Key Takeaways

- Direct, AI-powered travel planning and integrated platforms are reducing the need for user-generated reviews, weakening Tripadvisor’s revenue streams and market influence.

- Declining brand relevance among younger travelers and stricter privacy laws are constraining user growth, engagement, and advertising revenue potential.

- AI innovation, experiences expansion, app transformation, and strategic partnerships are driving stronger engagement, monetization, and positioning Tripadvisor for durable growth and margin improvement.

Catalysts

About Tripadvisor- TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

- The widespread adoption of generative AI and intelligent digital assistants threatens to reduce consumer reliance on user-generated review platforms like Tripadvisor, as travelers increasingly turn to direct, AI-powered planning tools, putting long-term web traffic, repeat use, and ultimately advertising and referral revenue in a structurally declining position.

- Escalating control over travel meta-search and booking by integrated platforms such as Google and Booking Holdings is expected to further disintermediate Tripadvisor, eroding referral fee income, reducing pricing power, and pressuring both revenue growth and gross margins over time.

- Persistently tightening privacy laws and increased consumer concerns about data collection and sharing are likely to constrain Tripadvisor’s ability to personalize recommendations and target ads effectively, undermining engagement rates and slowing the expansion of advertising revenue and net margins.

- Tripadvisor’s brand is losing relevance with younger travelers who favor visually oriented or influencer-driven channels like TikTok and Instagram over traditional, text-heavy review sites, implying a long-term deceleration in new user acquisition, diminished ad impressions, and increasing risk of revenue contraction.

- The travel market is evolving toward sustainable, slower, and more experiential travel, which may lead to a structural decrease in overall travel frequency and reduce the size of the addressable market for mass-market, comparison-based platforms like Tripadvisor, pressuring top-line growth and threatening future earnings.

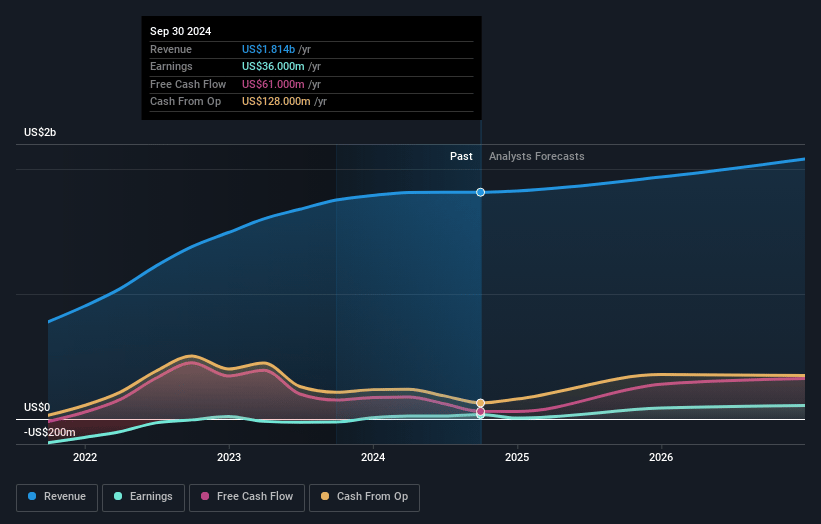

Tripadvisor Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Tripadvisor compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Tripadvisor's revenue will grow by 6.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from 2.9% today to 5.0% in 3 years time.

