Key Takeaways

- Expanded video, creator monetization, and new paid tiers are expected to accelerate engagement and revenue growth, boosting long-term margins and earnings.

- International expansion and product personalization are deepening user engagement, increasing market share, and reinforcing persistent revenue and profit growth potential.

- Spotify's subscriber growth in lower-revenue markets, rising costs, unproven content investments, fierce competition, and regulatory pressures could constrain future profitability and revenue expansion.

Catalysts

About Spotify Technology- Provides audio streaming subscription services worldwide.

- Analysts broadly agree that the expansion of video podcasts and creator monetization tools will drive engagement and higher-margin ad revenue, but the rapid pace-evidenced by a 44 percent increase in video consumption and over $100 million paid to creators in a single quarter-suggests video could fundamentally reshape Spotify's user time spent, boosting retention and accelerating both premium and advertising revenues beyond existing forecasts, while materially lifting long-term gross margins.

- Analyst consensus expects that new paid tiers, such as superfan options and higher-priced Premium packages, will incrementally increase average revenue per user, but with proven price elasticity, exceptionally strong market share gains even after recent price hikes, and a model that still commands among the lowest entertainment costs globally, there is potential for multiple upward price adjustments across regions, unlocking significant subscription revenue growth and sustained expansion in net earnings.

- Spotify's aggressive investment in international growth-particularly in high-potential regions like India, Africa, and Southeast Asia-is powering disproportionate subscriber gains and deepening engagement, suggesting its total addressable market could be orders of magnitude larger than current projections, delivering compounding user, revenue, and long-term earnings growth as digital streaming adoption accelerates globally.

- The ongoing global shift in consumer behavior toward mobile-first, AI-personalized, and multi-format media consumption plays directly to Spotify's expanding ecosystem; the company's AI-driven curation and product development speed-ups could yield breakthrough engagement and monetization dynamics, materially enhancing gross margins and operating leverage through personalized product offerings at scale.

- With the platform's growing ubiquity across over 2,000 partner devices-including integration into smart speakers, connected cars, and emerging consumer devices-Spotify stands to benefit from exponential increases in per-user listening hours and cross-selling opportunities, supporting persistent ARPU growth, robust customer stickiness, and upward movement in operating income over time.

