Last Update 23 Nov 25

Fair value Decreased 9.62%TTD: Share Strength Will Build As AI And Buyback Momentum Continue

Analysts have lowered their price target for Trade Desk by approximately $6.64 to $62.33. They cite near-term headwinds and a slightly softer outlook on growth and margins. However, fundamentals and longer-term drivers remain intact.

Analyst Commentary

Recent Street research offers a nuanced view of Trade Desk's prospects, with both optimistic and cautious tones reflected in recent price target movements and commentary.

Bullish Takeaways

- Bullish analysts note that Trade Desk delivered a strong quarter, beating expectations and raising guidance. This suggests core growth could return to the 20% year-over-year range by year-end.

- There is confidence that fundamentals remain robust. New platform initiatives like Kokai are showing increasing adoption and are expected to drive improved advertiser outcomes.

- Analysts highlight limited downside risk for shares at current valuations. They describe the forward setup as attractive with forward estimates considered "derisked."

- Bullish perspectives emphasize the company's ability to execute well even amid a challenging advertising environment. There has been strong execution against tough year-over-year comparisons and signs of incremental improvement in ad demand.

Bearish Takeaways

- Bearish analysts express concern about near-term headwinds, including intensifying competition from larger players and potential regulatory impacts. These factors may pressure the company’s operating environment and growth trajectory.

- Valuation concerns linger after recent volatility. One major firm now views the stock as a "show me" story due to management changes and anticipated topline deceleration for next year.

- Some caution that incremental improvements, while positive, may be insufficient to dispel worries about slowing growth rates and competitive threats in the broader digital ad ecosystem.

- Persistent margin pressures and a slightly softer near-term outlook have led to a series of downward price target revisions by several research houses.

What's in the News

- OpenAI is hiring for a new Growth Paid Marketing Platform Engineer to build out in-house ad tools for ChatGPT, signaling a move toward its own paid marketing platform. This development is being closely watched by Trade Desk and industry peers (ADWEEK).

- Trade Desk provided earnings guidance for the fourth quarter of 2025, projecting revenue of at least $840 million.

- The company has repurchased 6,229,482 shares between July and October 2025, completing 5.88% of its buyback plan with a cumulative spend of $1.91 billion. The buyback plan was recently expanded by $500 million.

- A major upgrade called Audience Unlimited was announced, introducing new AI-powered tools to improve digital advertising campaign targeting and optimize costs.

- Trade Desk and DIRECTV are collaborating on a customized version of Ventura TV OS, aiming to provide an integrated streaming platform for third-party manufacturers and partners.

Valuation Changes

- Consensus Analyst Price Target: Lowered from $68.97 to $62.33, reflecting a decrease of approximately 9.6%.

- Discount Rate: Remained virtually unchanged at 6.96%.

- Revenue Growth: The projected growth rate has edged down slightly from 16.24% to 15.84%.

- Net Profit Margin: Margins dipped marginally, moving from 18.91% to 18.78%.

- Future P/E: The forward price-to-earnings multiple has decreased significantly from 50.36x to 41.85x.

Key Takeaways

- Trade Desk benefits from the shift toward connected TV and data-driven, measurable advertising, leveraging strong partner relationships and advanced AI platforms for higher growth and margins.

- Global and channel expansion, along with a focus on transparency and independence, position Trade Desk to gain market share as industry trends favor open, objective platforms.

- Heavy reliance on large clients, competition from walled gardens, dependence on CTV, high innovation costs, and limited geographic diversification create significant growth and earnings risks.

Catalysts

About Trade Desk- Operates as a technology company in the United States and internationally.

- The continued rapid shift of ad spend from linear TV to connected TV (CTV) is driving significantly faster growth for Trade Desk's highest-margin channel; deepened relationships with leading CTV and streaming content partners (Disney, Netflix, Roku, LG, etc.) position Trade Desk to capture an outsized share of the expanding premium digital video ad market, which should accelerate revenue and earnings growth as CTV penetration increases globally.

- There is rising demand among brands and agencies for data-driven, measurable advertising with transparent ROI, and Trade Desk's platform (especially with advanced AI/ML features in Kokai and partnerships in retail media and measurement) is uniquely positioned to take share as advertisers prioritize analytics, measurable outcomes, and performance over brand-based, IO-driven spend; this should structurally support revenue growth and improve gross margin as advertisers migrate spend for higher ROI.