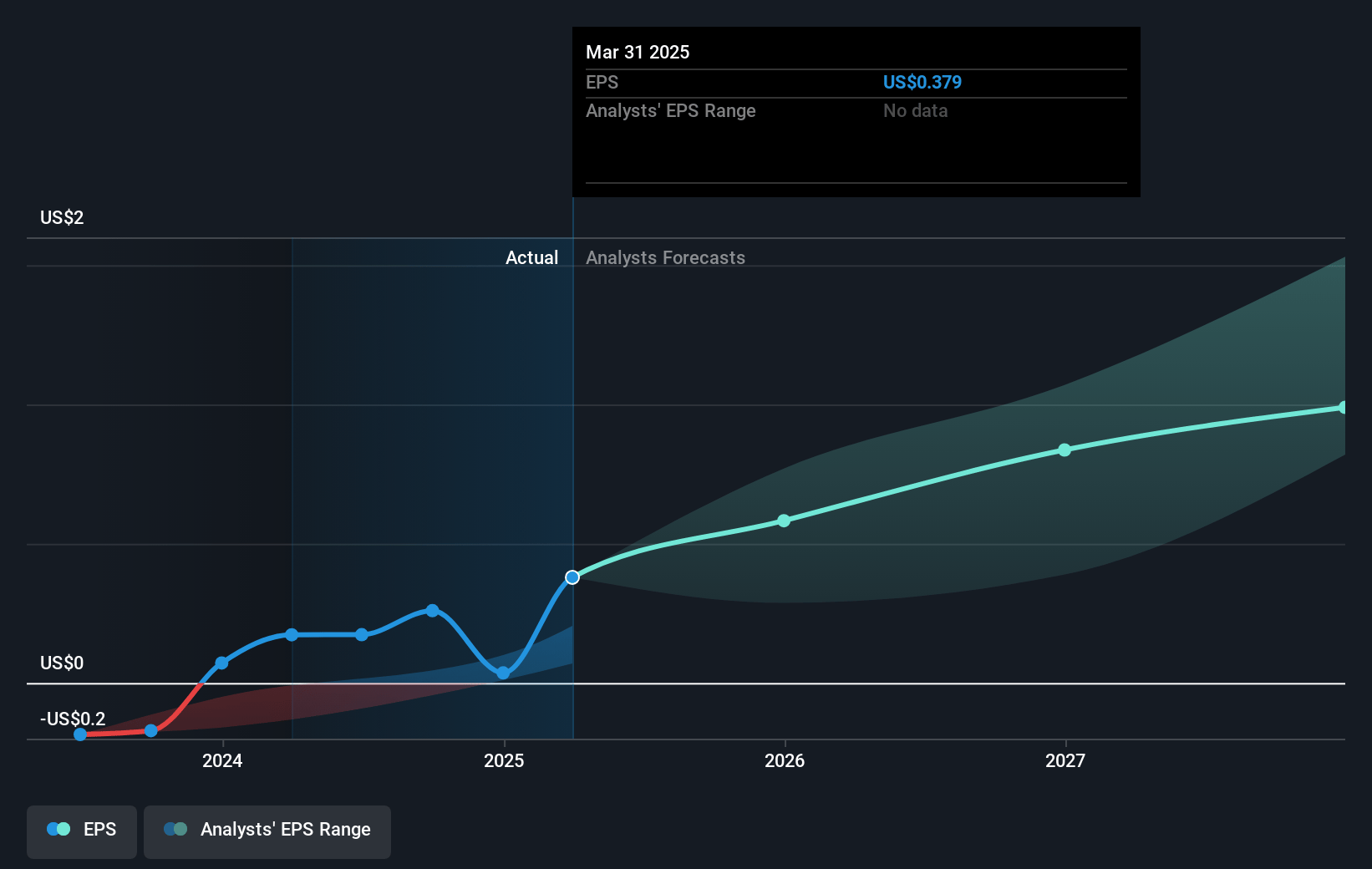

- The bearish analysts expect earnings to reach $109.1 million (and earnings per share of $0.92) by about July 2028, up from $53.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 12.3x on those 2028 earnings, down from 39.3x today. This future PE is lower than the current PE for the US Interactive Media and Services industry at 16.8x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.02%, as per the Simply Wall St company report.

Tripadvisor Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's ongoing investment and innovation in AI-driven personalization, recommendation engines, and product enhancements across search, booking, and app experiences are already delivering uplift in conversion rates, traveler engagement, and monetization, which could result in higher revenue and improved earnings over time.

- Expansion into experiences through Viator and TheFork, including continued mid-teens bookings growth, increased supply depth, strong cohort retention, improved margins, and immediate profitability of third-party channels, supports the case for durable long-term revenue growth and gross margin expansion.

- The recent Liberty TripAdvisor Holdings merger and share buyback will reduce share count by approximately 17 percent, streamline the capital structure, and grant greater flexibility for capital allocation, supporting potential improvements in earnings per share and shareholder returns in future periods.

- The mobile app transformation, coupled with ongoing marketing optimization and stronger direct channel engagement, is boosting repeat bookings and customer loyalty, which could stabilize or increase long-term user growth and ad revenue.

- Strategic partnerships with leading AI, tech, and payment platforms (such as Amazon, Microsoft Azure, OpenAI, and planned Mastercard collaborations) are expanding TripAdvisor’s reach, creating new monetization avenues, and reinforcing the platform’s relevance, potentially driving incremental revenue and strengthening net margin resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Tripadvisor is $11.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Tripadvisor's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $24.0, and the most bearish reporting a price target of just $11.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be $2.2 billion, earnings will come to $109.1 million, and it would be trading on a PE ratio of 12.3x, assuming you use a discount rate of 9.0%.

- Given the current share price of $17.64, the bearish analyst price target of $11.0 is 60.4% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.