Last Update 01 May 25

Key Takeaways

- Sustained patient demand and operational efficiency improvements are poised to enhance revenue growth and financial stability by driving cash flow breakeven.

- Strategic financing and manufacturing capacity expansions support commercialization success and strengthen future revenue prospects.

- Bluebird bio faces financial risks due to declining revenues, cash runway concerns, potential delays in achieving cash flow breakeven, and NASDAQ compliance issues.

Catalysts

About bluebird bio- A biotechnology company, researches, develops, and commercializes gene therapies for curative severe genetic diseases in the United States.

- The company has more than doubled patient starts from 27 to 57 since Q2, with 30 patient starts already scheduled for 2025, indicating sustained demand and providing a clear path to reach cash flow breakeven by the second half of 2025, impacting future revenue growth.

- Bluebird bio plans to reduce its cash operating expenses by 20% by Q3 2025, which should improve net margins and overall financial stability.

- The manufacturing capacity is adequate to support the anticipated increase in drug deliveries, and they plan to double LYFGENIA capacity in 2026 based on demand, which will bolster future revenue streams.

- Timely access to therapies like LYFGENIA, ZYNTEGLO, and SKYSONA, with outcomes-based agreements covering 200 million U.S. lives and no denials for coverage, should support revenue growth and commercialization success.

- The company's engagement with Hercules for additional financing and the potential approval of Proposal 4 for a reverse stock split may provide necessary capital to achieve financial targets, impacting earnings and operation continuity.

bluebird bio Future Earnings and Revenue Growth

Assumptions

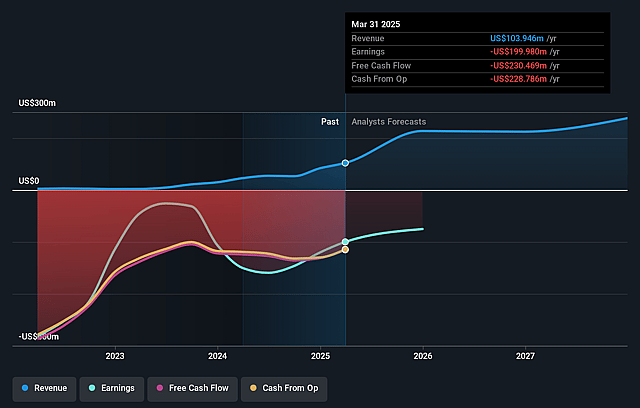

How have these above catalysts been quantified?- Analysts are assuming bluebird bio's revenue will grow by 61.2% annually over the next 3 years.

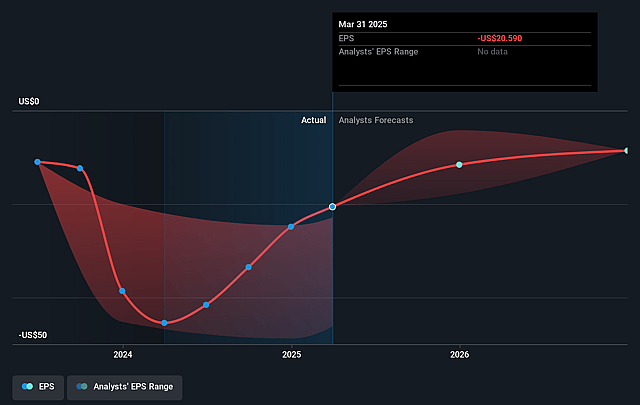

- Analysts are not forecasting that bluebird bio will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate bluebird bio's profit margin will increase from -287.2% to the average US Biotechs industry of 15.9% in 3 years.

- If bluebird bio's profit margin were to converge on the industry average, you could expect earnings to reach $55.7 million (and earnings per share of $5.57) by about May 2028, up from $-240.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 1.6x on those 2028 earnings, up from -0.2x today. This future PE is lower than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 0.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.41%, as per the Simply Wall St company report.

bluebird bio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company reported a significant decrease in quarterly revenue from $16.1 million in Q2 to $10.6 million in Q3, primarily due to manufacturing timeline variations, which may impact near-term revenue streams and financial stability.

- Bluebird bio is facing cash runway concerns, with existing cash only expected to fund operations into the first quarter of 2025. This presents a risk to financial viability if additional financing is not secured, affecting net margins and earnings.

- The company relies on scaling patient starts to achieve cash flow breakeven by the second half of 2025, but potential delays in patient scheduling and drug delivery could hinder this target, impacting projected revenues.

- A restatement of financials earlier this year could indicate underlying financial management issues, which may undermine investor confidence and impact future revenue and net margins.

- There is an ongoing need for authorization of additional shares through a reverse stock split to regain NASDAQ compliance and maintain financing flexibility, suggesting potential dilution risks that could affect earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $6.5 for bluebird bio based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $8.0, and the most bearish reporting a price target of just $5.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $350.8 million, earnings will come to $55.7 million, and it would be trading on a PE ratio of 1.6x, assuming you use a discount rate of 11.4%.

- Given the current share price of $4.12, the analyst price target of $6.5 is 36.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.