Key Takeaways

- Demand for premium visual content and AI-driven personalization fuels higher user retention, recurring revenue, and robust long-term growth prospects.

- Exclusive partnerships and geographic expansion strengthen market position, enhance pricing power, and support sustainable margin improvement.

- Increasing AI competition, legal uncertainty, open access trends, and debt burden threaten profitability, pricing power, and long-term financial stability.

Catalysts

About Getty Images Holdings- Provides creative and editorial visual content solutions in the Americas, Europe, the Middle East, Africa, and Asia-Pacific.

- As the shift toward digital marketing and communication accelerates globally, businesses increasingly require fresh, high-quality visual content, positioning Getty Images to benefit from rising demand and expand both its addressable market and its recurring revenue streams, supporting robust top-line growth.

- Ongoing advancements in artificial intelligence allow Getty Images to enhance its AI-driven search, tagging, and content recommendation systems, boosting user experience, streamlining content discovery, and improving personalization—all of which are catalysts that can drive higher conversion rates, net margins, and user retention.

- The company's consistent growth in annual subscription revenue, now surpassing half of total sales and featuring strong renewal rates of over 92 percent, generates predictable, high-margin income and produces greater visibility into future earnings, setting the stage for long-term growth even through macroeconomic volatility.

- Exclusive, multi-year partnerships with leading sports leagues, events, and entertainment brands deepen Getty's proprietary, premium content repository—improving pricing power, raising average revenue per user, and reinforcing competitive differentiation that has the potential to sustain and grow EBITDA margins over time.

- By expanding its customer footprint across new geographies—particularly in fast-growing markets in Latin America, Asia Pacific, and EMEA—and demonstrating strong growth in service verticals such as video and custom content, Getty Images is positioned to drive license volumes and increase overall revenue through greater global penetration.