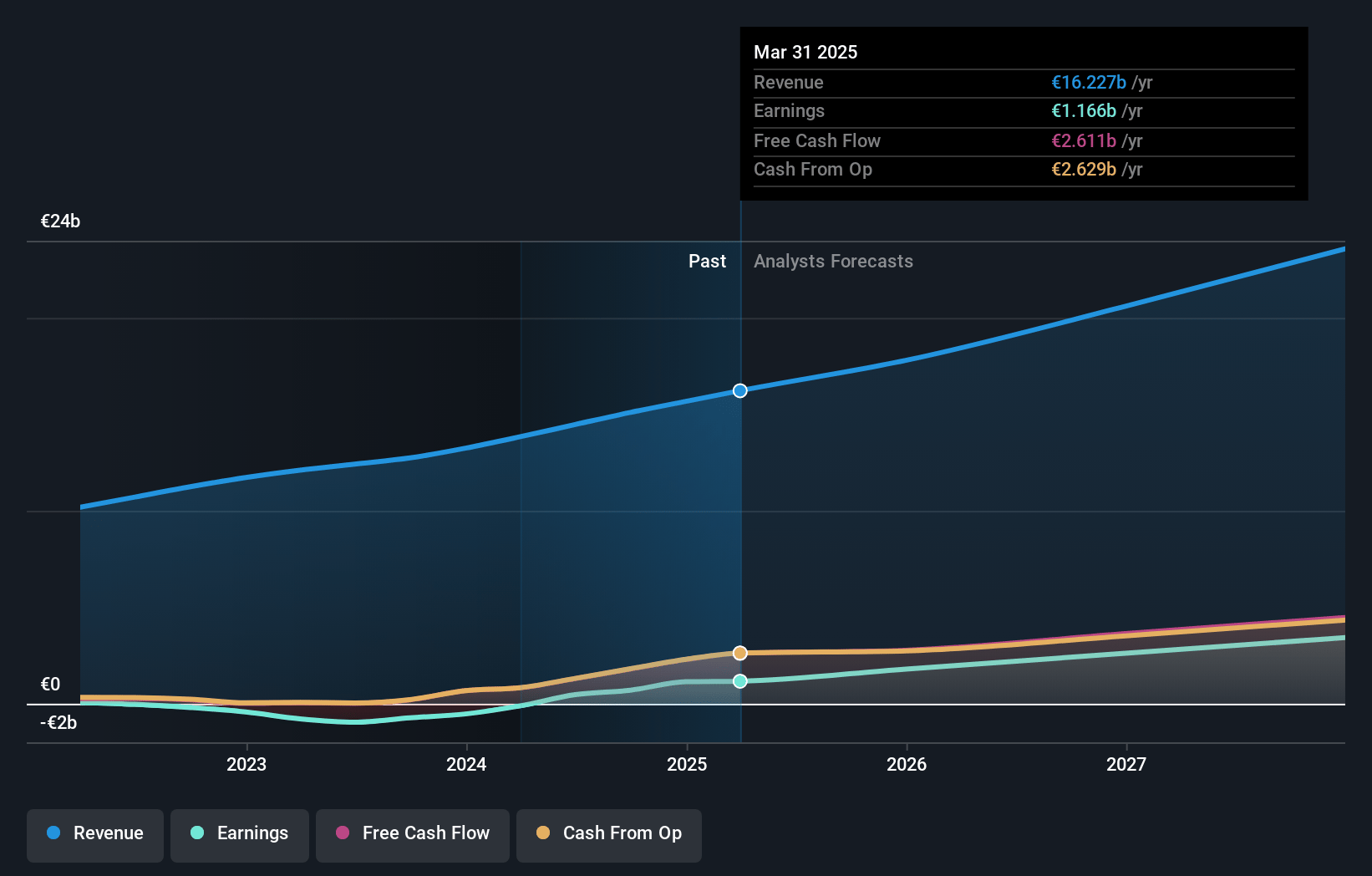

Spotify Technology Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Spotify Technology compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Spotify Technology's revenue will grow by 19.0% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.2% today to 16.4% in 3 years time.

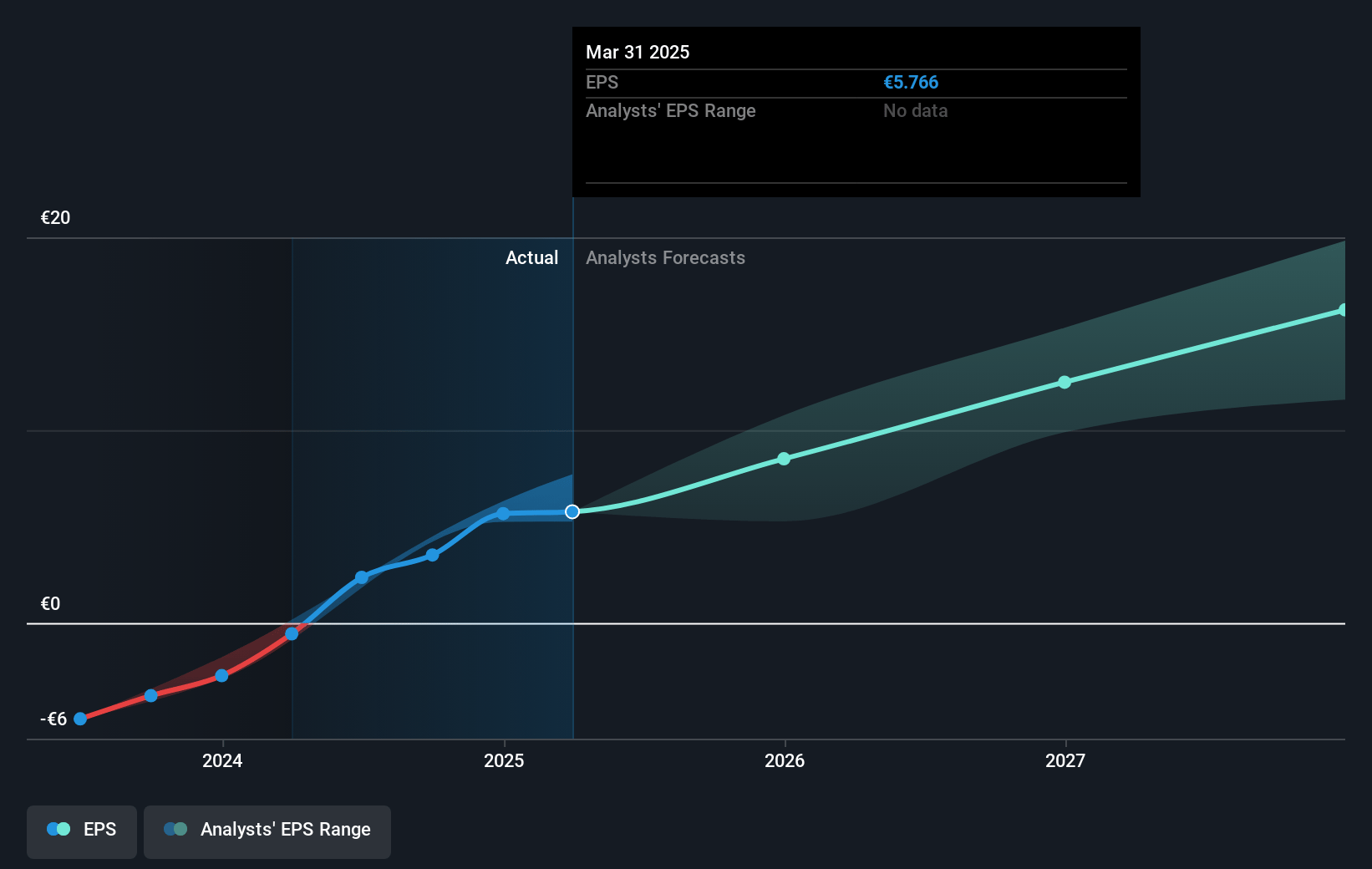

- The bullish analysts expect earnings to reach €4.5 billion (and earnings per share of €22.2) by about July 2028, up from €1.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 48.2x on those 2028 earnings, down from 106.7x today. This future PE is greater than the current PE for the US Entertainment industry at 27.6x.

- Analysts expect the number of shares outstanding to grow by 2.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.51%, as per the Simply Wall St company report.

Spotify Technology Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Spotify's ongoing expansion into emerging markets is driving subscriber growth, but these regions typically generate lower average revenue per user, which could constrain long-term top-line revenue and limit overall earnings growth.

- The company continues to face persistent, high content acquisition and royalty costs, especially as major record labels and rights holders consolidate their bargaining power, threatening Spotify's ability to sustainably expand net margins.

- Significant investments in podcasting, video, and audiobooks may not achieve profitable scale, as evidenced by continual references to ongoing innovation and experimentation, which increases the risk of future writedowns or restructuring and may pressure bottom-line earnings.

- Intensifying competition from large technology companies such as Apple, Amazon, and YouTube, who are willing to subsidize music streaming as part of broader ecosystem strategies, could challenge Spotify's pricing power, increase customer churn, and negatively impact both revenue and profitability.

- Increasing global regulatory scrutiny and evolving privacy requirements around technology and content distribution may result in higher compliance costs and limit Spotify's ability to personalize user experiences, thereby impacting user engagement and dampening future advertising revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Spotify Technology is $907.68, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Spotify Technology's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $907.68, and the most bearish reporting a price target of just $468.54.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be €27.3 billion, earnings will come to €4.5 billion, and it would be trading on a PE ratio of 48.2x, assuming you use a discount rate of 8.5%.

- Given the current share price of $709.15, the bullish analyst price target of $907.68 is 21.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives