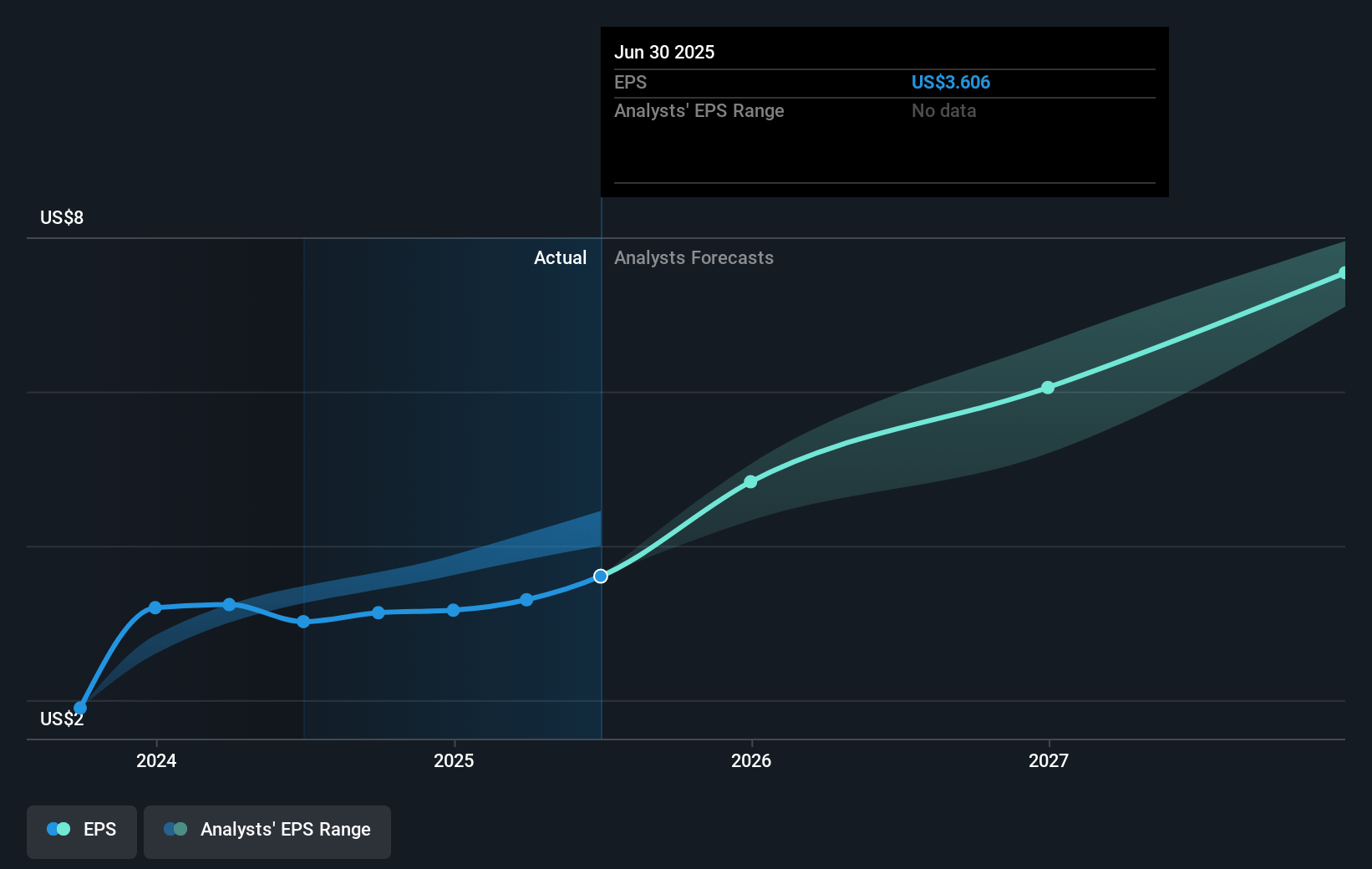

- The bullish analysts expect earnings to reach $2.2 billion (and earnings per share of $7.72) by about April 2028, up from $968.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, down from 36.1x today. This future PE is greater than the current PE for the US Real Estate industry at 21.1x.

- Analysts expect the number of shares outstanding to decline by 2.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.78%, as per the Simply Wall St company report.

CBRE Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The persistent shift toward remote and hybrid work models could structurally lower long-term demand for commercial office space, putting sustained pressure on CBRE’s leasing and property management revenues, leading to weaker revenue and margin growth over time.

- Accelerating adoption of technology and digital real estate platforms risks commoditizing brokerage services, which may erode CBRE’s fee structures and operating margins, thereby negatively impacting net income and profitability.

- Long-term demographic trends, including slower population growth and waning urbanization in developed economies, could suppress core real estate market transaction volumes and limit CBRE’s long-term top-line growth.

- The company’s significant exposure to traditional office and retail sectors leaves it vulnerable to sector-specific secular declines, which could hinder revenue diversification and place downward pressure on blended operating margins over the long term.

- Rising regulatory and ESG compliance demands may increase CBRE’s selling, general and administrative expenses, compressing net margins and undermining sustainable earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for CBRE Group is $165.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of CBRE Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $165.0, and the most bearish reporting a price target of just $112.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $48.6 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 7.8%.

- Given the current share price of $118.19, the bullish analyst price target of $165.0 is 28.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.