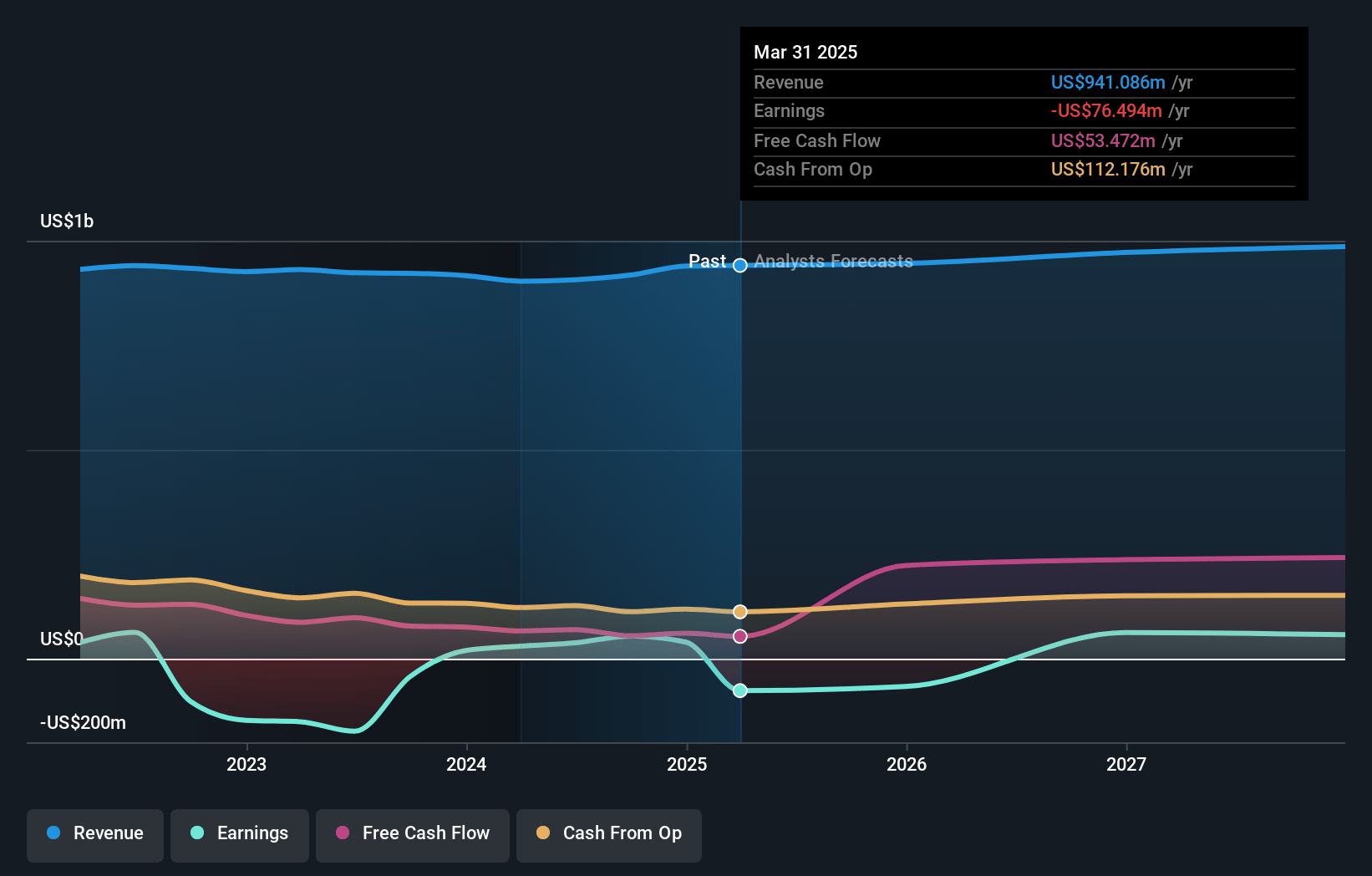

Getty Images Holdings Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Getty Images Holdings compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Getty Images Holdings's revenue will grow by 2.2% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from -8.1% today to 7.9% in 3 years time.

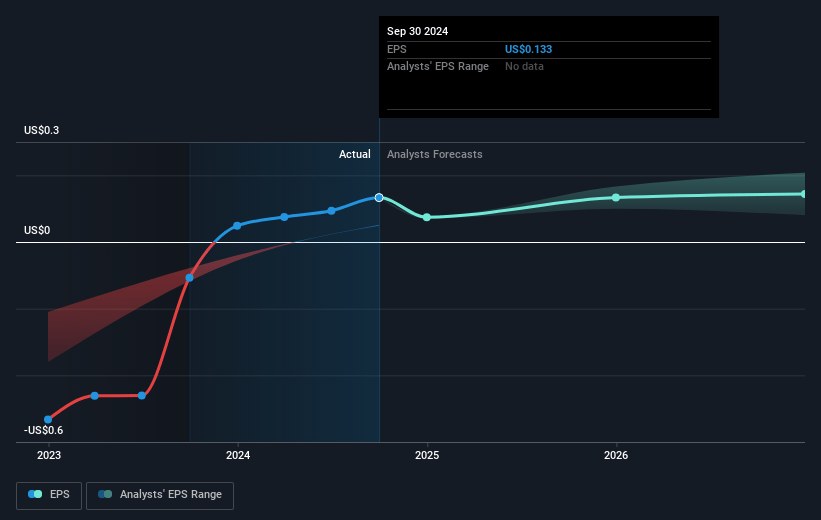

- The bullish analysts expect earnings to reach $79.7 million (and earnings per share of $0.18) by about July 2028, up from $-76.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 56.7x on those 2028 earnings, up from -9.5x today. This future PE is greater than the current PE for the US Interactive Media and Services industry at 17.1x.

- Analysts expect the number of shares outstanding to grow by 0.73% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.6%, as per the Simply Wall St company report.

Getty Images Holdings Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Getty Images is facing the proliferation of AI-generated content, which threatens to commoditize traditional stock photography, reduce demand for its core offerings, and exert downward pressure on both revenue and margins over time.

- The ongoing legal challenges concerning AI and copyright ownership, such as litigation with Stability AI, could bring significant, unpredictable legal liabilities and higher compliance costs, negatively impacting earnings and net margins.

- The trend towards open access and freely available media content continues to attract budget-conscious consumers, which may shrink Getty Images’ addressable market and lead to longer-term revenue declines.

- Brand erosion poses a risk as enhanced stock image libraries and integrations from major tech companies like Adobe and Canva could diminish Getty’s competitive edge, resulting in reduced pricing power that would compress revenue and net profit margins.

- The company is carrying a substantial debt load, with high interest expenses, and any softening in operating performance or persistently slow top-line growth—exemplified by weak creative revenue growth and pressure in agency business—could constrain free cash flow and limit flexibility, further threatening earnings and financial stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Getty Images Holdings is $7.7, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Getty Images Holdings's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $7.7, and the most bearish reporting a price target of just $2.05.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $1.0 billion, earnings will come to $79.7 million, and it would be trading on a PE ratio of 56.7x, assuming you use a discount rate of 11.6%.

- Given the current share price of $1.75, the bullish analyst price target of $7.7 is 77.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.