- The full rollout and high adoption of the new AI-powered Kokai platform, including new tools like Deal Desk and supply chain innovation (OpenPath, Sincera integration), is already leading to >20% better campaign performance and causing existing clients to increase spend at a much faster rate; as the remaining clients transition and the product matures, this should drive step function increases in platform efficiency, gross margin, and average revenue per client.

- Trade Desk is still early in its global expansion and its push into nontraditional channels (retail media, digital out-of-home, digital audio), with international growth outpacing North America and new partnerships accelerating; this geographic and channel diversification expands TAM and reduces concentration risk, providing strong multi-year support for top-line revenue growth.

- The growing regulatory, advertiser, and consumer push for transparency, privacy, and independence-combined with the pullback of Google and Facebook from open Internet programmatic and increased scrutiny of walled gardens-favor independent, objective platforms like Trade Desk. This competitive positioning is driving a structural shift of ad budgets to Trade Desk, which should translate into durable revenue and margin expansion over the long term.

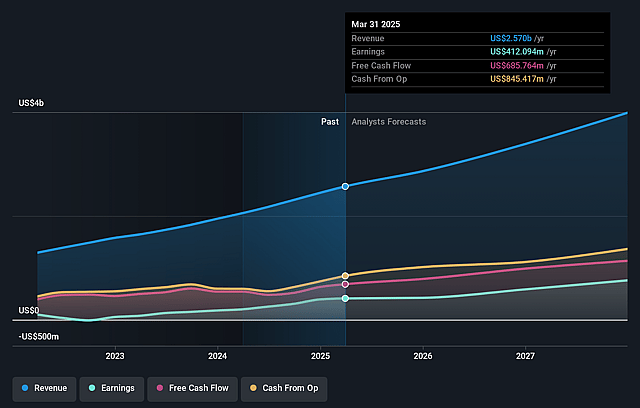

Trade Desk Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Trade Desk's revenue will grow by 17.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 19.2% in 3 years time.

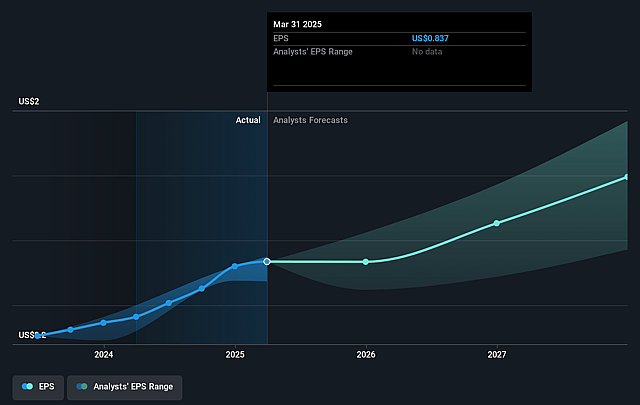

- Analysts expect earnings to reach $823.2 million (and earnings per share of $1.72) by about September 2028, up from $417.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $946.0 million in earnings, and the most bearish expecting $360.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.0x on those 2028 earnings, down from 61.4x today. This future PE is greater than the current PE for the US Media industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Trade Desk Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's exceptionally high reliance on large, global brands and enterprises exposes it to concentrated revenue risk; ongoing macro headwinds such as tariffs, inflation, and volatility in the auto and CPG sectors could lead to cuts in ad spend from these clients, materially impacting near-term and potentially long-term revenue growth and earnings stability.

- Despite a bullish narrative around the open Internet, Trade Desk is facing a persistent risk that walled gardens (e.g., Meta, Amazon, Google) continue to take digital ad market share at a faster pace due to their control of inventory, integrated data, and simplified measurement, limiting Trade Desk's share gains and dampening overall revenue growth prospects.

- While CTV is highlighted as the fastest-growing segment, Trade Desk's substantial dependence on CTV as a growth driver creates exposure to any future saturation, competitive disruption, or cyclical swings in streaming ad inventory, which could lead to earnings volatility and slow overall top-line growth.

- Although management emphasizes innovation in AI and supply chain transparency (e.g., Kokai, OpenPath, Deal Desk), the escalating industry-wide costs to develop and maintain cutting-edge AI-driven solutions may compress operational margins if revenue growth and pricing power do not keep pace.

- Trade Desk's current customer mix is heavily skewed toward North America (~86% of spend), indicating long-term geographic concentration and limited international scale; failure to accelerate global expansion could constrain addressable market growth and leave revenues vulnerable to North American economic cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $75.394 for Trade Desk based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $823.2 million, and it would be trading on a PE ratio of 53.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $52.4, the analyst price target of $75.39 is 30.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.