Narratives are currently in beta

Key Takeaways

- Facility expansions and service shifts are positioned to enhance revenue growth through regulatory compliance, increased capacity, and improved margins.

- Strong liquidity and free cash flow foster potential for strategic reinvestment, mitigating leverage while enabling growth in earnings.

- Delays in capital expenditures and foreign exchange headwinds, along with rising compliance costs and interest expenses, threaten Sotera Health's growth and profitability.

Catalysts

About Sotera Health- Engages in the provision of sterilization, lab testing, and advisory services in the United States and internationally.

- The facility expansions and EO facility enhancements underway at Sterigenics and Nordion position Sotera Health to meet stringent regulations, indicating possible future revenue growth through compliance and increased capacity.

- Nordion's recent success in cobalt development, with the expectation of the first Cobalt 60 harvest in 2028, suggests sustained future revenue streams in the face of market demand for this product.

- Nelson Labs' shift towards higher core lab testing volumes and away from lower-margin expert advisory services projects is improving margins, indicating potential for better net margins.

- The company's strong liquidity position and positive free cash flow expectations may reduce net leverage, potentially allowing for reinvestment in growth initiatives that could positively impact earnings.

- Sotera Health's ability to secure favorable pricing across its segments amidst cost pressures suggests a potential for revenue growth and maintenance or enhancement of net margins.

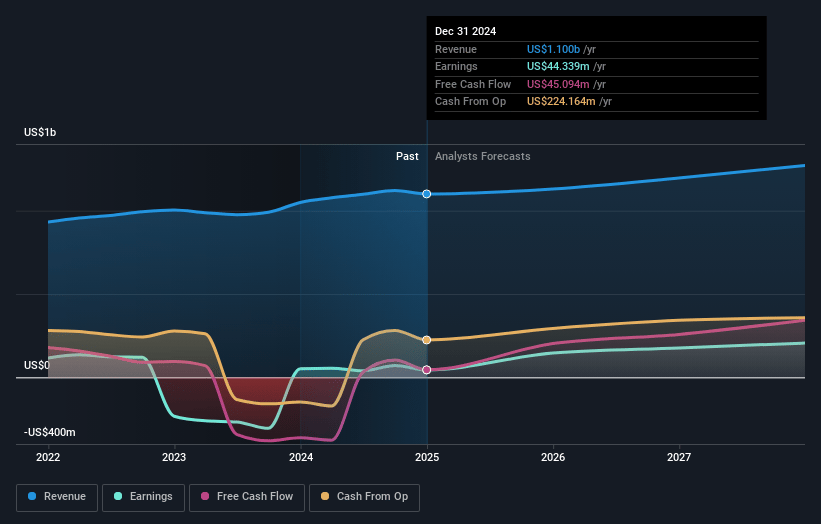

Sotera Health Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Sotera Health's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.3% today to 18.7% in 3 years time.

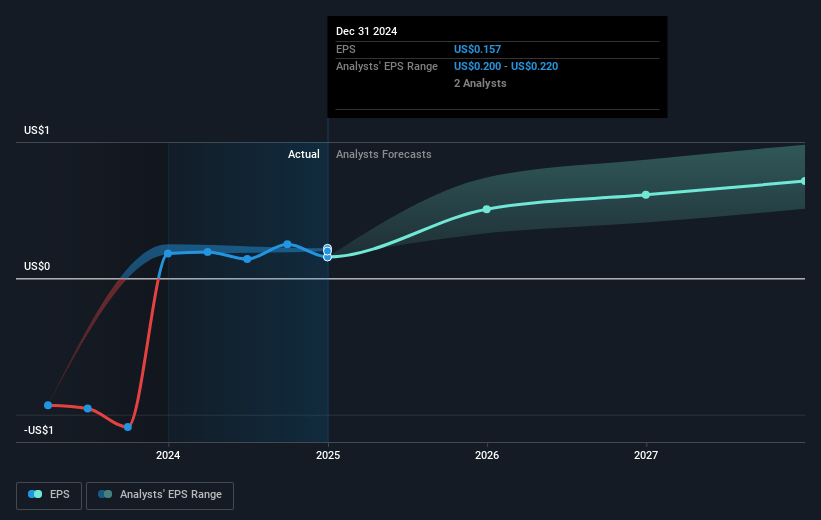

- Analysts expect earnings to reach $242.5 million (and earnings per share of $0.84) by about November 2027, up from $70.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2027 earnings, down from 54.7x today. This future PE is lower than the current PE for the US Life Sciences industry at 41.6x.

- Analysts expect the number of shares outstanding to grow by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.5%, as per the Simply Wall St company report.

Sotera Health Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's capital expenditures have seen delays primarily due to timing in cobalt development projects and vendor performance issues, which could impact future growth and operational efficiency. This delay might push peak CapEx to 2025, affecting free cash flows and potentially straining financial resources in the short term.

- Expert advisory services at Nelson Labs are expected to see diminishing volumes, coinciding with declining revenue in Q4 2024, posing a risk to top-line growth and profitability for this segment.

- The new stringent NESHAP regulations and required compliance investments present operational risks and could lead to increased costs for Sterigenics, potentially affecting net margins if cost-cutting efforts or pricing power cannot match these increases.

- Interest expense remains a significant burden at $42 million for the third quarter, similar to the previous year. This high debt servicing cost could constrain net income growth and limit financial flexibility.

- Foreign exchange headwinds negatively impacted revenue across business segments, particularly Sterigenics, which faced a 60 basis point impact, and Nordion, which experienced a 90 basis point impact. This continued forex risk could adversely affect revenue and profit margins if unfavorable currency movements persist.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $17.43 for Sotera Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $20.0, and the most bearish reporting a price target of just $15.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2027, revenues will be $1.3 billion, earnings will come to $242.5 million, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 7.5%.

- Given the current share price of $13.61, the analyst's price target of $17.43 is 21.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives